Introduction

The 401(k) contribution tool embedded in this post computes the percent 401(k) contributions needed to meet a required end-of-year total.

Use the tool to assess your contribution status and do periodic adjustments as needed.

Let’s first describe why funding a 401(k) is important.

Benefits of a 401(k)

If you are a company employee, you probably have access to a 401(k) plan. The 401(k) is an investment fund that grows tax free, and you fund it via your before-tax gross pay.

The 401(k) should offer you enough investment options/types such that you feel the risks are acceptable.

Investing in your 401(k) as soon and with as much as you can provides several benefits to you:

- The money grows tax free

- The money grows exponentially (see my power of compounding post). Your asset allocation choices will determine how much.

- Your company will probably donate to your 401(k) as well (by matching what you contribute or outright just giving you the extra money).

401(k)s are Not Perfect

A couple of potentially not-so-great things about 401(k)s:

- You get penalized if you withdraw early (typically before 59 1/2 but see this for more details).

- When you withdraw the money, it gets taxed like your regular income (ordinary income) so those graduated income tax tables come into play.

- You have to start withdrawing (and paying taxes) the money at age 72 (according to 2023 rules).

I think the good outweighs the bad.

- Just the discipline of having regular cash withdrawn automatically to fund your investments will help prevent you from not saving enough. It’s human nature for most of us to AVOID delaying gratification ,so, we have to invent systems to fight against our bad habits. Doing auto withdrawals into a 401(k) investment fund is one of those systems.

- You could be throwing free money away because some companies will only match (to a limit) what you contribute.

This post has an embedded (and downloadable) calculator that will help you ensure you are taking sufficient amounts out of each paycheck (pay stub) in order to maximize your contributions.

401(k) Contribution Calculator Description

Overview of How to Use 401(k) Contribution Calculator

We’ll cover more details in the examples, but in general, you’ll follow the sequence below:

- Work from the top down , starting in section I., and update all blue fonted cells.

- Provide information on your pay schedule, your age and the allowable contribution amounts.

- Enter a % of gross pay contribution to the 401(k) in section IVa. Enter any Bonus % contribution in IVb.

- Update the 401(k) contribution table with Past (fixed value) and Future (linked to value described in 3.) % contribution amounts (col 3).

- Update the 401(k) contribution table with your gross pay, bonus, and company match information.

- Manually adjust IVa. % input to achieve the desired 401(k) contribution.

401(k) Contribution Calculator

- Scroll to the far right to ensure all required input cells are updated.

- Download the tool if you want to see the detailed calculations (you need Microsoft Excel software to run it).

- If you are going to download the spreadsheet, you can easily modify it to automate the iterative part of the calculation (that has to be done manually in the embedded version). See Appendix 1.

401(k) Contribution Calculator Example 1: Semi-Monthly Payment

Isaac gets a raise starting in March of 2023. His gross pay goes from $90,000 to $100,000. He was contributing 5% of each of his payments to his 401(k).

Isaac runs the calculator to determine how much he needs to adjust this percentage for the remainder of the year (2nd payment in March and onward).

- Section I: He gets paid Semi-Monthly so he will choose Semi-Monthly from the drop down list. His base pay will be paid out 24 times over the year (twice a month).

- Section II: Isaac will enter 2023 for the year and his age is 40. The calculator will remind him if he is able to contribute additional funds due to his age (he is <50 so this wont apply).

- Section III. Isaac checks online and finds that the maximum yearly allowable contribution for 2023 is $22,500 and an additional catch-up of $7,500 for people aged 50 or older. Since he is not 50 yet, the calculator wont accept a value in this cell. (Press cancel or delete if you get an error message due to a faulty entry).

- Section IVa. Isaac enters a first guess of 22.9%. He’ll see some red window warnings and, he will ignore them for now

- Section IVb. Isaac enters the desired amount he wants taken out of any bonus payments. He chooses 5%.

- Section V. Isaac now goes down to the 401(k) table and fills out all the required cells.

401(k) Table Update (Eg.1)

- Col 1 provides the timing of the payments based on Isaac’s Section I input. For Semi-Monthly, there will always be two payments each month for a total of 24 payments

- Col 2 and Col 4 are reverse counters based on the Section I input.

- Isaac needs to update Col 3 with the % amount taken from each payment. For the payments already made, Isaac just enters that fixed value (5%).

- For the second payment in March and later payment cells, Isaac enters an estimate for the %. He does this by linking to the Section IVa. % (22.9%). He will copy this down all the way to the last payment. Isaac links the first cell and then copies that cell down into the other cells. Note that the grey shaded rows should not be updated with values because they are after the 24th payment. For Bi-Weekly payments, the number of payments could be 26 (typically) or 27 (sometimes) , so in one of these cases, Isaac would have included those rows.

- Isaac enters his yearly gross pay in Col 5.

- Isaac enters his yearly bonus pay into Col 7.

- Col 6 and 8 compute the amount contributed in dollars.

- Isaac enters his company’s contribution to his 401(k) in Col 9. His company contributes a flat 8% of his gross pay. Isaac can enter the actual values in these cells or he can enter a formula that will do the calculation for him.

401(k) Contribution Calculation (Eg.1)

- Isaac now goes back to Section IVa and sees that his contribution estimate is $19,838, which is less than the maximum.

- Isaac increases the Section IVa % manually to 26.26% (from 22.9%) to get the max amount of approximately $22,500. He could have also adjusted the bonus % pay contribution as well.

- Isaac now knows that a 26.26% per payment contribution going forward , along with his company’s 8% contribution will amount to $30,364 deposited into his tax free 401(k) investment funds.

If you download the spreadsheet , you can easily automate the iterative part that has to be done manually in the embedded version. See Appendix 1.

401(k) Contribution Calculator Example 2: Bi-Weekly Payment

Aristotle gets a raise starting in March of 2021. His gross pay goes from $90,000 to $100,000. He was contributing 5% of each of his payments to his 401(k).

Aristotle runs the calculator to determine how much he needs to adjust this percentage for the remainder of the year (2nd payment in March and onward).

- Section I: He gets paid Bi-Weekly so he will choose Bi-Weekly from the drop down list. His base pay will be paid out 27 times over the year. Note, every two weeks means 26 payments typically. But since we have leap years every 4 years, it is possible to receive 27 payments in one year (depending on when the first pay advice occurs). Aristotle must also enter the 1st pay date which is 1/1/2021 in this example.

- Section II: Aristotle will enter 2021 for the year and his age is 55. Because he is over 50, he is reminded that he can contribute additional funds (catch-up) due to his age.

- Section III. Aristotle checks online and finds that the maximum yearly allowable contribution for 2021 is $19,500 and an additional catch-up of $6,500 for people aged 50 or older. He enters these values in section III.

- Section IVa. Aristotle enters a first guess of 26.5% as recommended by the tool. He’ll see some red window warnings and, he will ignore them for now

- Section IVb. Aristotle enters the desired amount he wants taken out of any bonus payments. He chooses 5%.

- Section V. Aristotle now goes down to the 401(k) table and fills out all the required cells.

401(k) Table Update (Eg.2)

- Col 1 provides the timing of the payments based on Aristotle’s Section I input. For Bi-Weekly payments in 2021 with a start date of 1/1/2021, there will be 27 payments for the year.

- Col 2 and Col 4 are reverse counters based on the Section I input.

- Aristotle needs to update Col 3 with the % amount taken from each payment. For the payments already made, Isaac just enters that fixed value (5%).

- For the second payment in March and later payment cells, Aristotle enters an estimate for the %. He does this by linking to the Section IVa. % (26.5%). He will copy this down all the way to the last payment. Aristotle links the first cell and then copies that cell down into the other cells. Note that in this example, all 27 rows are being utilized because there are 27 payments in the year.

- Aristotle enters his yearly gross pay in Col 5.

- Aristotle enters his yearly bonus pay into Col 7.

- Col 6 and 8 compute the amount contributed in dollars.

- Aristotle enters his company’s contribution to his 401(k) in Col 9. His company contributes a flat 8% of his gross pay. Aristotle can enter the actual values in these cells or he can enter a formula that will do the calculation for him.

401(k) Contribution Calculation (Eg.2)

- Aristotle now goes back to Section IVa and sees that his contribution estimate is $23,194 , which is less than the maximum.

- Aristotle increases the Section IVa % manually to 29.94% (from 26.5%) to get the max amount of approximately $26,000 (including catch-up amount). He could have also adjusted the bonus % pay contribution as well.

- Aristotle now knows that a 29.94% per payment contribution going forward , along with his company’s 8% contribution will amount to $33,879 deposited into his tax free 401(k) investment funds.

If you download the spreadsheet , you can easily automate the iterative part that has to be done manually in the embedded version. See Appendix 1.

Conclusion

Use our on-line embedded 401(k) contribution calculator to determine the % contribution requirement from each of your pay stubs. The calculator will work for both Semi-Monthly (24 payments) and Bi-Weekly payment (26 or 27 payments) schedules.

If you have Microsoft Excel software, you can download the tool as well.

Appendix 1: Simple Excel Automation Example

The embedded 401(k) calculator requires the user to enter the desired % deduction from remaining payments to meet the desired year end total contribution amount to the 401(k). That is:

- Make the sum of the deductions for the year (name this calculation cell “SetCell”) equal to

- a desired value (the allowable value in section III. of the calculator. Name this cell “ToValue”.)

- by changing the % in section IVa. of the calculator (Name this cell “byChanging”.)

Note: In Excel, you can name specific cells or ranges of cells. Formulas are a little more intelligible if they use names.

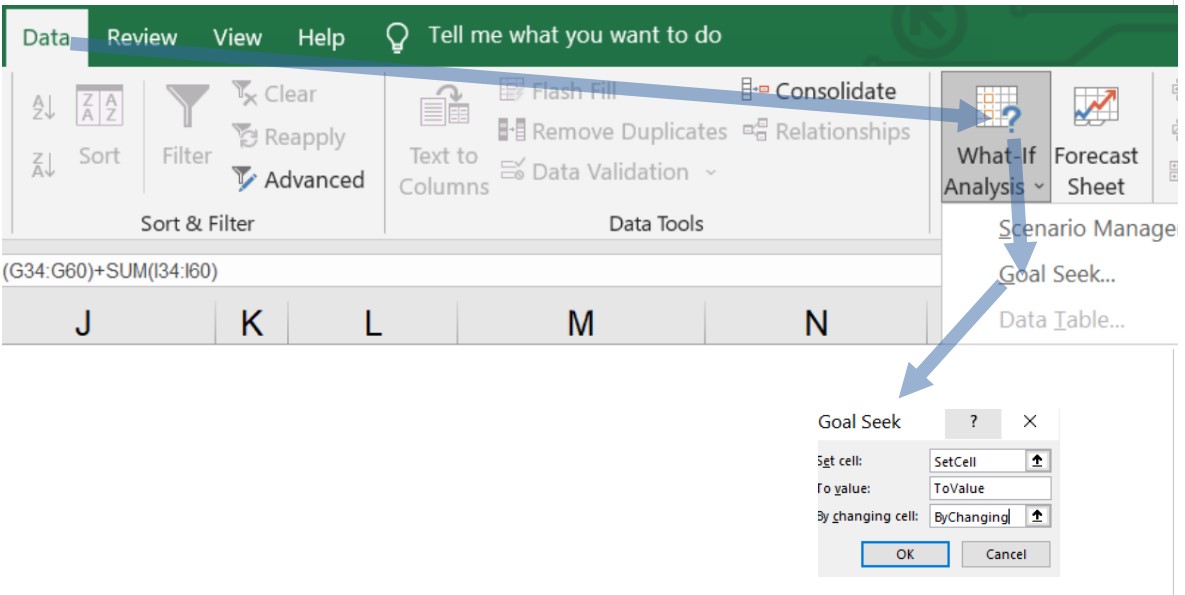

In Excel, from the top Ribbon, choose Data/What if Analysis/Goal seek to get the Goal seek box you see in Schematic 1.

Schematic 1: Excel Ribbon Menu Commands for Goal Seek Function

If we enter the values as shown in the Goal Seek box and hit OK, excel will do an iterative calculation and arrive at the solution (26.26% in example 1). Note: not quite…. an actual value has to be entered into the To_value box but in the automated version described next, we can substitute with “ToValue”.

Now, how can we automate this so the user doesn’t have to execute each of these steps manually?

First, we write a little program using a built in programming language called VBA. It will look as follows:

Private Sub CommandButton1_Click()

‘ Use Goal Seek to compute fixed percentage deduction from

‘ remaining paychecks to meet end of year total 401k deduction

‘ target

Range(“SetCell”).GoalSeek Goal:=Range(“ToValue”), ChangingCell:=Range(“ByChanging”)

End Sub

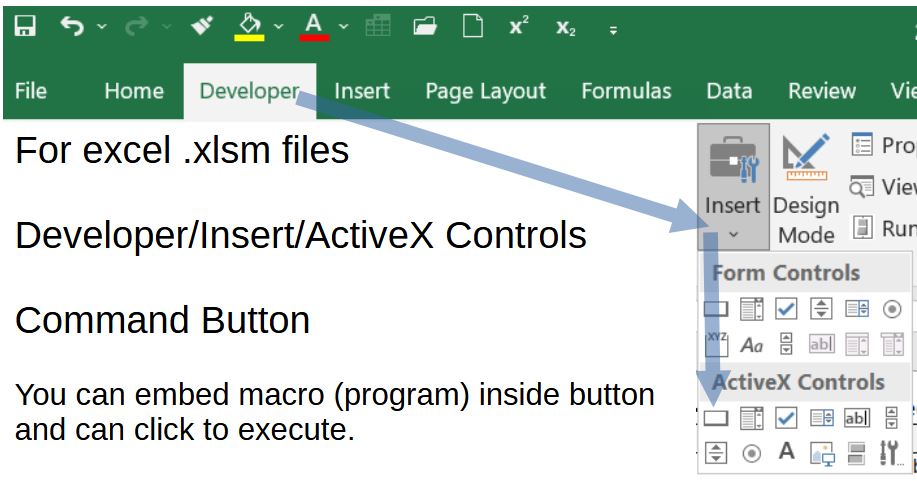

Let’s embed the little program above into a calculation button so the user can conveniently press the button and get a solution.

In Excel, from the Top Ribbon, choose Developer/Insert/ActiveX Controls Command Button. See Schematic 2.

Schematic 2: Excel Top Ribbon to Command Button

The button (just choose “properties” and “right click/view code” to set up) is then easily set up and formatted.

Then click on the button to execute the command.

Cool.

Note 1: You must save the excel file as an “.xlsm” type in order for VBA programs to work.

Note 2: The term “macro” is used to describe these automated programmed steps (see more on this term here).

Disclaimer: The content of this article is intended for general informational and recreational purposes only and is not a substitute for professional “advice”. We are not responsible for your decisions and actions. Refer to our Disclaimer Page.