Introduction

This article defines Capitalism and its tools of implementation: Economics, Finance, and Accounting.

Economics, Finance, and Accounting explain the flow of money and assets in society. Corporations, the engines of growth in capitalistic systems, utilize these concepts/tools/techniques to maintain and increase our standard of living. Similarly, individuals can use a baseline understanding of these topics to make better individual investment decisions.

This post defines these terms and their relationship to each other. Before doing so, we’ll review some inspiring historical backdrop.

Use my Financial Glossary (will open as a separate tab) for definitions of terms not fully explained in this post.

Last Revision: August 30, 2022

Menu

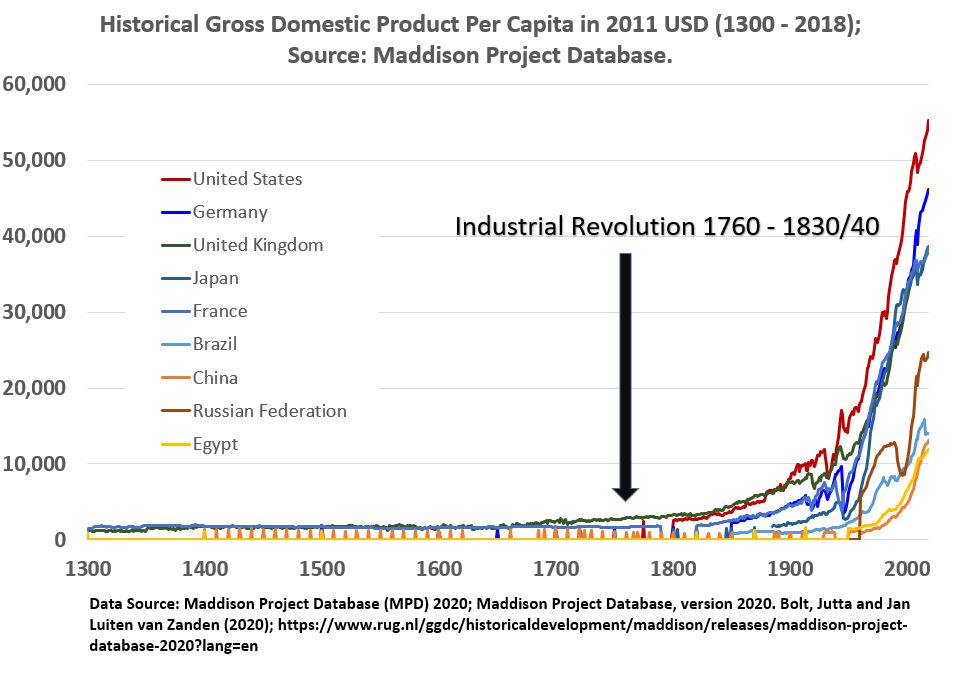

The Industrial Revolution

In the 1760s, an economic/political system called Capitalism allowed Great Britain to begin transitioning from an agrarian society to an industrial one. This Industrial Revolution was enabled by the invention of new technologies and manufacturing techniques/systems that massively improved productivity. Minimal government intervention was crucial in this development. It is primarily Capitalism that has given the Western nations (and all nations to a lesser or greater degree) the standard of living they enjoy today.

Capitalism’s value proposition in a most basic and idealistic form, can be described as follows:

- Give people the freedom to voluntarily produce, sell and purchase at mutually agreed prices.

- Let self interest be the primary motivation.

- The result will be a net increase in the standard of living.

Graph 1: Historical GDP Per Capita for Various Countries in 2011 USD

The Invisible Hand

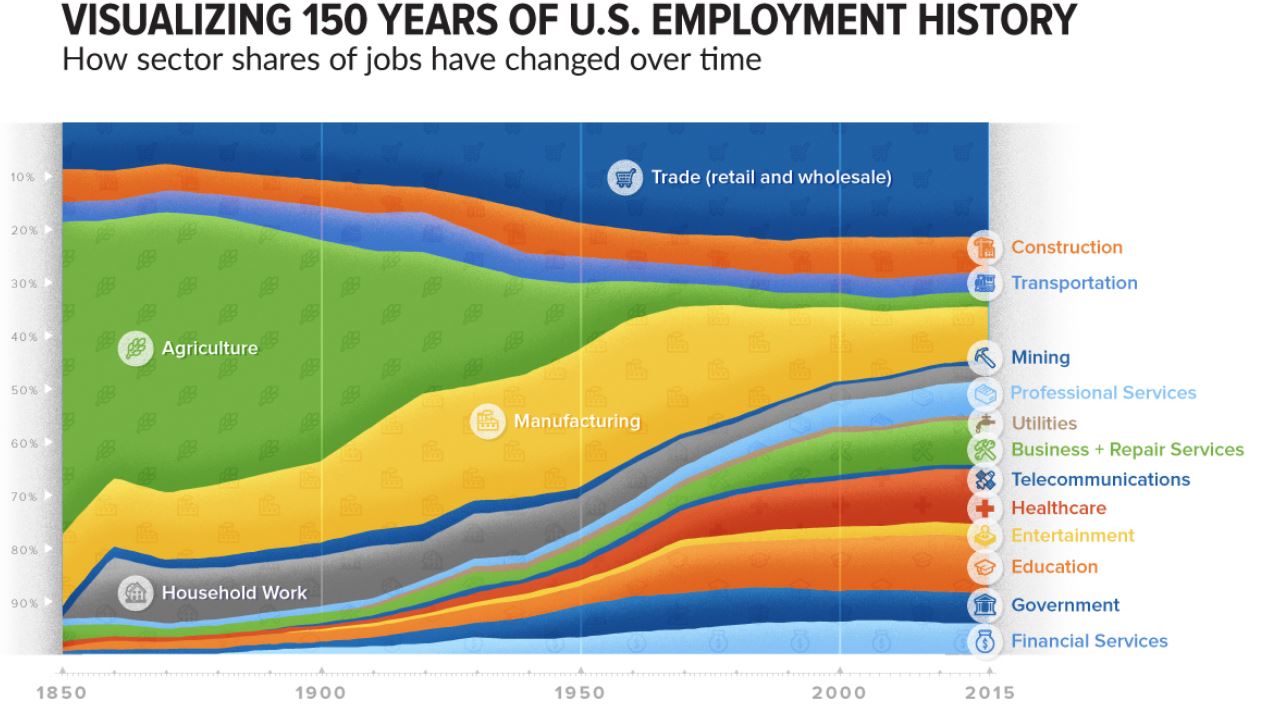

Graph 2: Visualizing 150 Years of U.S. Employment History

Of course, we are not living in a perfect world operated by robots, but, unintended consequences, excesses (greed), or downright injustices will occur (have occurred) in any system. Some key issues of today (in 2022) that Capitalism must address in a meaningful and just way, are income inequality and pollution’s damage to the environment.

However, there is no historical proof that any other system can do better (to the contrary). As Winston Churchill once quipped in a speech to Great Britain’s House of Commons (Nov 11,1947): “…democracy is the worst form of government, except for all those others that have been tried.” This statement applies just as well to Capitalism, since democracy is the political framework best suited for it.

U.S. Business Enterprises

“It is enterprise which builds and improves the world’s possessions.” – John Maynard Keynes (From Volume 6: A Treatise on Money: The Applied Theory of Money)

The engine of Capitalism is the business enterprise or firm. Private business enterprises operating in “free” markets with governments providing the proper economic and legal framework, create wealth for nations. These enterprises provide specialization and organizational expertise to create value.

According to the IRS (July 2022 data), of the 152.5 million workers in the U.S., 130.3 million (85.4%) work for private non-government businesses. The IRS categorizes businesses as follows:

- Sole Proprietorships

- Partnerships

- Corporations

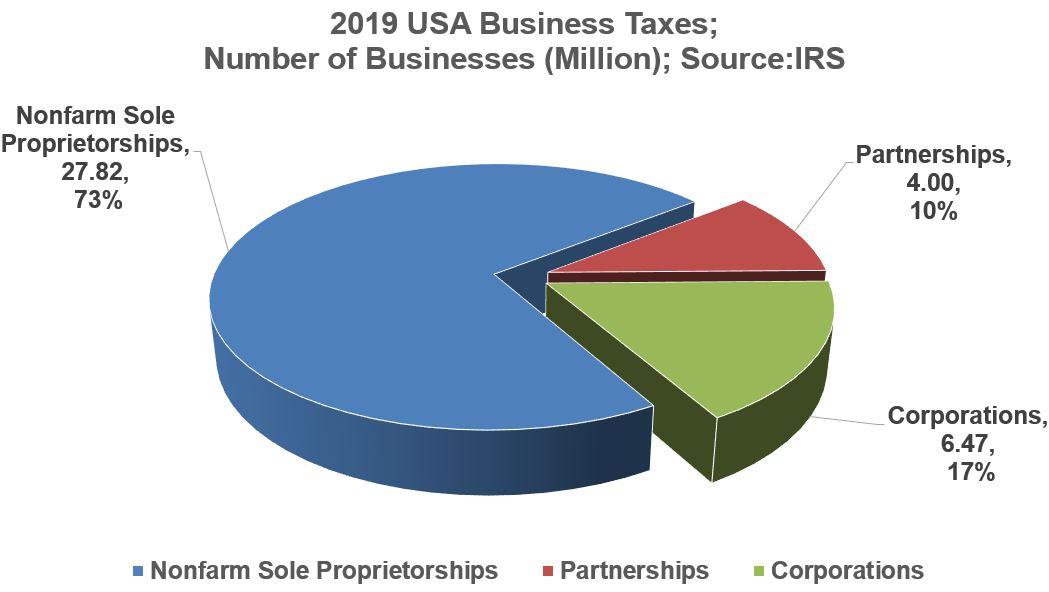

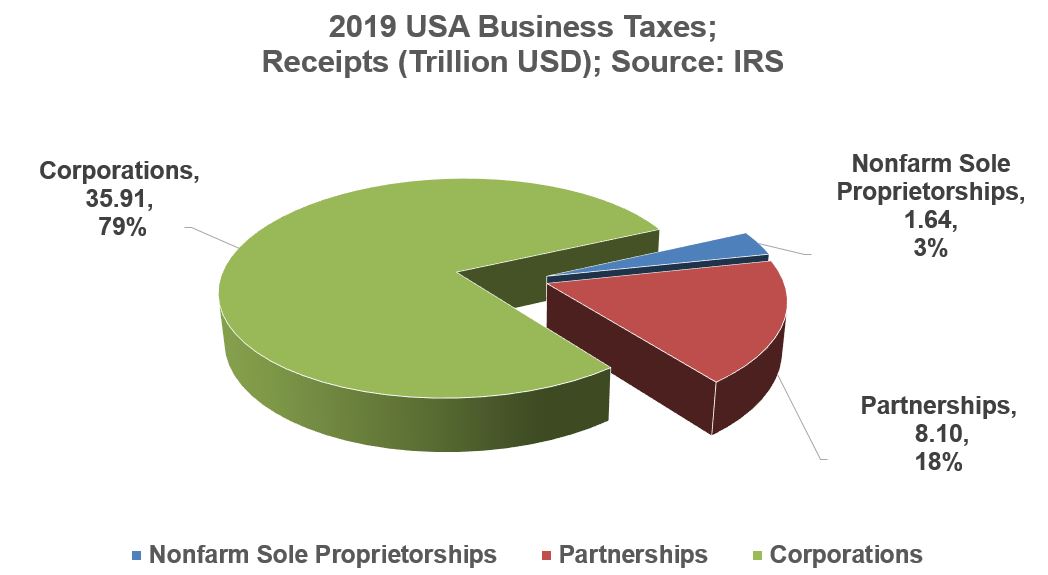

Refer to the 2019 IRS tax statistics in Graphs 3 and Graph 4.

Sole Proprietorships are small individually owned businesses. They number about 27.8 Million which represents about 73% of the total number of businesses in the U.S. However, their revenues (receipts) make up only 3% of the total. Sole Proprietorships don’t provide liability protection (against debts owed etc.).

Partnerships consist of two or more people. These also carry a default unlimited personal liability but can be structured to get liability protection. There are about 4 million of these, contributing to about 18% of the revenues.

Corporations are the “Big Dogs”; the main drivers of the U.S. economy. There are about 6.47 million corporations (17% of the total) but their revenues far outnumber the others (35.9 Trillion USD which is 79% of the total).

Note: Many will identify English and Dutch Trading companies in the 17th century as the first modern corporations, however there is evidence to suggest the first modern corporation with stock shareholders was a French Milling company called the Bazacle company (founded in 1372). (https://en.wikipedia.org/wiki/Bazacle_Milling_Company )

Graph 3: 2019 USA Business Tax Data: Number in Millions of Businesses Submitting Taxes

Graph 4: 2019 USA Business Tax Data: Receipts in Trillion USD of Businesses Submitting Taxes

Corporations

Corporations are the prime movers of Capitalism. They are the specialized organizations that produce desired products in the most efficient and profitable way.

Some of the corporation’s key characteristics are:

- People who own the company stock, own a fractional share of the company.

- Corporations are separate legal entities (i.e. separate from the owners).

- They are protected by limited liability.

- Business Managers run the company from day to day.

In order for Business Managers to determine the best allocation of money and assets, they employ financial concepts and tools. We should strive to gain a basic understanding of these concepts as well since the economic world affects and impacts each and every one of us (e.g. our daily purchases and sales and our long term wealth building through investments). We should start with an understanding of the basic definitions and characteristics of Economics and the related fields of Finance and Accounting.

Economics

Economics is a Social Science which describes the flow of money and resources in society. It is Social in that it addresses the wants and needs of humans. Examples of economics related concepts and activities are:

- Supply and demand, equilibrium price, and price elasticity

- Characterization of national aggregate production like the Gross Domestic Product

- Goods and services price tracking (CPI inflation indicator)

- Government Fiscal Policy (Tax and Spend policies)

- Federal Reserve Monetary Policy (Money Supply, Discount Rates, Reserve Requirements, Open Market Operations)

- Economic Indicators (Leading, Coincident, Lagging)

Under this broad umbrella lie two related fields: Accounting and Finance. These are more localized “ground level” activities that are concerned with the recording of money flows and assets (Accounting) and the analysis of this data to determine future action (Finance).

Accounting

Accounting is the science of recording the historical flow of money and assets in a corporation. Corporations account for their business transactions by submitting quarterly and annual financial statements. This provides credibility and transparency and allows lenders, shareholders and potential investors access to key data provided in a structured and standardized way. Of course, financial managers in the company also analyze this data to determine future actions in the company. Some characteristics of Accounting are:

- Accounting is often called the “language of business”.

- Companies report financials using Accrual Accounting typically i.e. Revenues and expenses are recorded when the transactions occur and not when the cash is actually exchanged. (e.g. accounts payable, receivable).

- Accounting records and allows analysis of business transactions.

- Current and past business transactions are recorded in a standardized way.

- Accounting produces useful metrics or raw data for useful metrics (Net Income, Operating Cash Flow, Free Cash Flow, Debt/Equity ratio, etc.).

Finance

Finance involves looking into the future and making investment decisions based on analysis. It differs from Accounting which defines the current situation or the past. Finance

- uses accounting structures and methods.

- uses historical data and analytical skills to develop future plans to maximize company wealth.

- focuses on cash flows.

- tracks value creation/loss.

- computes metrics like Net Present Value and Internal Rate of Return to help determine future investments.

Conclusion

Corporations are the engines of Capitalism and wealth creation. Understanding how they work requires an understanding of Finance. Finance is the science/art of analyzing historical business transactions (e.g. financial accounting data) to make future investment decisions. Finance relies on and uses economic and accounting principles.

Many of the concepts and tools of Finance trickle down to the individual investors toolbox and are therefore important to understand.

Appendix

Recommended Reading

- Free to Choose by Milton & Rose Friedman; Harcourt, Brace, Jovanovich; New York; 1980

- Economics by Paul A. Samuelson and Willian D. Nordhaus; McGraw-Hill/Irwin; 1221 Avenue of the Americas, New York, NY, 10020. Copyright © 2010

Disclaimer: The content of this article is intended for general informational and recreational purposes only and is not a substitute for professional “advice”. We are not responsible for your decisions and actions. Refer to our Disclaimer Page.