Introduction

Have you ever wondered about how you are going to pay for college for your kids (or yourself)? How much will it cost? How much will you need to save? The education calculator embedded in this article will help you determine those things. You can jump right to it or you can work through this article and learn a few interesting facts (and maybe a few alleged facts !) about education costs and funding.

My hope is that this information will spark sufficient interest to compel you to become a wiser decision maker with respect to education funding (we are mainly addressing post-high school education , but the tool can be used for any education funding).

This article

- describes how higher education costs have skyrocketed over the years.

- presents the most popular reasons for huge education price increases.

- describes the (woeful) status of education debt.

- provides an embedded education funding calculator with examples.

College Education Costs Have Skyrocketed!

College Costs have Significantly Outpaced Inflation

In the United States, higher education costs increase year after year and at a rate faster than any other good or service. The same can be said for private schooling on any level.

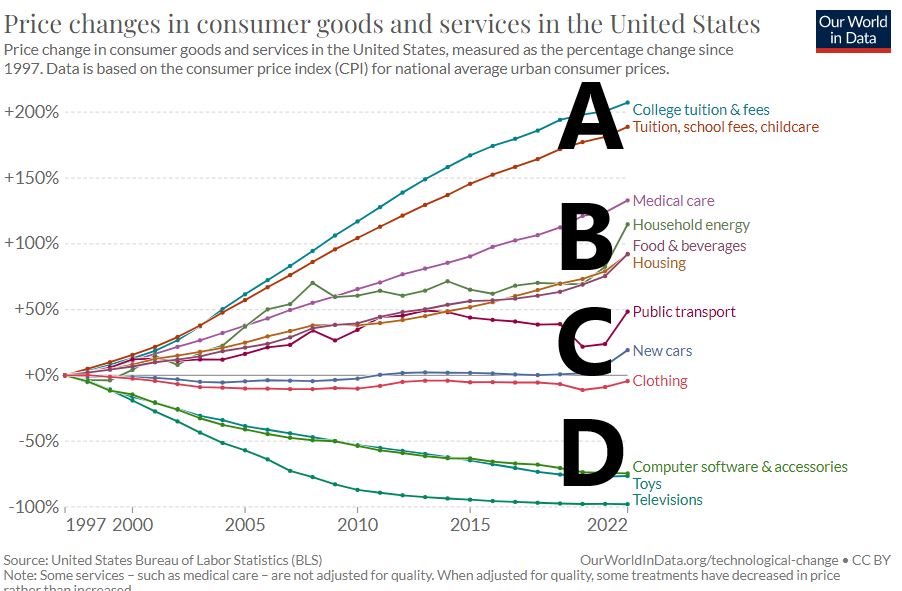

Take a look at Schematic_2.1 below, courtesy of ourworldindata.org.

Schematic 2.1: Price Changes in Consumer Goods and Services in the United State

According to Schematic_2.1, the price of college tuition (A on the graph) doubled (**) since 1997 ,but computer related items and TV costs (D on the graph) dropped significantly. Some economists argue that price levels and the extent of government intervention correlate inversely. For higher education the intervention comes in the form of government loans (more on this in later sections).

(**) It’s more than this I think. I looked at data from the U.S. Department of Education, National Center for Education Statistics for the period 1997 to 2022. I compute the following: For all 2 and 4 year institutions, average prices have increased by the following factors:

- All Institutions (1997 to 2022 cost increase factor): 2.7x

- Public Institutions (1997 to 2022 cost increase factor ): 3.1x

- Private (for-profit and not-for-profit Institutions 1997 to 2022cost increase factor ): 2.6x

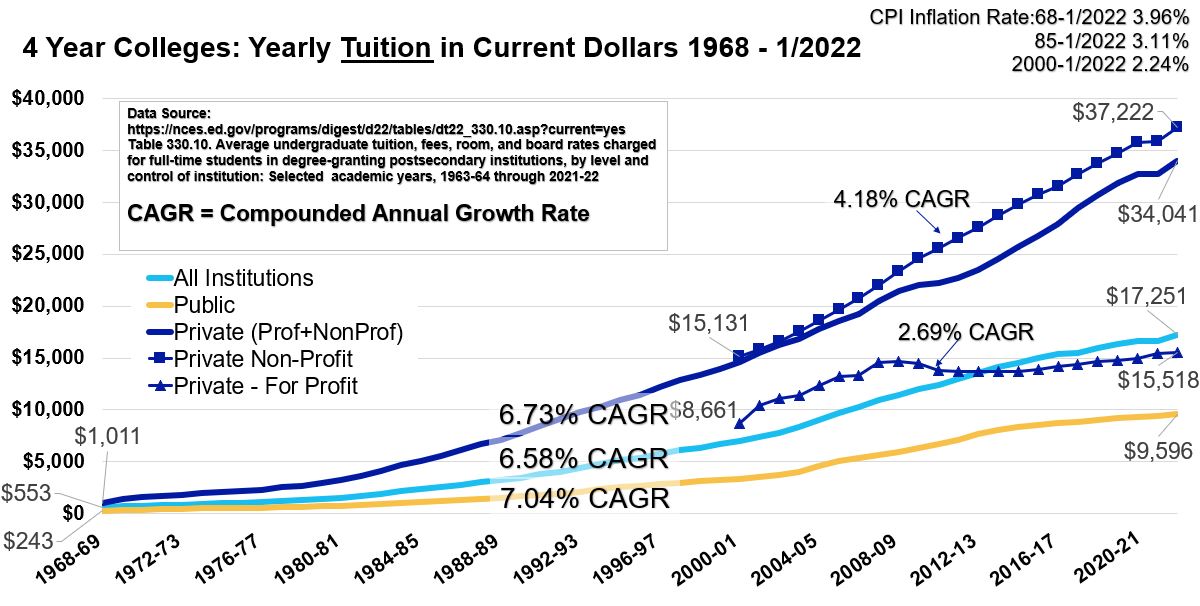

Check out Schematics_2.2 and 2.3 below which I generated from the U.S. Department of Education, National Center for Education Statistics Table 330.10.

In Schematic_2.2, the average tuition costs for all institutions, public institutions, and private institutions are plotted over time.

Schematic 2.2: 4 Year College Yearly Tuition + Fees in Current (not adjusted for inflation) Dollars

So, for example, for private for-profit and non-profit colleges, the average tuition (only tuition) cost was about $34,041/yr in 2022.

- The Compounded Annualized Growth Rate (CAGR) from 1968 to 2022 was 6.73%. You can compute the CAGR with this formula (CAGR = (End Value/Beginning Value)^(1/periods) – 1). So 6.73% =(34,041/1011)^(1/54)-1. For Private colleges, the average price increased by about 33.7 times (or 3367%).

- Or we can describe the growth using the lump sum compounding formula: 1011(1+.0673)^54 = $34,041.

- The CAGR of 6.73 is 6.73/3.96 = 1.7x the rate of inflation for the same period. Because of the compounding effect, this difference is huge over 54 years: The growth factor is (1.0673)^54= 33.7x for tuition increases versus (1.0396)^54 = 8.14x for general inflation increases.

- The growth factors will vary based on the time period you choose. For example, if we just look at not-for-profit private schools from 2000 to 1/2022, the growth rate was 4.18%. Compared to the inflation rate for this period, tuition grew 4.18/2.24 = 1.9x.

- No matter how you slice it, average college costs have grown much faster than inflation. (let’s say 1.5x to 2x depending on what you measure and what timeframe you use).

- One exception since 2000 is for-profit private college costs growth which is roughly 20% higher than the general inflation rate. The numbers of these kinds of schools peaked out in 2012 and have essentially fallen ever since. Some have entered bankruptcy (See Corinthian Colleges , ITT Technical Institute, and Education Corporation of America) and others have been accused of overcharging and under delivering.

Don’t Forget Room and Board and Other Expenses

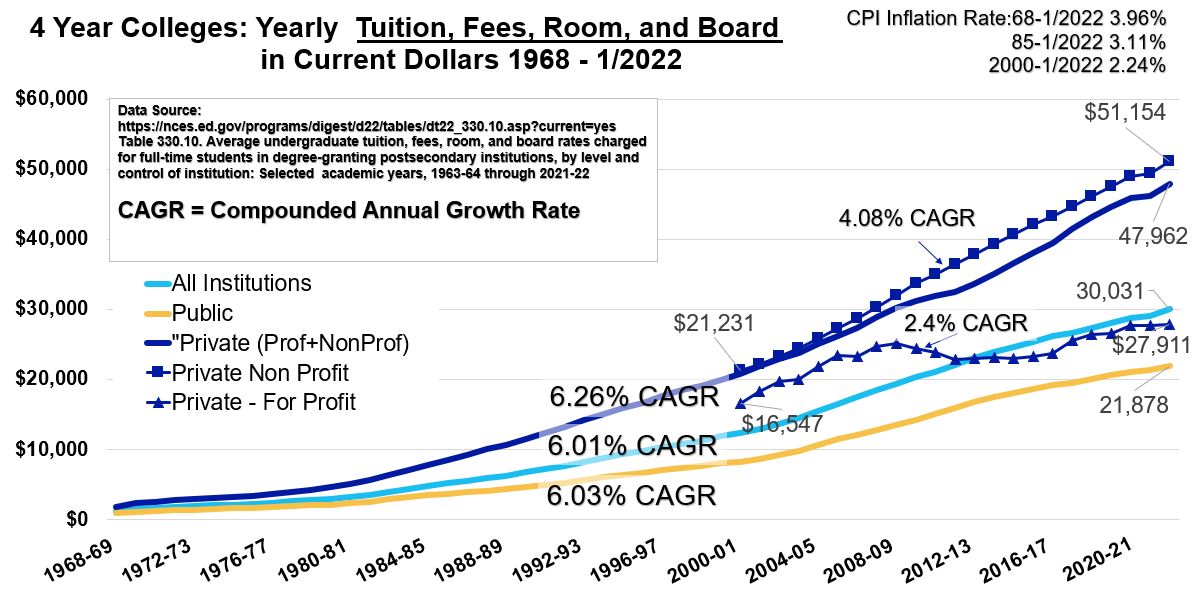

Sadly, we are only talking about tuition and fee costs in the above graph. On average, I estimate that room and board and food costs will run you an additional $16,000 /year.

Schematic_2.3 shows the average total costs (tuition + room and board and other expenses). Look at the average yearly total cost for non-profit private colleges at $51,154/year !!

Schematic 2.3: 4 Year College Yearly Total Cost in Current (not adjusted for inflation) Dollars

If you scour the internet, you will find articles claiming that college costs have risen as high as 5x the inflation rate. If you pick the right start and end data and do the CAGR calculation you can probably get these higher numbers. Just remember that the compounding effect will make a big difference even when the number is much smaller that 5x (Most of my computations resulted in 1.2 to 2x the inflation rate which still produce very large differences).

Averages

All the cost data shown in the graphs above are based on averages. With averages you need to be very careful. An average tells you the most typical value. But this assumes that the distribution is normal (i.e. you get a symmetrical bell shaped distribution curve when you plot frequency vs value ranges; You can use Microsoft Excel to do this). The more the distribution deviates from normality, the less meaningful the average will be.

I used a massive data base compiled by Collegescorecard.ed.gov to take a look at the distributions. For public institutions , the cost distributions are skewed to the right, meaning the average is going to be larger than “typical”. You can look at the mode (most common value) or median (the middle value) to see what typical might mean.

For private institutions, the distribution is more even but very irregular. All this to tell you that the average might not really be meaningful to you. For initial estimates, you have to start somewhere so I would recommend you go to https://educationdata.org/average-cost-of-college.

But you wont really get a working idea of your actual cost until you narrow down your college selection (public or private, in-state or out-of-state, etc.).

High Cost Colleges

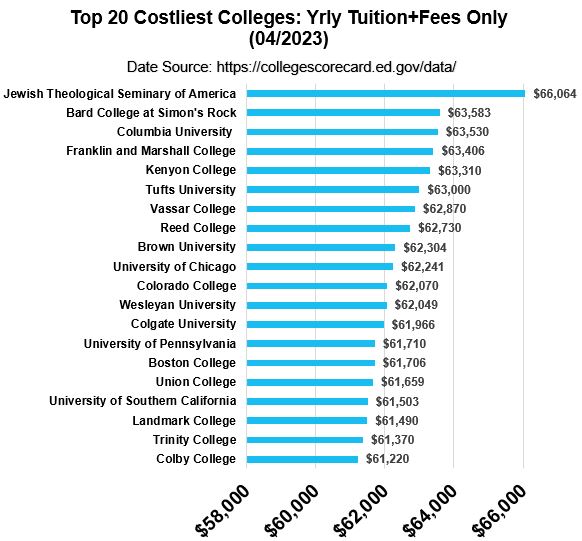

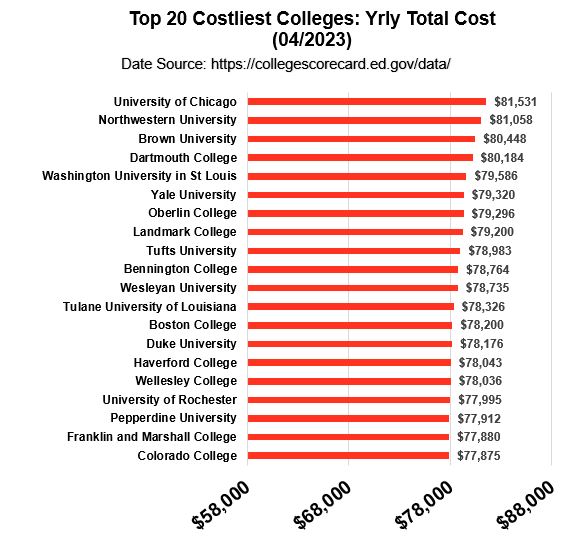

Case in point, look at the (absolutely ridiculous?) costs of the following universities which I compiled from Collegescorecard.ed.gov . Schematic_2.4 shows the top 20 college tuition-only costs. The top 20 universities based on total cost are shown in Schematic_2.5.

Schematic 2.4: Top 20 Costliest Colleges: Yearly Tuition + Fees Only

Schematic 2.5: Top 20 Costliest Colleges: Total Cost

So, let me get this straight; an undergraduate degree from the University of Chicago costs approximately $81,531/year? Assuming your kid gets out in 4 years, you will have paid $326,000 !! According to the Collegescorecard.ed.gov data set, there are 250 schools that have tuition and fees > $45,000/yr. Let’s add an average $16,000 for additional expenses and that comes out to $61,000/yr total costs for over 250 universities. ($244,000 /4 years). H.F.S.

Why on earth are college costs skyrocketing like this? Read on.

Why are College Costs so High?

I’ve provided some reasons below for why college costs have increased much faster than the general inflation rate. Keep in mind that

- Many of the reasons are not mutually exclusive making this a multivariable problem to solve.

- Several of the proposed reasons are intriguing enough to warrant deeper study, but we’ll only present some broad strokes in this article.

1. Basic Economics

Supply prices are going to rise as demand rises. There are a limited supply of university slots available today. Lots more demand than supply gives these institutions massive leeway to raise prices. Why would a university stop raising prices if people are constantly willing to pay those prices? What is driving demand?

Demand: College Degrees Increase Pay

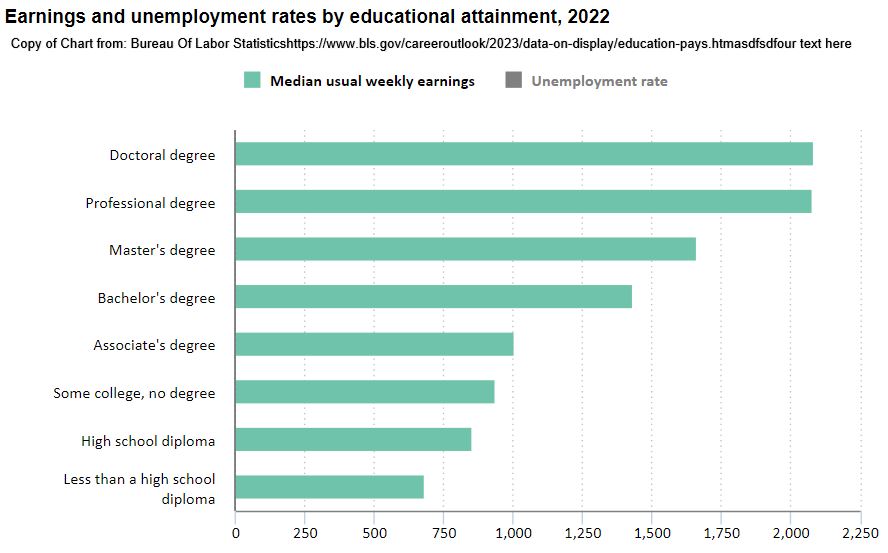

Fundamentally people believe that a college degree will raise their standard of living above those who don’t have college degrees. The data bear this out:

In the BLS Chart shown in Schematic_3.1 , you can see how people with four year college (or higher) degrees have better weekly earnings than people with Associates Degrees, High School Diplomas or less than High School Diplomas.

Schematic 3.1: Bureau of Labor Statistics Education Pays Chart 2022

Demand: Enrollment

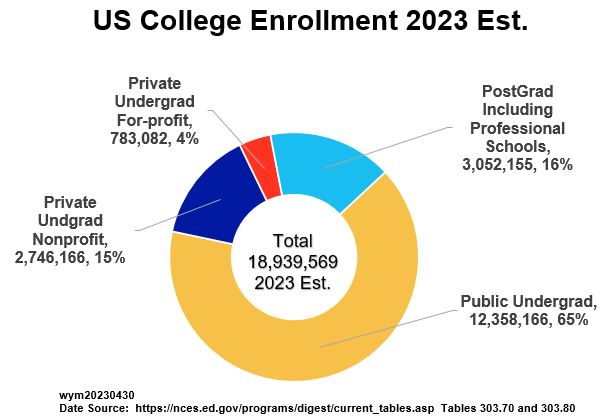

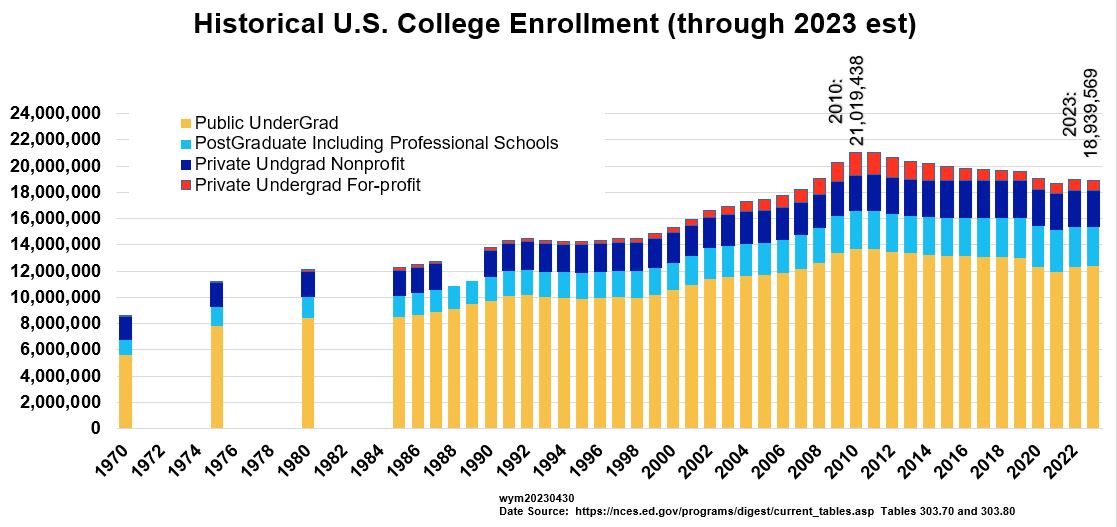

See Schematics_3.2 and 3.3 below for US college enrollment data. These charts were generated from the data available at the National Center for Education Statistics

Schematic 3.2: US College Enrollment 2023 Estimated (18.9 Million)

Schematic 3.3: Historical US College Enrollment (Peaked in 2010 at 21 Million)

Notice there was a steady increase in enrollment until about 2010. Total Enrollment has been dropping since 2010. Some of the reasons for this are:

- The Great Recession of 2007 – 2009 and the Covid Pandemic 2019-2022

- Decline in Youth Population (See : Looming Enrollment Cliff)

- Poor performance of many private for-profit Institutions. (some of the reasons for this are: low graduation rates, poor job placement, tarnished reputation due to malfeasance and resultant governmental investigations etc.; see : For Profit College System is Broken)

- Belief (due to the above) that college education is not worth the price

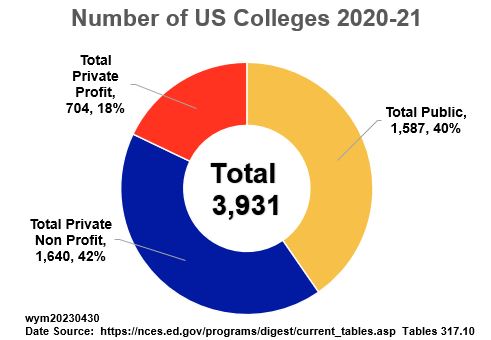

Supply

According to the National Center for Education Statistics ,NCES, at the end of 2020, there were about 3,931 (2 and 4 year) public and private colleges in the US. About 42% percent are private non-profit institutions and about 40% are public universities. The remaining 18% are private for-profit institutions: These are owned and operated by private groups (e.g. Devry, Strayer, Univ. Of Phoenix etc.).

Schematic 3.4: Number of US Colleges 2020-21 (3,931 total)

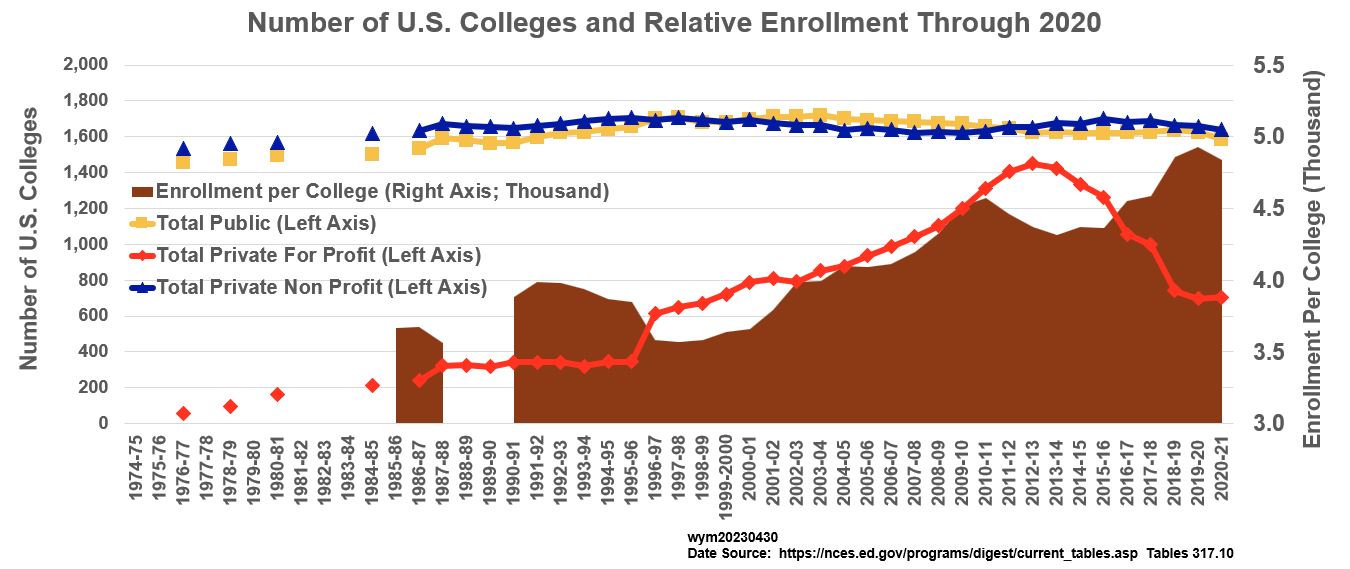

Schematics_3.5 and 3.6 chart historical enrollment and number of colleges. Some interesting patterns appear in these charts.

Schematic 3.5: Historical US College Enrollment (Number of Public and Non-Profit Private Colleges are Flat)

The enrollment data points in Schematic_3.5 (and 3.6) are expressed as the ratios of the total enrollment / number of colleges. You can see that the number of traditional public and private (non-profit) institutions have remained roughly constant. But look at the trend of the number of private for-profit colleges (the red line). These have increased a lot over the years. As noted earlier, they “blew up” due to the Great Recession and bad performance (bad graduation rates, lots of government scrutiny and lots of bankruptcies).

But notice the brown area curve in Schematic_3.5. This enrollment/number of colleges ratio dipped starting in 2012 ,but it has gone right back up (suggesting overall demand is still high, regardless of the drop in the for-profits.)

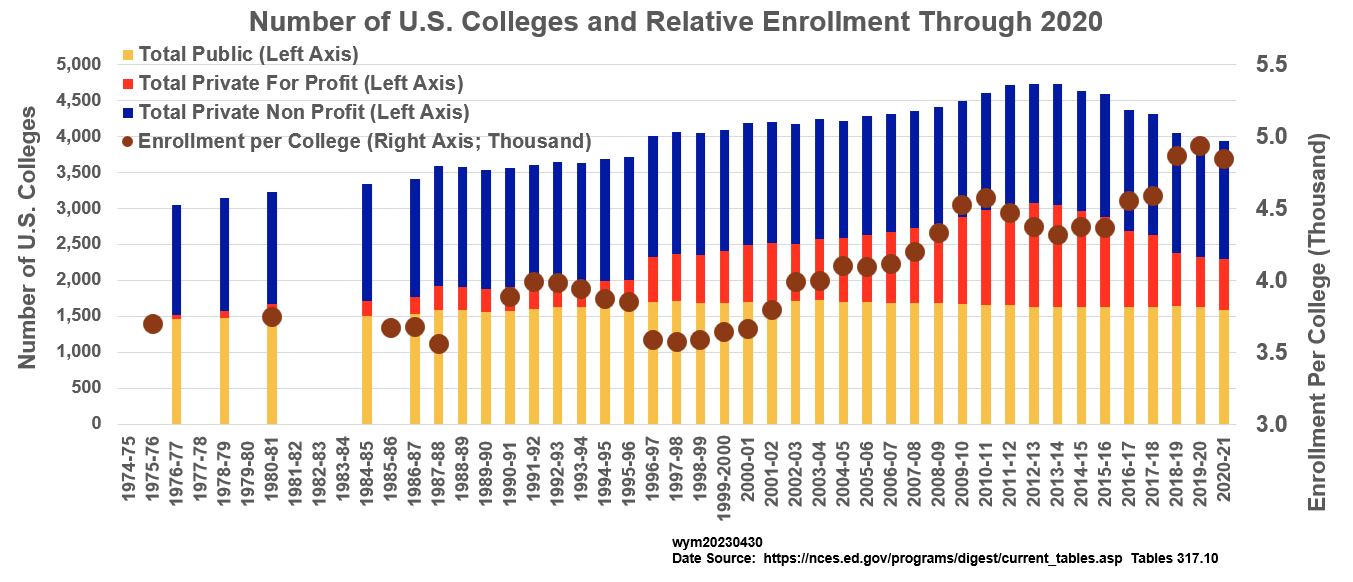

Schematic_3.6 is a variation of Schematic_3.5 where the stacked bars show the college number totals. The enrollment/number of colleges ratio is shown as the brown dot trend. Again, the most recent value is a little off the highest value.

Schematic 3.6: Historical US College Enrollment (Number of Public and Non-Profit-Private Colleges are Flat)

So, the charts above tell me that demand is very strong and allows the current operators to keep the costs high.

2. Marketing: Selling exclusivity

I’ll call this the “country club” effect. Some people (enough people for sure) will pay more for status, bragging rights, and extra services. Some suggest that Ivy League schools among other high tuition schools pander to exclusivity (as enrollment rates at many elite schools have hardly increased through the years. Read this: Why Don’t Elite Colleges Expand Supply?)

3. Less Public School Funding

Public Colleges are receiving less money from state governments. This is a long term trend. Read this: 2016 Center on Budget & Policy Priorities Funding Down, Tuition Up

4. More College Services

To attract students colleges are spending heavily on new campus facilities and student services (dorms, food service, gyms, other facilities, counseling and healthcare services). Have you been on your average campus recently? Things have gotten very fancy. I can see how administrative university costs would increase given these additional services. Read this: 2019 The Cost of Excess – College Runaway Spending

5. Faculty Costs

Some claim that increasing costs of faculty have contributed to increased college costs but looking at the data from NCES, I don’t see significant growth here (relative to general inflation). For example, from 1990 to 2021, using the NCES data, I compute a compounded annual growth rate of 2.5%.

The data might look different for elite colleges though. There are several articles out there describing how educational teaching jobs don’t tend to improve productivity-wise but tend to increase in cost to keep up with equivalent paying jobs in higher productivity fields (otherwise people would go to the higher paying jobs). This is sometimes called the Baumol Effect or Baumol’s Cost Disease. Again it’s not super clear to me how significant a contributor this has been to overall college costs.

6. Federal loans

In additional to being non taxable enterprises (watch this Stossel Video freeloader-u and read 2020 Stossel Reason.com how-elite-colleges-rip-off-taxpayers), colleges (many claim) are massively benefiting from Federally funded student loans.

This one is a very controversial topic as there seem to be as many articles supporting it as there are discounting it.

In February 18, 1987 then Secretary of Education William Bennett published an influential article titled “Our Greedy Colleges“. In it Bennett claims that financial aid has enabled (not necessarily caused) the rates of tuition increases to be higher than the inflation rate. There have been numerous studies trying to confirm or disprove this theory.

The “Bennett Hypothesis” goes something like this: Loans are available to students regardless of need (i.e. students are not vetted like with a normal loan). Parent and Graduate PLUS loans are easy to get as well. The universities know this so increase the cost to, in essence, capture some of this government assistance. The universities get paid up front so there is no great incentive to ensure those students graduate.

Readings:

- 2022 NationalReview.com why-college-still-costs-too-much

- 2022 Mciverinstitute.com the-real-reason-for-the-student-loan-crisis-government

- 2022 Causes and Solutions-to-the-student-debt-crisis

- 2022 RichmondFed.org Do Student Loans Drive Up College Tuition?

- 2021 Medium Why College Is Too Expensive

- 2019 Why College Tuition Is so Expensive?

- 2019 Berkley Economic Review our-greedy-colleges-revisited

- 2017 Martin Center The Bennett Hypothesis Turns 30

- 2017 NY Fed Credit Supply and the Rise in College Tuition

- 2016 NBER Accounting for Rise in College Tuition

- 2015 Downsizinggovernment.org : Higher Education Subsidies

- 2014 Relationship between Fed Student Aid & Increases in College Prices

Student Debt

Ok, let’s dig into Federal Student Debt a little more. In this section I’ve created some graphs using data from the following two resources:

- Household Debt and Credit Information from the New York Federal Reserve

- Office of Federal Student Aid

Federal Student Debt tracked by the Office of Federal Student Aid comprise three categories:

- Direct Loans are loans made directly by the U.S. Department of Education

- Federal Family Education Loans (FFEL) are loans that were originally funded by private companies (but are now Federally backed).

- Perkins Loans were subsidized loans (the government payed the loan’s interest while student was in school). Perkins loans are no longer available to students.

Based on the Federal Student Aid Portfolio Summary Table for Q2 2023,

- Direct Loans amount to $1.446 Trillion or 87.93% of total federal student aid.

- FFEL (Federal Family Education Loans) amount to $194.7 Billion or 11.84%.

- Perkins loans amount to $3.7 Billion or .23%.

- Total Federal Student Loan Amount = $1.644 Trillion (does NOT include Private Student debt).

- According to the Federal Reserve G19 report , Total Federal + Private Student Debt in Q2 2023 was about $1.774 Trillion. So, if we assume that the same estimation basis was used, Private Debt adds an additional $130 Billion to the Federal only total.

- Remember that 1 Trillion is 1 with 12 zeros after it (it’s a F.B. number).

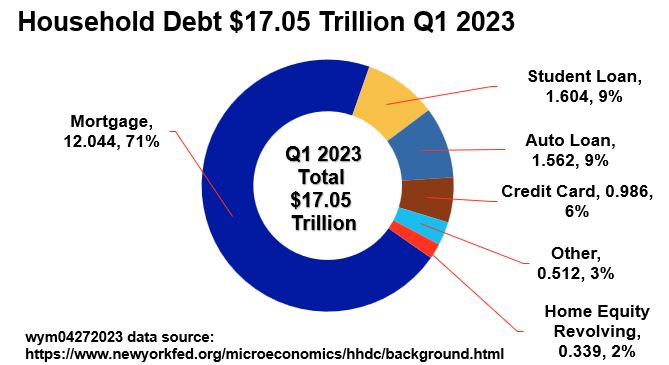

Let’s get some perspective on the Federal Student Debt by looking at overall Household Debt (See Schematic_4.1 below).

Schematic 4.1: Household Debt Q1 2023 Snapshot ($17.05 Trillion)

Note: New York Fed Data only includes Federal Student Debt (Private Debt not included)

Federal Student Debt is counted and tracked as part of what is called Household Debt. Household Debt is basically private consumer debt made up of Mortgages, Student Loans, Auto Loans, Credit Card Loans, Home Equity Loans and other.

Schematic 4.1 shows a snapshot estimate of Household debt as of Q1 2023. Mortgages represent about 71% of the total Household Debt ($12 Trillion!). Using a US Q1 2023 US GDP (Gross Domestic Product) of $26.53 Trillion, Mortgage Debt is ~45% of the total US GDP. You can imagine how a “housing crisis” could destabilize the US economy (as it has in the past).

We’ll put aside the very interesting (terrifying) topic of the total US Debt and save that for another article. Let’s focus on the Federal Student debt. It’s about 9% of total Household Debt and comes in second behind Mortgages. A close third is Auto Debt.

Please note that the New York Federal Reserve data does not include Private Student Debt whereas the Federal Reserve G19 report does (rough difference is about $120 Billion for Q2 2023).

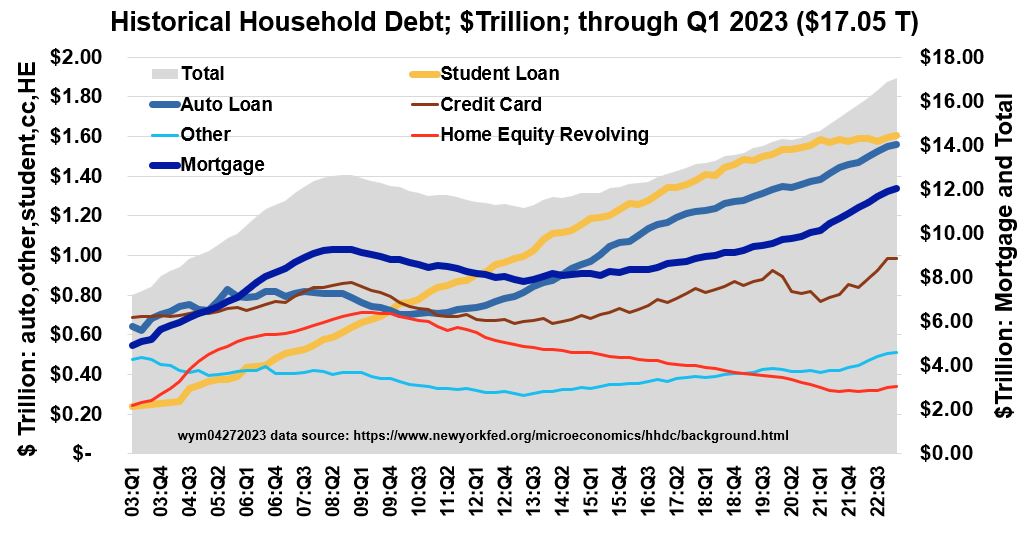

Schematic_4.2 below shows historical Household Debt using a line_area chart. Mortgage Debt and Total Household Debt values should be read off the right axis. Notice that

- Student Debt growth has been consistently upward sloping (slowed in recent years due to the Great Recession and Covid).

- Only Student Debt, Auto Loan Debt and Mortgage Debt have been (substantially) rising in recent years.

- The shape of the Mortgage Debt line can be explained by the Subprime Mortgage Crisis of 2007–10. Mortgage Debt levels peaked in Q3 2008 and broke through these pervious highs in Q2 2019 (11 years later).

Schematic 4.2: Historical Household Debt Through Q1 2023 (Only Federal Student Debt Counted)

Note: New York Fed Data only includes Federal Student Debt (Private Debt not included)

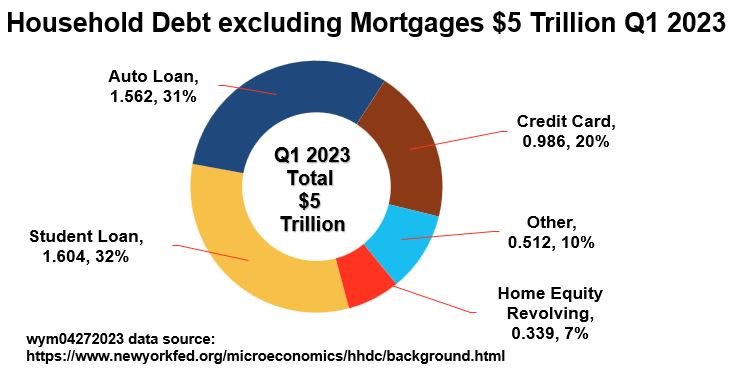

Schematics_4.3 and 4.4 below are the same pie and area charts as above, except that we’ve removed the Mortgage numbers.

Schematic 4.3: Household Debt Excluding Mortgages Q1 2023 Snapshot ($5 Trillion)

Note: New York Fed Data only includes Federal Student Debt (Private Debt not included)

Not including Mortgage Debt, Federal Student Loans and Auto loans make up about 32% and 31% of the remaining $5 Trillion household debt.

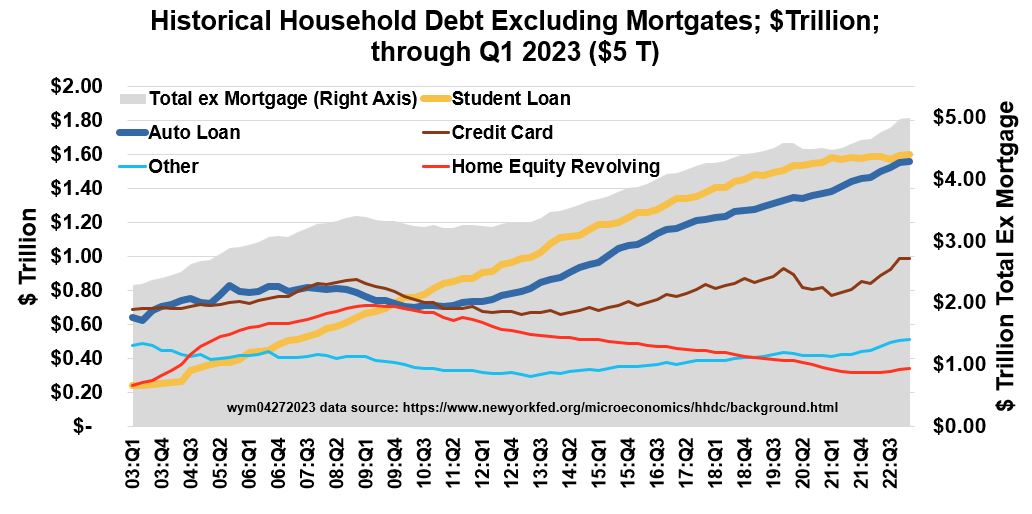

Schematic_4.4 is the same as Schematic_4.2 except Mortgage Debt is not included. We see that Student and Auto Debt have steadily increased since ~2010/11.

Schematic 4.4: Historical Household Debt Excluding Mortgages Q1 2023 ($5 Trillion)

Note: New York Fed Data only includes Federal Student Debt (Private Debt not included)

Student Debt Characteristics

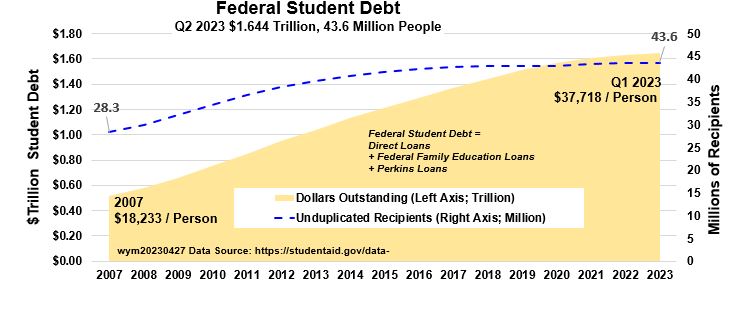

Schematic_4.5 below was generated using data from the Federal Student Aid Portfolio Summary. According to data from this source:

- Total Federal Debt as of Q2 2023 is $1.64 Trillion

- The Federal Student Debt per borrower is $37,718 (double the value from 2007)

Schematic 4.5: Historical Federal Student Debt Through Q1 2023 ($1.64 Trillion)

Note: The Federal Student Debt values don’t include Private Student Debt.

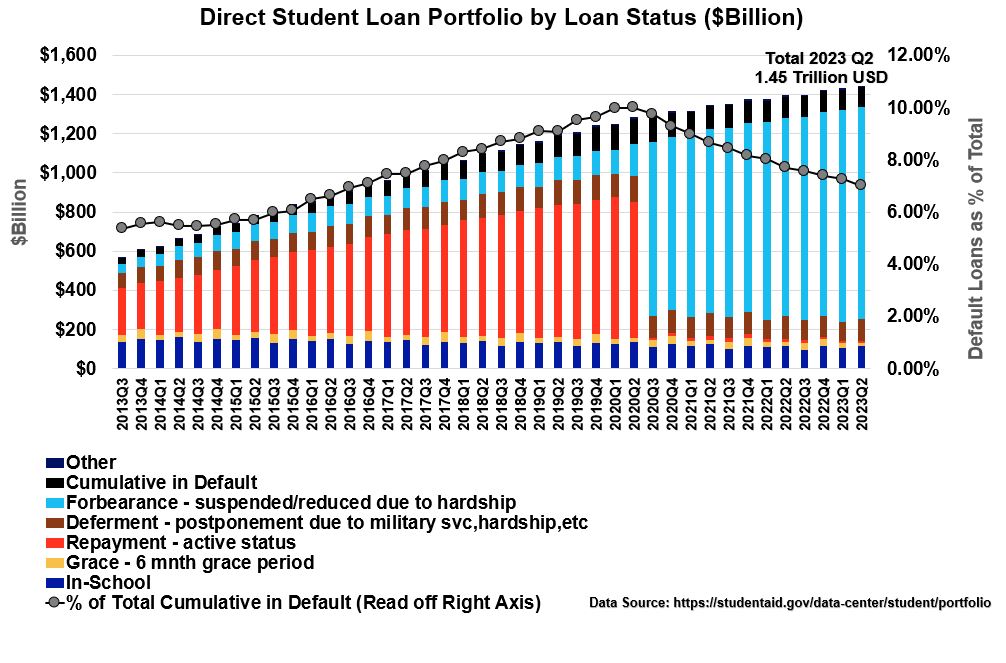

Schematic_4.6 shows information on Federal Direct Loans through Q2 2023. Note that after Q1 2020, Provisions in the CARES ACT as well as administration executive actions have caused large shifts in categorization. So, I don’t think the data can be reasonably interpreted after Q1 2020. I don’t believe there is any real substantial reason for the default line (with grey dots) to begin dropping.

The government is interfering and trying to figure out ways to relieve what they know is a big problem with debt holders being unable (or finding it very difficult) to pay back their loans.

Schematic 4.6: Historical Federal Direct Student Loan Portfolio Through Q2 2023

Note: The Federal Student Debt values don’t include Private Student Debt.

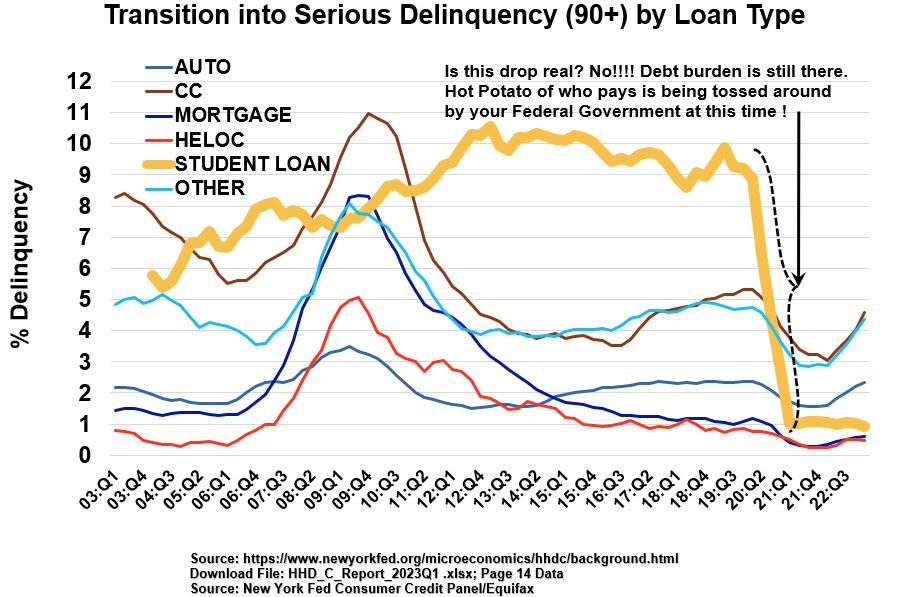

Look at Schematic_4.7 below, which I created from another set of data (from the ‘page 14 data’ sheet of the excel download from the New York Fed microeconomics page).

Delinquency rates for Student Debt are much higher than other consumer debts. Again, ignore the recent precipitous drop. If it’s real, it just means the government has to figure out a way to recover those delinquency costs (can you guess what they’ll probably try to do?).

Schematic 4.7: Consumer Debt Delinquency Rates (New York Fed Data)

Here are a few other sobering statistics for you (based on this article by the Austin American Statesman and other references listed below):

- Based on data from the National Center for Education Statistics, a review of borrowers who started college in 2012, shows that only 40% (i.e. 60% didn’t) had a bachelors degree 6 years later (39% had no degree at all with the others having associate degrees or certificates).

- Note: The above study might not be fully representative and a little misleading because it only looks at 2012 freshman. In addition, undergraduate college completion rates are often longer than 4 (5? or 6?) years (this is kind of a problem in itself isn’t it?). Also, Graduate school borrowers are not included in the statistic.

- A 2019 Federal Reserve Survey of Consumer Finances showed that 43% of households who had education debt did not have a college degree.

- To summarize…Houston, we have a problem. There are probably many people who are holding debt that might not have the capacity to earn enough to pay back loans in a timely manner.

- Other References: (a) 2022 Verification that 40% of debt owners dont graduate (b) 2021 Almost 40% of borrowers with student loan debt didn’t finish their degree in 6 years (c) 2019 Why College Tuition is So Expensive.

Summary

So, to summarize, the data above tells us that:

- As of Q2 2023, outstanding Federal Student Debt is about $1.64 Trillion (with an additional ~.134 Trillion of Private Student Debt).

- After Mortgage Debt, Student Debt is the highest consumer debt (Auto Loan Debt is a close third).

- Student Debt growth over the years has shown the steepest trajectory upwards. (compared to the other consumer debts).

- Student Debt delinquency rates are much higher than the other consumer loans.

- Some studies show that a large percent of education debt belongs to people without degrees.

Ok, we now know a little more about the state of education cost and debt. Let’s switch gears and describe how you can use the education funding calculator embedded in this article.

Education Funding Calculator Description

The Education Funding Calculator (located in the next section) computes monthly, yearly, or lump sum (today) savings requirements for funding a college education. Note that the tool can be used for any type of future cost planning.

The Calculator uses Time Value of Money (TVM) calculations to

- compute the Net Present Value (NPV) of current savings and future college costs. This represents the lump sum required today to fund the future estimated costs.

- compute the annual (with straight reduction to monthly) savings required to meet the future costs. The required periodic savings payments are computed based on inputs defining the duration and timing of the savings.

The Calculator uses the following Excel TVM Functions:

- Net Present Value Function: =NPV(rate,value1,value2,value3,…)

- Periodic Payment Function: =PMT(rate,nper,pv,fv,type)

Where

- NPV = net present value of all cash inflows and outflows

- PMT = periodic constant payments (savings) at beginning or end of period

- rate = rate of return of investment

- value1,etc = cash inflow (savings) or cash outflows (costs) for each year

- nper = number of compounding periods

- pv = present value

- fv = future value

- type = 1 (cash flow timing at beginning of period) or 0 (…end of period)

Funding Calculator Examples

Let’s go through 3 examples of how to use the embedded Education Funding Calculator.

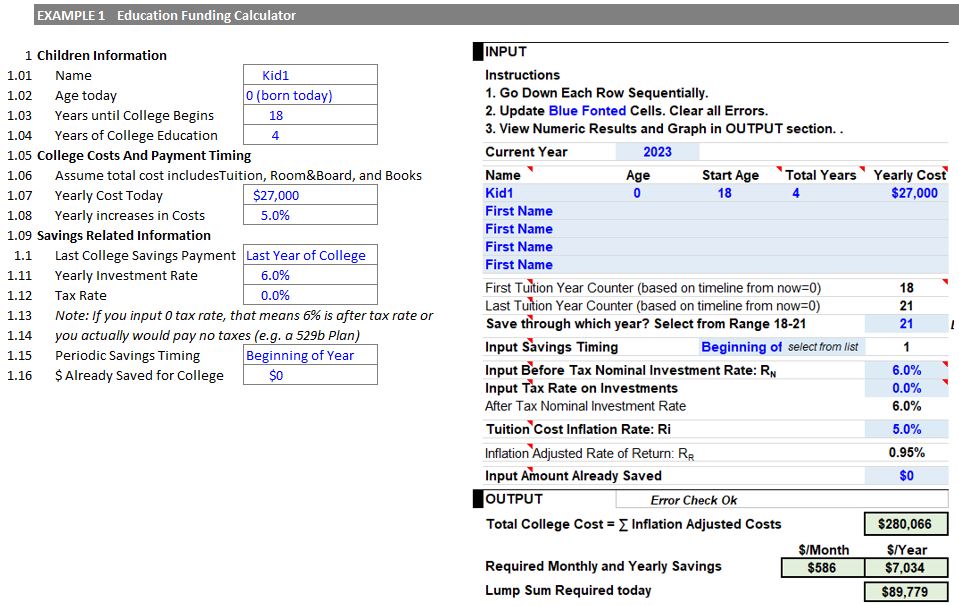

Example 1 One Child Born Today (no current savings)

- You have 1 child born today.

- She will attend college when she is 18.

- It will take her four years to finish.

- Today’s yearly cost for college is assumed to be $27,000.

- The cost of college will increase 5% each year.

- Assume you will save until the last year of college.

- Assume your yearly investment rate return is 6%.

- The tax rate is 0% (it’s in a 529 B college savings plan). Note that we could set this as zero percent also if we assume our yearly investment rate of return is an after tax return.

- Savings will occur at the beginning of the year.

- Assume you have no current savings for college.

Enter these values into the INPUT section of the calculator.

Results (see the OUTPUT section of the calculator)

- Total inflation adjusted education cost will be $280,066.

- Required Yearly savings are $7,034/yr ($586/mo).

- The single value lump sum required today to pay for this will be $89,779.

Schematic 7.1 : Education Cost Funding Calculator Example 1

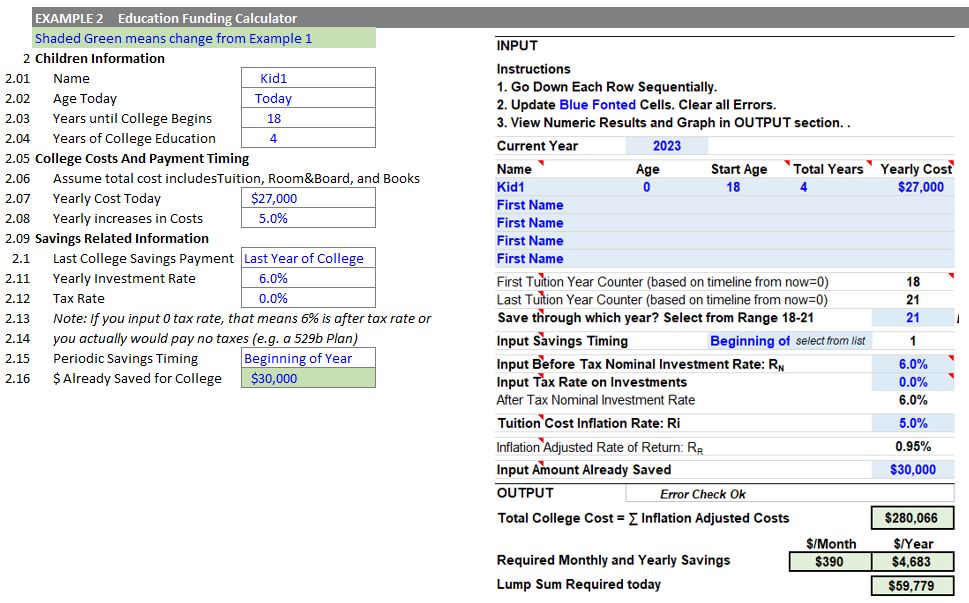

Example 2 One Child Born Today (with current savings)

- You have 1 child born today.

- She will attend college when she is 18.

- It will take her four years to finish.

- Today’s yearly cost for college is assumed to be $27,000.

- Assume the cost of college will increase 5% each year.

- You will save until the last year of college.

- Assume your yearly investment rate of return is 6%.

- Assume tax rate is 0% (it’s in a 529 B college savings plan). Note that we could set this as zero percent also if we assume our yearly investment rate of return is an after tax return.

- Savings will occur at the beginning of the year.

- Assume you have current savings for college for $30,000.

Enter these values into the INPUT section of the calculator.

Results (see the OUTPUT section of the calculator)

- Total inflation adjusted education cost will be $280,066.

- Required Yearly savings are $4,683/yr ($390/mo).

- The single value lump sum required today to pay for this will be $59,779.

Schematic 7.2: Education Cost Funding Calculator Example 2

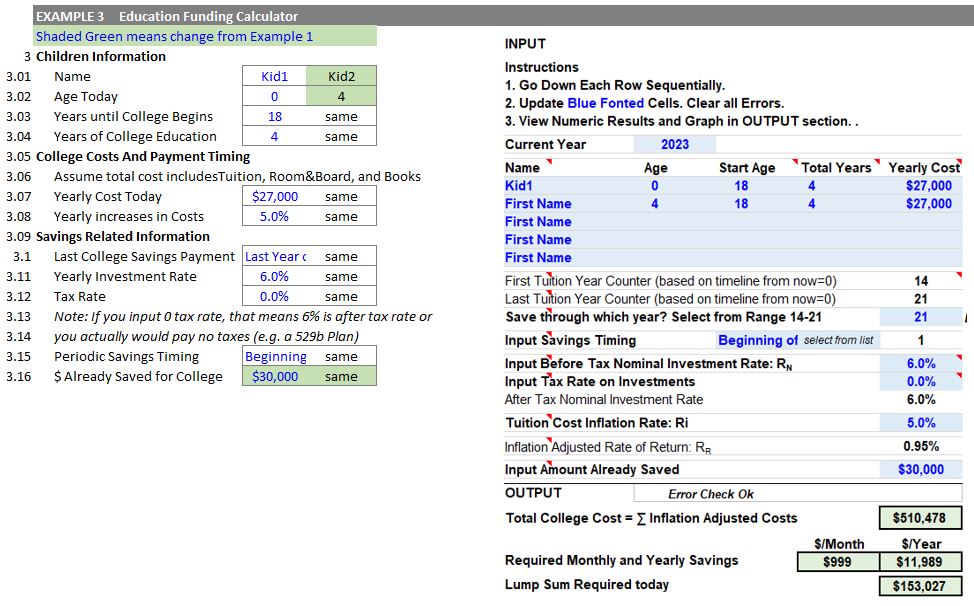

Example 3: 2 Kids (with current savings)

- You have 1 child born today.

- You have a child who is 4 years old.

- They will both attend college when they are 18.

- It will take them four years to finish.

- Today’s yearly cost for college is assumed to be $27,000 (for both kids).

- Assume the cost of colleges will increase 5% each year.

- Assume you will save until the last year of college.

- Your yearly investment rate of return is 6%.

- Assume tax rate is 0% (it’s in a 529 B college savings plan). Note that we could set this as zero percent also if we assume our yearly investment rate of return is an after tax return.

- Savings will occur at the beginning of the year.

- Assume you have current savings for college for $30,000.

Enter these values into the INPUT section of the calculator.

Results (see the OUTPUT section of the calculator)

- Total inflation adjusted education cost will be $510,478.

- Required Yearly savings are $11,989/yr ($999/mo).

- The single value lump sum required today to pay for this will be $153,027.

Schematic 7.3: Education Cost Funding Calculator Example 3

Conclusion

As we look to causes and reasons for the explosion in college costs (and excessive education debts) , I think first and foremost we need to remind ourselves to take ownership of the decisions we make.

The “buck” stops with us. We are accountable for our decisions. Yes, it’s possible that others will deceive us or just give us bad advice, but in the end, we are making the payments and we are borrowing the money.

We should educate ourselves and seek help from reliable consumer protection organizations and our State and Federal Governments.

Let’s use and apply common sense as we make our choices. We should be answering questions like: Does the institution have a good reputation? What degree do we want? Does the degree pay out over time relative to the cost? If I borrow, how long will it take me to pay the loan back?, etc.).

Let’s summarize some of the key points of this article:

College Costs have grown from 1.5x to 2x as fast as the general inflation rate

College Education costs have increased at a much higher rate than inflation. Due to compounding (exponential growth), a few percentage points difference over many years results in large multiplier differences.

For example, from 1968 to 2021, tuition costs at private for-profit and non-profit colleges increased by a compounded annual return of 6.73% versus about a 3.96% inflation rate. Over this 54 year period, tuition costs increased 1.7x as fast as the general inflation rate. So, costs grew by 33.7x while the general costs of goods and services increased by about 8.14x!

If you look over different time periods (public or private colleges), the tuition rates have grown anywhere from 1.5x to 2x the inflation rate.

The cause/s of this cost explosion is a highly politicized topic. There are multiple variables at play and there is generally a lack of consensus on many of the suggested reasons.

Causes of High Costs – Supply and Demand

My view is that a big reason for the massive cost inflation is that enrollment growth is outpacing the availability of college “slots”. Traditional private and private colleges numbers have remained fairly constant through the years while enrollment has boomed.

It is true that for-profit private institutions (e.g. Devry, Strayer, Univ. of Phoenix etc.) boomed along with the boom in enrollment but their numbers rapidly declined during the Great Recession (a little bit of fraud didn’t help either). But enrollment has remained high. So, basic supply and demand is a big reason I think.

An interesting question is, why haven’t traditional public and non-profit private institutions increased in number (or sufficiently in enrollment). Some suggest that accreditation is difficult and is heavily influenced by the existing universities themselves.

Other Causes of High Costs

Other popular reasons for high college costs are

- Less government funding of public institutions. This has been happening since Reagan was governor of California.

- Non academic administrative and service costs have increased

- Free-for-all, unvetted, Federal Education Loan subsidies enable universities to crank tuitions up, etc. Please note there is no vetting process that occurs with these Federal loans like there would be with a traditional lender (to give the lender some assurance the borrower will be able to pay the loan back).

Education Debt is Becoming a Problem (is a Problem)

At $1.64 Trillion, Education (Student) Debt is the second largest consumer debt after Mortgage Debt. It has shown the fastest growth relative to all the other consumer debt types.

With respect to % of loans with a 90+ day delinquency status (8-10%), Education Debts are much higher than the other consumer debts: 3.74x Auto Debt, 1.67x Credit Card Debt, 7.58x Mortgage Debt,1.5x Heloc Debt, and 1.87x Other Debt.

More than one study shows that roughly 40% (maybe higher) of people with education debt DO NOT have a college degree after 6 years.

Your Educational Institution is Accountable

U.S. public and private non-profit Institutions are tax-exempt because they are (1) non-profit organizations that provide a (2) public good.

- With respect to (1), at least on the surface (emotional level perhaps), I don’t think the average citizen is going to see any fairness in super exclusive schools not paying taxes (see Stossel’s articles and video). Many of these have tiny student bodies and massive endowments and they don’t pay a lick of taxes. Meanwhile, your average income earner pays the brunt of taxes.

- You might argue that if institutions started being taxed, they would just raise tuition to compensate for that. Yes, but at least the average person (who is not going to attend or pay for Expensive Exclusive University X) benefits since the government gets more taxes.

- Perhaps there should be some reasonable assessment done by the government that adjusts tax status based on several factors including tuition, endowment amounts, enrollment size, whether the university is public or private etc.

- Under the purview of “providing a public good”, educational institutions should be providing feedback and guidance to any prospective students who borrow money. The feedback/guidance could consist of a risk assessment and a return on investment analysis.

You are Accountable

Listen, in a free society, people (i.e. universities) are going to take whatever people are willing to pay. You, payer of the tuition, are accountable and responsible for you actions (and the consequences of your actions).

Do the necessary work to understand more about education cost and loans (use the internet or go to your local library and ask the librarian for resources).

If you are considering borrowing money for education:

- Understand the degree or degree options being considered (their effectiveness in securing a job, their return on investment, etc.). Go to trusted sites (like The Bureau of Labor Statistics) to see what typical pay and pay ranges are.

- You should assess the quality of the degree granting institution. What overall reputation does it have? Are graduation rates reasonable? What are it’s % hired rates for the degree of interest?

- Regarding educational loans, make sure you understand the total costs (including compounding interest) and how long it will take to repay the loan.

- Determine if the loan you are taking is affordable relative to the value of the degree you desire. Use an affordability calculator like this one (www.studentdebtsmarter.org/affordabilitycalculator).

Use the power of time and compounding savings to save for future educational costs. Use the embedded calculator in this article to see what your yearly (monthly) savings need to be to fund your (your kids’) future education.

Disclaimer: The content of this article is intended for general informational and recreational purposes only and is not a substitute for professional “advice”. We are not responsible for your decisions and actions. Refer to our Disclaimer Page.