Last Update: November 7, 2022

Introduction

This post provides a broad review of available investment asset classes.

The sec.gov glossary defines an investment as

“..money that is put at risk for the purpose of making a profit”.

In this post, we’ll review the various investment choices available to United States citizens.

I think there are ways for foreigners to invest as well but this post will not cover that topic specifically.

Understanding the general characteristics of various investment categories (investment asset classes) is important.

Some of the reasons for this are:

- It will teach you how risky some investment are relative to others, and will allow you to properly match your risk tolerance to your investment choices.

- You’ll know the options available from which to build your investment strategy.

- A broad understanding provides a foundation for further study into the performance of the various asset classes and how they correlate relative to benchmarks or other assets.

- If you choose to have your investments actively managed for you, you increase the odds of having a transparent and honest relationship with your advisor (because you will generally understand your options and be able to discuss your choices intelligently).

Most people will categorize investments into four asset classes:

- Cash and cash equivalents.

- Equities.

- Fixed income.

- Alternative investments (i.e. everything else)

This post will review available investment options but will only scratch the surface.

Useful links are provided for further study.

Menu

- Investment Asset Classes Overview

- Core Asset Class Types

- Cash and Equivalents

- Government and Corporate Debt

- Equity Market

- Equity Characteristics Overview

- Equities – Style and Size Box

- Equities – Size (Market Capitalization)

- Equities – Style (Value vs Growth)

- Equities – Industries/Sectors/Cyclical vs Defensive

- Equities – Global Characteristics

- Alternative Investments – Overview

- Real Estate

- Infrastructure

- Master Limited Partnerships

- Derivatives

- Commodities

- Currency

- Life Insurance

- Annuities

- Collectibles

- Asset Nomenclature Revisited

- Investment Companies

- Private Equity and Hedge Funds

- Crowdfunding

- Investment Options Table

- Platforms and Markets

- Conclusion

- Appendix 1 – GICS – Stock Classifications

- Appendix 2 – MSCI Country Classifications

Investment Asset Classes

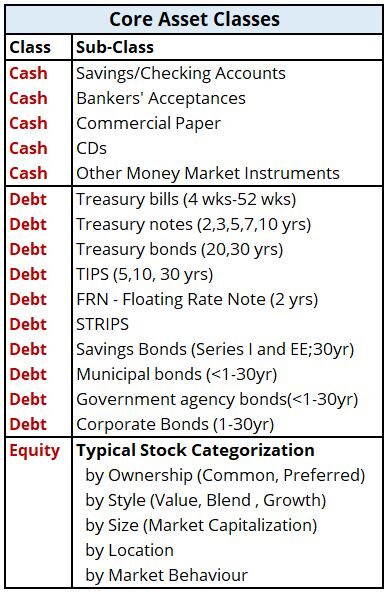

We can somewhat arbitrarily create four categories to describe the investment universe:

- Cash and Cash Equivalents: e.g. hard cash (bills and coins),savings accounts and money market funds.

- Debt instruments: e.g. bonds where you basically own a loan.

- Equity or stocks: where you own part of a corporation.

- Other is basically everything else. You will often hear the term Alternative Investments to describe this category. Alternatives examples would be real estate or commodities.

Graphic 1 – Investment Asset Classes

Cash is the least risky asset and by risky we mean probability of losing money on the investment.

According to the Securities and Exchange Commission (SEC)

“..risk refers to the degree of uncertainty and/or potential financial loss inherent in an investment decision. In general, as investment risks rise, investors seek higher returns to compensate themselves for taking such risks.”

Equities or stocks are riskier than Cash and Debt investments.

See this great Forbes article on the financial definition of risk: Forbes article on Risk and Volatility.

Let’s call Cash, Debt, and Equity , the Core Asset Classes (or Core Assets for short).

In addition to being able to singularly invest in each of the Core Assets, we are also able to invest in combinations of these assets through investments “pools” called Mutual Funds and Exchange Traded Funds (and others).

The “Alternatives Class” is the catch-all repository for other investment options like real estate, commodities (steel and precious metals for example) , derivatives and others. Some of these Assets can be extremely risky.

Let’s first dig deeper into some of the investment options in the Core Asset Classes

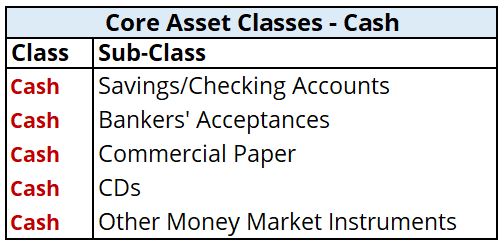

Core Assets – Cash and Equivalents

Most of us are familiar with this category.

Cash and its Equivalents is the physical cash or those financial instruments that can be converted to cash quickly.

Table 2 – Cash Types

See finra.org (bank products) for more information on these types of accounts.

Typical “Cash and Cash Equivalent” investments are:

- Savings Accounts (Interest Income producing accounts)

- Money Market Accounts (Similar to Savings Accounts)

- Certificates of Deposit (Income producing time deposits)

These types of investments are liquid by definition (i.e. finances are easily turned back to cash).

They are often federally insured as well.

Short term duration debt instruments are also considered Cash Equivalents (See Finra.org or Investopedia) .

Examples of these are:

- Bankers’ Acceptances,

- Corporate Commercial Paper,

- Short Duration government bonds and municipal bonds (see next section)

Investment instruments for Cash Equivalents are often fixed income Mutual Funds called Money Market Funds.

Mutual Funds essentially pool (i.e. gather or collect or combine) various investments together that meet some common theme or strategy.

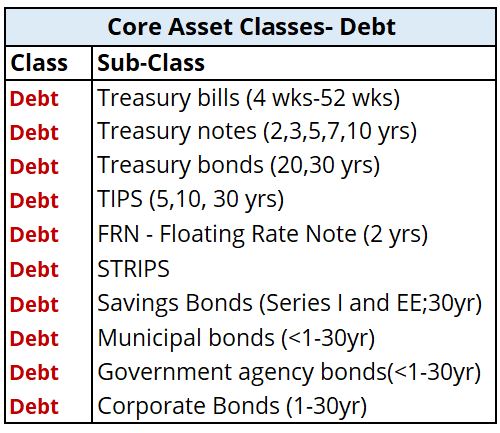

Core Assets – Government Debt

Debt is typically in the form of a bond.

Finra defines a bond as

“… a loan an investor makes to a corporation, government, federal agency or other organization in exchange for interest payments over a specified term plus repayment of principal at the bond’s maturity date.”

The time from original issue to maturity date is called the duration.

Table 3 – Debt Types

TreasuryDirect.gov is your one-stop-shop for all things government bonds (not including municipal bonds, though).

TreasuryDirect provides the key characteristics of available bonds and allows you to directly purchase Treasuries, TIPS (see below), FRNs (see below), and Savings Bonds.

You can also purchase through a bank or broker (directly or via various investment instruments like Mutual Funds and Exchange Traded Funds (ETFs) ).

Finra is another good source for general bond information.

Government Bond Types

Here is a descriptive list of government bond types starting with the shortest duration bonds,

- Treasury Bills (4 wk to 52 wk duration)

- Treasury_Notes (2,3,5,7,10 year durations)

- Treasury Bonds (20,30 year durations)

- TIPS – Treasury Inflation Protected Securities (5,10,30 year durations)

- Floating Rate Notes (FRNs) (2 year duration)

- STRIPS – Separate Trading of Registered Interest and Principal of Securities.

- The principal component and the interest components are separated and made into standalone investments.

- Savings Bonds (30 year duration).

- There are two types of Savings Bonds; EE and I bonds.

- According to Treasury Direct, “I Bonds protect against inflation. They earn both a fixed rate of interest and a rate based on inflation.”

- Municipal bonds are issued by cities, governments, and municipalities to primarily fund infrastructure projects.

- Many of them are exempt from federal taxes (and some are exempt from state taxes as well).

- Government Agency Bonds – Bonds (e.g. Mortgage Backed Securities) issued by Federal Government Agencies like Ginnie Mae and Government Sponsored Enterprises (GSE) like Fannie Mae ,Freddie Mac, and Farmer Mac.

- Ginnie Mae: Government National Mortgage Association

- Fannie Mae: Federal National Mortgage Association

- Freddie Mac: Federal Home Loan Mortgage

- Farmer Mac: Federal Agricultural Mortgage Corporation

Core Assets – Corporate Debt

The SEC website Investor.Gov and Finra provide excellent introductory material on Corporate Bonds.

My advice is; read all the corporate bond articles on the Investor.Gov site and you will be headed in the right direction.

Corporate Bonds just like Government Bonds are debt obligations that pay periodic interest (typically) and pay back the principal (amount borrowed) at some specified time.

You can buy corporate bonds via banks or brokerages.

- For example your Schwab or Fidelity brokerage account will allow you to buy bonds in both the primary market (original issuance) or secondary market (where bonds are being re- bought and re-sold).

- You can also buy bonds via Mutual Funds or Exchange Traded Funds (which are pooled investments using a certain investment category or theme.)

Some key attributes of Corporate Bonds are:

- Unlike U.S. Government bonds, the credit quality (i.e. the ability of the company to pay interest and principal back) of Corporate Bonds covers a wide range.

- Bonds are categorized as “investment grade” or “non investment grade” according to assessments done by one or more credit rating agencies.

- The three major credit rating agencies (they are U.S. companies) are Moody’s, Standard & Poor’s, and Fitch.

- See these links for more information: SEC bulletin on Credit Rating and Investopedia on Credit Rating Agencies.

- Corporate Bond holders generally have priority over stock holders if the company has financial difficulties.

- Corporate Bond durations can be categorized as :

- short duration (<3 years),

- Medium Duration (4-10 years), and

- Long Duration (>10 years).

- Corporate_Bonds can pay periodic fixed interest or periodic floating interest(where interest is adjusted relative to a benchmark).

- Zero Coupon Bonds do not pay out interest during the duration of the bond but include the accrued interest at maturity (i.e. principal plus interest is returned).

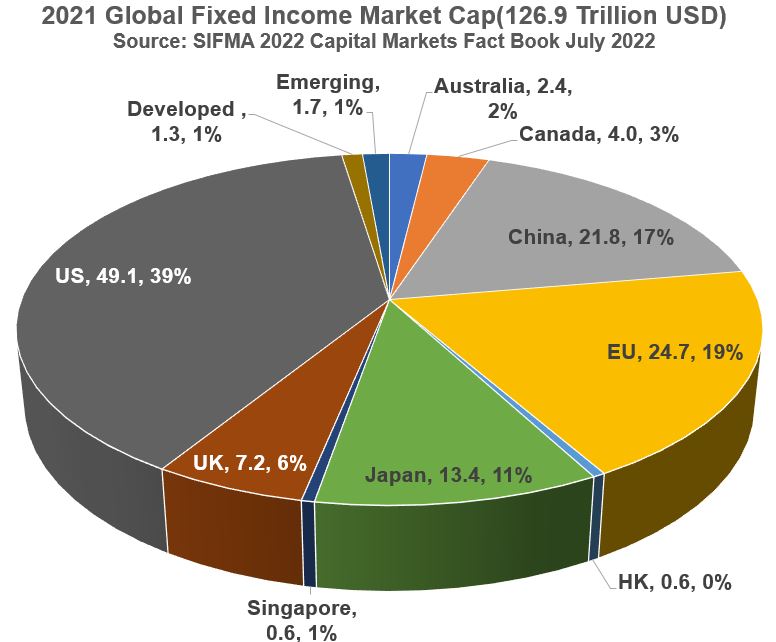

Core Assets – Bond Market Size

According to the SIFMA Capital Markets Factbook 2022, the size of the fixed income market is enormous:

- World market capitalization: 126.9 Trillion USD (i.e. 126,865.5 Billion USD).

- USA market capitalization: 49 Trillion USD (38.6% of the World capitalization)

Take note that about 79 Trillion USD of bonds are internationally based.

Graphic 2 – Market Cap. of World Fixed Income

Core Assets – Equity

Read the Finra.org or SEC (Investor.gov) sections on stocks.

Equities or equity refer/s to stocks which represent fractional ownership in publicly traded companies.

The value of the stock will fluctuate with investor demand. Some stocks return a portion of their earnings back to shareholders via periodic dividend payments.

Dividend paying stocks tend to be more mature, established companies that are no longer in a high earnings (profit) growth mode.

Etymology of the Word “Equity”

A reasonable explanation for the origin of the term “equity” can be found here (see the Kevin Beach section).

To paraphrase this source: Historically, English Common Law was often too harsh and required interpretation and judgment for the sake of fairness or “equity”.

Over many years the concepts of legal versus beneficial ownership were established.

In the original corporations of the 17th century, managers were the trustees (legal owners) of the companies and issued certificates of ownership to the investors (beneficiaries).

These investors were described as owning “equities” in the company, meaning they had fair and equitable rights as shareholders.

Today, shareholder rights would include fractional ownership, ownership transfer, voting, suing, inspecting corporate documents, and owning dividends (see this Investopedia link for more information on Shareholder rights).

Equity Market Size

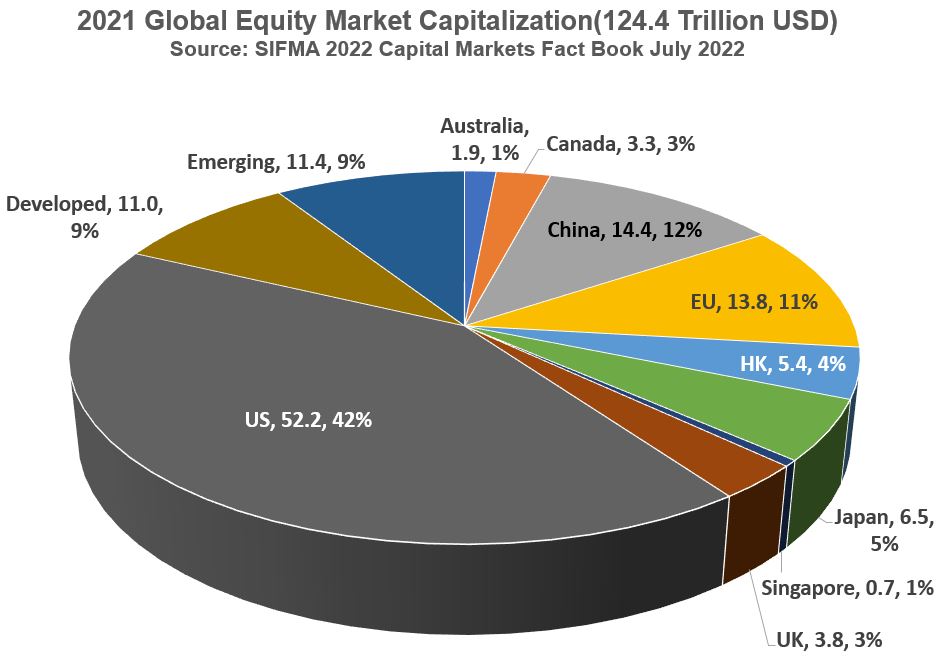

Like the global fixed income market, the global stock market is huge.

According to the SIFMA Capital Markets Factbook 2022:

- World stock market capitalization = 124.4 Trillion USD (similar to the 126.9 Trillion for the fixed income market).

- USA stock market capitalization = 52.2 Trillion USD = 42% of Total (compared to 49 Trillion = 38.6% of Total for the fixed income market).

Graphic 3 – Market Cap. of World Equities

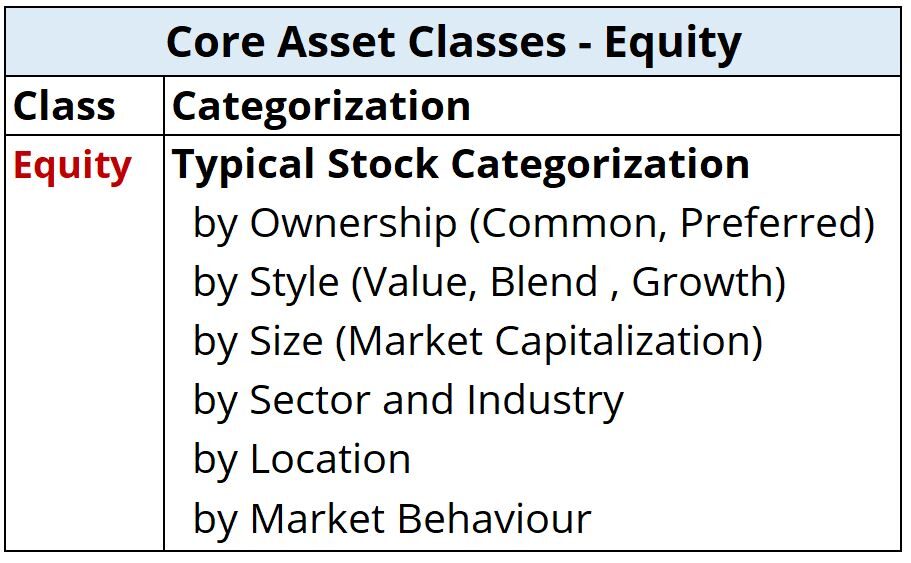

Equity Characteristics

Stocks can be described using combinations of category descriptions as described in the following sections.

Table 4 – Equity (Stocks)

Equity Characteristics – Ownership

The vast majority of stocks are Common Stocks.

- The price fluctuates and is based on buyer demand (it is not capped or limited).

- Common Stocks can pay dividends but the dividends can be adjusted up or down or ever eliminated (they are not guaranteed).

Preferred Stock usually guarantees its dividend payments.

- The dividends are fixed and are paid out before dividends on common stock.

- Price movement is also limited with Preferred Stocks.

If the company fails, the order of obligations to owners is:

- (1) Bond holders

- (2) Preferred Shareholders

- (3) Common Shareholders.

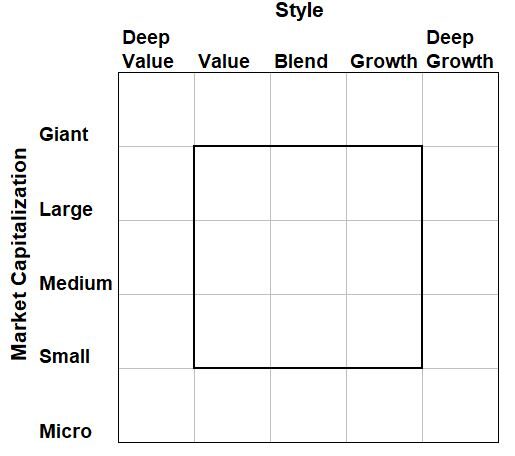

Equity Characteristics – Style and Size

Two commonly used characteristics of stocks are

- Market capitalization (number of shares outstanding x share price)

- Growth vs Value financial performance often described as the “style” of the company

Morningstar provides one of the more useful general investment information websites.

They also invented the 9 and 25 category style box shown below in Graphic 4.

The style box concept is now used almost universally to describe stocks and investment funds like Mutual Funds and Exchange Traded Funds (ETFs).

The Morningstar style box allows for 25 combinations of size and style.

- The originally constructed box had 9 categories but has recently been expanded to 25 boxes to allow for more granular representation of Mutual Funds and ETFs.

- From the Morningstar web site, if you choose a certain ETF or Mutual Fund, you can go to the “Portfolio” section to see its style box.

Graphic 4 – Morningstar Style Box

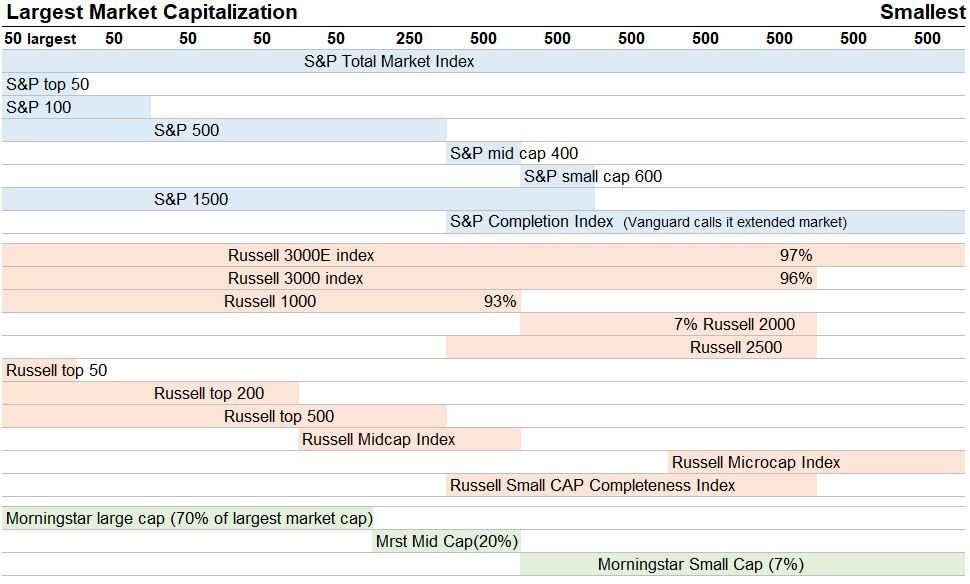

Equity Characteristics – More on Size

Morningstar provides a convenient definition for Large, Mid, and Small market cap (capitalization) stocks.

These definitions will not always be 100% consistent with firms who have created and marketed their own size definitions (e.g. S&P, FTSE Russell, etc.).

If you are trying to devise an investment mix based on market capitalization, consider sticking with a consistent set of definitions from the same firm to avoid too much overlap or redundancy.

Morningstar Definitions for Stock Size

The Morningstar definitions for stock size are based on a cumulative capitalization scale of all stocks in a particular country or geographic area (style zone).

- Giant-Cap Stocks (Top 40% of the cumulative market capitalization)

- Large-Cap Stocks (Top 70% of the cumulative market capitalization).

- Mid-Cap (70%-90% of the cumulative market capitalization).

- Small-Cap (90%-97% of the cumulative market capitalization)

- Micro-Cap (97%-100% of the cumulative market capitalization)

Other Stock Size Definitions

Firms like S&P Global , FTSE-Russell, and MSCI define market capitalization by number of stocks. For example:

- S&P top 50 US stocks (largest 50) are Mega-Cap stocks (Morningstar would call these Giant-Cap stocks although definitions would not exactly match).

- S&P 500 index, S&P Mid-Cap 400, and S&P Small-Cap 600 represent the largest 1500 US stocks.

- The Russell 1000 index represents the top 1000 largest cap US companies (Large-Cap + Mid-Cap) and the Russell 2000 represents the next 2000 largest cap companies (Small-Cap).

Refer to Table 5 below for examples of how S&P (S&P Global) and Russell (FTSE-Russell) define some of their market capitalization indices.

Table 5 – Example of Market Capitalization Index Definitions from S&P, Russell, and Morningstar for US Stocks.

As I noted before , if you are trying to devise an investment mix based on market capitalization, consider sticking with a consistent set of definitions from the same firm to avoid too much overlap or redundancy.

Equity Characteristics – More on Style

We can define a continuum (a range) of stocks spanning from slower growing “Value” stocks to faster growing “Growth” stocks.

By growth, we generally mean earnings per share growth.

In general (not always), new companies tend to start out as growth stocks where revenue and earnings growth rates are higher than average and where the company will tend to reinvest its revenue/earnings back into the company (no dividends).

As the company matures and becomes more established (and perhaps with fewer above average growth opportunities), the company’s price trajectory might “stabilize” and it might consider distributing parts of its earnings back to investors in the form of dividends.

Read the following for some good general information on Growth vs Value stocks.

Financial sheet (Income, Cash, Balance) data points are usually used to differentiate between Value stocks and Growth stocks.

Use my Accounting Primer to remember what the financial sheets look like.

Morningstar uses the following financial metrics to define Value stocks:

- dividend yield (Higher = Higher Value Characteristic)

- price relative to: revenue, earnings, book value, and cash flow (Lower = Higher Value Characteristic)

Morningstar uses the growth rates of earnings, sales, cash, and book value to define Growth stocks (Higher = Higher Growth Characteristic).

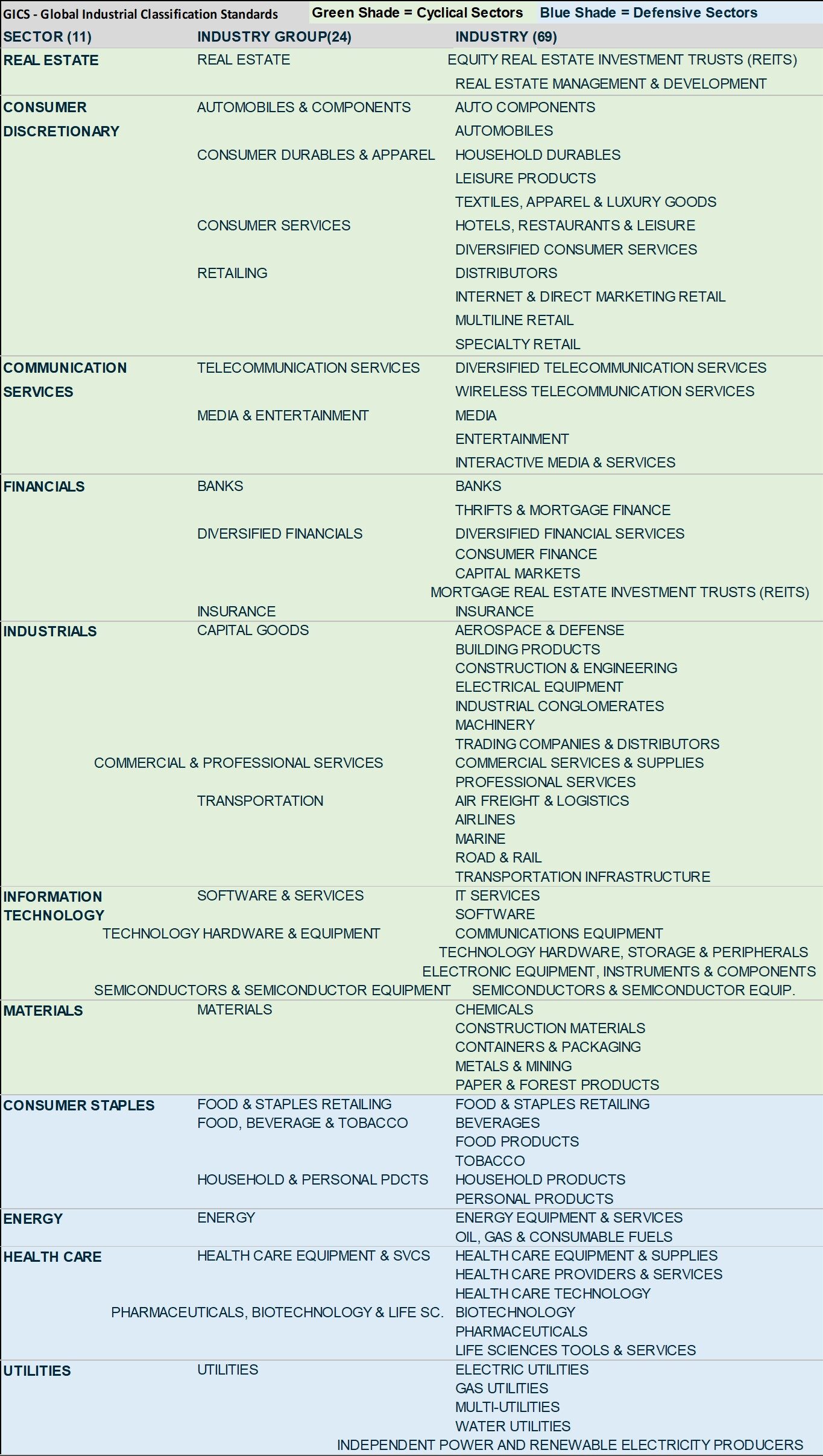

Equity Characteristics – Industries and Sectors

There is more than one industry classification system out there (of course). Some of the major ones are:

- Standard Industrial Classification (SIC) system developed by the US government in 1937. See this Investopedia article also.

- In 1997, SIC codes were further expanded to NAICS (North American Industrial Classification System)

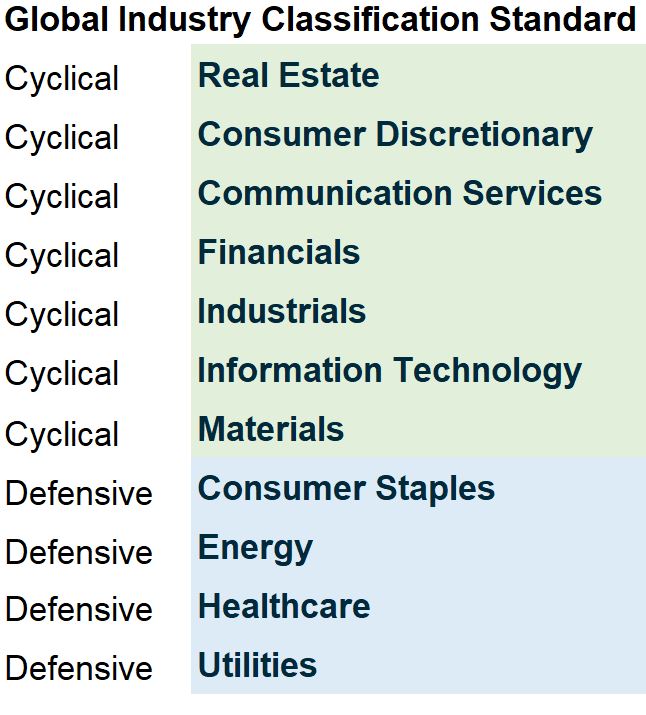

- In 1999, the investment research firm MSCI (Morgan Stanley Capital International) and S&P (Standard and Poor’s ; known as S&P Global today) developed a Global Industry Classification Standard (GICS) which is broadly used today.

- The GICS categorize the stock universe into 11 sectors, which are divided into 24 industry groups (which ,as of Oct 2022, are divided into 69 industries and 158 sub-industries).

- The FTSE-Russell developed an Industry Classification Benchmark (ICB) in 2005 which consists of a four tier structure ( as of Sept 2022; 11 industries, 20 super sectors, 45 sectors, and 173 subsectors).

Let’s focus a little more on the MSCI/S&P GICS since they seem to be frequently used in the industry. Table 6 lists the 11 industry Sectors of the GICS.

Table 6 – Global Industry Classification Standard GICS

For example, in the Consumer Discretionary Sector, there are 4 industry groups (Autos, Consumer Durables, Consumer Services, and Retailing).

The Consumer Durables, for example, can be further broken down into 3 industries (Household Durables, Leisure Products, Textile Apparel and Luxury goods).

Refer to Appendix 1 to see the full breakdown of the 11 sectors into their respective 69 industries.

Equity Characteristics – Cyclical vs Defensive Stocks

In Table 6 above we conveniently identified each stock sector as being either Cyclical or Defensive.

This categorization is based on the sensitivity of the stock to fluctuations in the economy.

The profitability of some companies will drop in recessionary periods and rise during market booms.

We call the stocks of these kinds of companies Cyclical Stocks.

- The products and services they sell are called Discretionary Products/Services.

- A luxury goods company stock would be an example of a cyclical stock.

Other companies are not greatly affected by the economy (relative to their cyclical counterparts at least).

They provide goods and services that people need regardless of how weak or strong the economy is.

Stocks of food or energy companies would fall into this category. These kids of stocks are called Non-Cyclical or Defensive or Secular stocks.

Equity Characteristics – Geographic Location

The market value of international (outside US) stocks is more than half the total.

Recall that out of 124.4 Trillion USD of global stock, about 52.2 Trillion USD is US based (42% of total).

That leaves 72.3 Trillion USD (58% of total) of non US based equity (stock).(source: SIFMA Capital Markets Factbook 2022) .

So you definitely need to know the “lay of the land” when it comes to international stocks.

The big three index providers are MSCI, S&P Global, and FTSE-Russell. They all provide stock classifications by country or region. You can learn more about each of these via these links:

S&P Global Country Classification Website ; S&P Global Country Classification pdf Oct 2022

FTSE Russell Country Classification Website ; FTSE Russell Country Classification pdf Sept 2022

MSCI Country Classification Website ; MSCI Country Classification Accessibility pdf June 2022

All of these providers classify countries as Developed, Emerging, or Frontier countries (markets).

As the names suggest, the most developed nations would go in the Developed category whereas the less developed would fall into the Emerging or Frontier categories.

Each provider provides a broad range of criteria in order to classify countries under one of these headings.

Equity Characteristics – Developed, Emerging, Frontier

The S&P definitions for these categories found in this document (S&P Global Country Classification pdf Oct 2022) seem to be generally applicable.

The definitions below are excerpted from this document located at https://www.spglobal.com/spdji/en/landing/topic/market-classification/.

- “Developed: A developed market is the most advanced in terms of economy, financial, and capital markets and satisfies all required classification conditions.” (source S&P Global)

- “Emerging: An emerging market shares some characteristics of a developed market but does not meet the full criteria necessary for that classification.

- Emerging markets may become developed markets in the future, or they might have been in the past. ” (source S&P Global)

- “Frontier: A frontier market is a developing economy with generally lower market capitalization and liquidity and/or more restrictions than an emerging market.

- Frontier markets may become emerging markets in the future, or they might have been in the past.”(source S&P Global)

- “Standalone: A standalone market is a developing economy that does not meet the required basic conditions for frontier markets described above.”(source S&P Global)

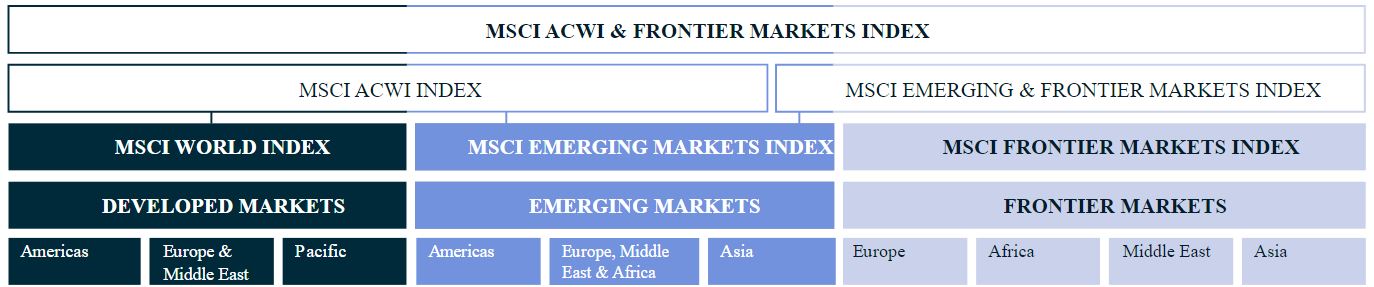

MSCI Country Classifications

MSCI provides a nice graphic for its country classifications.

The partial graphic below in Graphic 5 is copied from the MSCI website.

Note that the standalone countries portion of the graphic is not shown. (see Appendix 2 for a full rendering of the graphic).

Graphic 5 – MSCI Country Classifications (source: https://www.msci.com/our-solutions/indexes/market-classification).

ACWI in the graphic above stands for All Country World Index.

Some example countries in each category are listed below:

- Developed: Americas(USA, Canada), Europe & ME (Germany, Israel, others), Pacific (Japan, Hong Kong, others)

- Emerging: Americas(Brazil, others), Europe, Middle East & Africa(Egypt, others ), Asia(China, others)

- Frontier: Europe (Iceland, others), Africa(Nigeria, others), Middle East(Jordan, others), Asia (Pakistan, others)

- Standalone: Americas (Jamaica, others), Europe (Russia, Ukraine, others), Africa(Botswana, others), Middle East (Lebanon, others)

International Equity Risks

SEC (Investor.gov) has a nice write up on the risks of investing in international stocks (outside USA).

These risks can include (paraphrased from the SEC Investor.gov site):

- Transparency and access to information

- Costs

- Working with non registered brokers

- Changes in currency exchange rates and currency controls

- Political, economic, and social events

- Different levels of liquidity

- Lack of legal remedies

- Different market operations

Keep in mind that many large US corporations have substantial presence and sales worldwide.

So one way to invest internationally is to buy stocks of these large global corporations.

Example of Currency Risk

Let’s finish up this section with an example of currency risk when investing in foreign stocks (non US stocks).

Example_Part 1: You buy 1000 Euros of stock when the exchange rate is 1.2 Euro/1USD.

- So you paid 1000/1.2 = 833 USD

Example Part 2: Some time in the future you sell (assume your investment value in Euros didn’t change).

- If exchange rate is the same: 1.2 EU/1 USD, then you get your 833 USD back. No gain or loss.

- If exchange rate goes down: e.g. 1 EU/1 USD, then you get 1000 x 1 USD/1 EU = 1000 USD (you made money on the currency rate change)

- If exchange rate goes up: eg. 1.4 EU/1 USD, then you get 1000 x 1 USD/1.4 EU = 714 USD (you lost money on the currency rate change).

So, there is a risk of losing money if the exchange rate goes up (EU/USD).

Alternative Investments

Recall Graphic 1 below showing the various asset classes.

We’ve discussed Cash , Debt, and Equity. Now on to Alternatives.

Graphic 1 – Investment Asset Classes

We will review 6 alternative investments

- Real Estate

- Infrastructure

- Commodities

- Derivatives

- Insurance

- Collectibles

Alternative Asset Classes – Real Estate

You can buy real estate directly (land, buildings, etc) and sell or collect income to make a profit.

You can also avoid the hassles of direct ownership by purchasing REITs (Real Estate Investment Trusts).

REITs are investment pools that allow you to invest in real estate without actually buying and selling it.

According to FINRA , “REITs are companies that own or finance income-producing real estate or related assets.

Today there are REITs that own everything from office or apartment buildings to hotels to mortgages or loans, with many specializing in a single type of real estate, such as retail, residential or industrial, among others.”

- FINRA has a nice article on real estate investing and REITs.

- Also, see this investors bulletin on REITs from the SEC.

REIT Characteristics

A few distinguishing characteristics of REITs are (see Investopedia article on REITs):

- They are corporation type legal entities but they have to pay at least 90% of their taxable profits to shareholders.

- The above allows them to be tax exempt on a corporate level (shareholders do pay taxes).

- Most are Publicly Traded REITs that you buy via the stock exchanges.

- Other types are Public Non-Traded REITs, and Private REITs.

- Most are Equity REITs (income from rents). Others are Mortgage REITs and Hybrid REITs (combination of the other two).

- REITs are good options for tax advantaged accounts (you pay dividend taxes in a taxable account).

- You can buy them as standalone stocks (the Publicly Traded ones) or via pooled investments like Mutual Funds or ETFs.

According to NAREIT , as of December 2021:

- The total world market capitalization of REITs is 2.5 Trillion USD

- The market capitalization of North American REITs is 1.8 Trillion USD

- The market capitalization REITs in the rest of the World is 700 Billion USD

Alternative Asset Classes – Infrastructure

Infrastructure describes real, physical, tangible assets that allow for the efficient functioning of a nation’s economy. Ok that’s a very broad definition. FEMAs Definition of Instructure is:

“Infrastructure Includes, at a minimum, the structures, facilities, and equipment for…roads, highways, and bridges; public transportation; dams, ports, harbors, and other maritime facilities; intercity passenger and freight railroads; freight and intermodal facilities; airports; water systems, including drinking water and wastewater systems; electrical transmission facilities and systems; utilities; broadband infrastructure; and buildings and real property. Infrastructure includes facilities that generate, transport, and distribute energy.” (source: 10/12/2022 https : // www.fema.gov / glossary/ infrastructure)

We describe this as a separate asset class but could have described it as a sector as well.

Many stocks make money in this area and can be identified via the sectors, industries, and subindustries of the GICS system we described earlier (see Appendix 1).

You can buy individual infrastructure stocks like Caterpillar or Vulcan Materials or you can buy a more diversified pool of stocks via Mutual Funds or Exchange Traded Funds (ETF).

Some REITs invest in infrastructure as well.

Government involvement in infrastructure type investments could provide opportunities.

For example, in 2022, the US government passed an infrastructure bill valued at 1.2 Trillion USD which might bode well for these types of investments.

The Investopedia article linked below provides a nice discussion with some informative links:

As specialized type of Infrastructure Asset is the Master Limited Partnership (MLP) which we’ll review in the next section.

Alternative Asset Classes – MLPs

Master Limited Partnerships (MLP) are a specialized type of infrastructure asset class.

They are US publicly traded (via stock exchanges) businesses that are established as Limited Partnerships.

This allows them to pass through earnings (as dividends) to shareholders (who are actually called unitholders since the MLP is not a corporation). So MLPs don’t pay corporate taxes.

MLPs by law must earn >= 90% of their income from qualifying income. Examples of qualifying income are:

- Income from exploration, development, mining or production, processing, refining, transportation, or the marketing of any

mineral or natural resource or the transportation or storage of any fuel. - Some passive income from interest, dividends, and property rent. (source: IRS)

Most MLPs today operate midstream oil and gas pipelines (and related facilities) and derive most of their income from collecting rents (tolls) on their use.

They are similar to REITs in that they don’t get taxed on the corporate level. Unlike REITS, MLP unitholders (they hold units not shares) can get some tax benefits.

However, IRS reporting is more difficult and requires submittal of a K-1 form (confusing to fill out and often is not issued in a timely manner by these MLPs).

According to Allerian,

- In 2014, there were roughly 80 North American MLPs with a market cap of about 800 Billion USD.

- Today there are about 50 MLPs with a market cap of about 400 Billion USD.

REITs are also allowed to invest in midstream oil and gas assets and this might be an alternative to investing in MLPs.

You can brush up on MLPs be reading the following articles:

Alternative Asset Classes – Derivatives

A derivative is a financial contract whose value is derived from an underlying asset or benchmark.

Derivatives are traded on the major exchanges as well as over-the-counter (broker dealer networks) exchanges.

The gross market value of all contracts is about 12.4 Trillion USD in 2021 (see Investopedia on size of derivatives markets & BIS derivative stats).

Examples of underlying assets are:

- stocks,

- bonds,

- commodities,

- currencies,

- Interest rates and

- market indexes.

These are fairly sophisticated investments used to hedge (i.e. to offset some risk) or speculate.

Four types of derivatives are briefly described in the bullets below:

- Futures: contracts that trade on an exchange between two parties for the purchase/sale and delivery of an asset at an agreed-upon price at a future date

- Forwards: similar to Futures but trade over-the-counter

- Swaps: two parties exchange the cash flows or liabilities from two different financial instruments. See You tube Example of an interest rate swap.

- Options (similar to a Futures contract but buyer is not obliged to exercise their agreement to buy or sell like in a Futures contract).

Derivative Example 1

Your company buys oil Futures at a certain price to ensure they hedge against price going above this price in future.

Derivative_Example 2

Buying a Call Option gives you the right to buy a stock at an agreed price and buying a Put Option gives you the right to sell a stock at an agreed price.

Derivative Example 3

You buy a Leveraged S&P 500 Index ETF (Exchange Traded Fund) whose price will change at 2x the price change of the underlying index (using debt and derivatives).

Investopedia provides some good general information. Brokerage services like Fidelity and Schwab provide good “options” training material.

- Investopedia on Derivatives

- Investopedia on using derivatives for hedging

- Investopedia on size of derivatives markets

- Fidelity (search for options or derivatives in site)

- Schwab (search for options or derivatives in site)

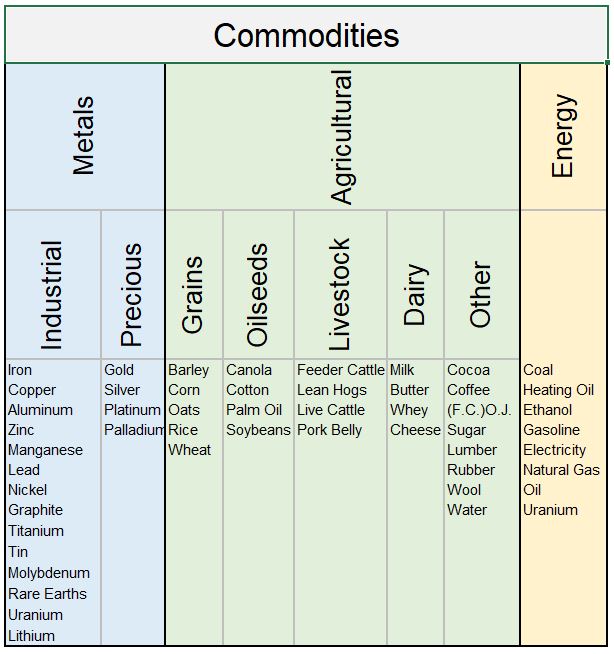

Alternative Asset Classes – Commodities

Like REITs and Infrastructure, Commodities are another type of real, tangible, physical asset.

Commodities are typically raw materials (versus finished products) that can be traded in a market.

Here is a more rigorous definition courtesy of the Library of Congress:

“A commodity is a basic good used in commerce that is essentially uniform across producers, where one unit of a specified size and weight is perfectly interchangeable with another.” Source: https://guides.loc.gov/commodities/introduction copied on 10/14/2022).

We can categorize commodities into three general types:

- Metals ,which can be further broken down into industrial (or base) metals and precious metals

- Agricultural products including livestock (meat) and dairy

- Energy products which can be subdivided further as well

See Table 7 for more detailed listings under each of the three commodity types. I used information from Commodity.com and CMEgroup.com to build the table.

Table 7 – Commodity Types

Professional Investing in Commodities

Professional investors (working for commodity businesses like agricultural companies or food producers) buy and sell futures contracts on various exchanges in to order to hedge against rising or falling prices.

We briefly covered futures in the derivatives section of this post.

- Example 1: A producer of a farm product might want to ensure that they can sell at current prices in the future.

- They can sell a futures contract at an agreed price to be delivered at a future date.

- If prices drop in the future, this hedge succeeds for the company.

- If prices increase, then they lose out at selling at higher prices (for this contract at least).

- Example 2: From the other side: A user of a farm product wants to ensure they buy at todays prices and not higher prices.

- They could buy futures contracts in this case.

- If prices go up in the future, this contract saves money and vice versa.

Some of the major commodities exchanges are:

- CME – Chicago Mercantile Exchange

- NYMEX – New York Mercantile Exchange

- CBOT – Chicago Board of Trade

- COMEX – Commodity Exchange (part of NYMEX)

- ICE – Intercontinental Exchange (digital)

- LME – London Metal Exchange

Individual Investing in Commodities

Retail (Individual) investors might consider commodities because they tend to be inflation hedges and they have a low correlation with stocks and bonds.

However, they have unique features which makes them a bit more complicated, risky, and possibly less flexible then a stock or bond investment (in general):

- They don’t generate income

- Logistics is a cost component of commodities (ships, cars, storage facilities)

- They can have volatile and unpredictable pricing due to unforeseen events in weather or geopolitics for example.

- e.g. Russia is one of the top three producers of Platinum Group Metals (namely Platinum and Palladium) and as its current war with Ukraine drags on (as of Oct 2022), there is potential for future pricing spikes.

The various ways in which individuals can invest in commodities are:

- Buy the commodity directly (practical for high cost density precious metals like gold; not so much for others).

- Buy and sell futures contracts as described in the previous section (you’ll have to meet the requirements of your brokerage if they allow you to do this).

- Invest in corporations (via stocks) that are in the commodity business.

- Looking at the GICS company sectors list (Appendix 1) you could choose stocks in the energy or materials sectors or you could choose stocks in the food, beverage, tobacco industry.

- Let professionals do the heavy lifting for you.

- You can invest in commodities or baskets of commodities via investment pools like Mutual Funds or Exchange Traded Funds (ETFs).

- You can also purchase Exchange Traded Notes (ETNs) which are basically bank notes (like bonds) that are priced based on an underlying commodity price or index.

- ETNs are backed by the banks (typically) that issue them so there is a risk of default.

Investing in Commodities – Buyer Beware

Before you invest in commodity Mutual Funds, ETFs, ETNs, read the prospectus details to understand your risks and how you will pay taxes.

If the funds invest more than a certain amount in futures, you will have to fill out and submit IRS K-1 forms which can be complicated (requiring possible advice from a tax professional).

K-1 forms are typically not submitted in time to meet the April IRS tax reporting deadline (meaning more administrative hassles for you).

ETNs are issued by banks and so you have to consider credit and default risks. See this nice article: Schwab on ETNs

Commodities Investing Sources

Some of the websites I used to write this section are listed below:

Alternative Asset Classes – Currency

I’m willing to bet your average retail investor is not investing directly in currencies but, currency markets (Foreign Exchange or FOREX) are the largest markets in the world (the daily volume of trading is multiples of the worlds stock markets; 6.6 Trillion USD average daily volume in 2019 according to BIS).

Some characteristics of these market are:

- They trade 24 hours a day across the world with very large volumes (so they are very liquid).

- They trade on one of the FOREX exchanges. These investments amount to a zero sum game since they are typically based on the performance of one currency versus another (pairs); for example, USD versus the Euro.

- Currency related investments can be very risky and complicated (see SEC on foreign Currencies). They can be leveraged (using borrowed money) as well as employ derivatives (options, futures, etc.).

For the retail investor some of the ways to invest in currencies (source: Investopedia on currency investments) are:

- Buy and sell currency pairs via a broker through one of the FOREX exchanges.

- Invest through foreign currency CDs and Savings accounts.

- Invest in foreign currency bonds.

- Buy Mutual Funds, ETFs (Exchange Traded Funds) and ETNs (Exchange Traded Notes) that invest in currencies. As noted before you need to read the fine print to see what financial tools are being used and how risky the investment is.

Alternative Asset Classes – Life Insurance

According to iii.org , in the US, 2021 net written life insurance premiums (the dollar amount of the policies underwritten by the insurer) amounted to 160 Billion USD.

There are two types of life insurance policies: Term and Permanent. The descriptors pertain to the duration or ‘term’ of the contract.

- Term Life Insurance is only valid for a specified number of years (10 – 30 years typically). The insurance holder pays premiums and if the holder dies within the specified years, his family receives a death benefit. There is no investment component in this kind of policy.

- Permanent Life Insurance is valid for the life of the holder. As long as the insurance holder pays the premiums, then upon his/her death, the family receives a death benefit. But these policies also have an investment (cash) component funded by a portion of the premium. These policies are sometimes called Cash Value Life Insurance.

Permanent (Cash Value) Life Insurance types can be further broken down into:

- Whole Life

- Universal Life

- Variable Life

- Variable Universal Life

A portion of the premiums paid for Cash Value policies go into funding cash accounts that grow (tax free) at fixed or variable rates.

I wasn’t able to verify this directly back to the source but web articles claim historical returns for Cash Value Life Insurance policies range from 1 to 3.5% (attributions I found were from Quotacy and Consumer Reports).

It is certainly true that premiums for Cash Value policies are many multiples the premiums of Term policies.

Term or Cash Value?

You will find a swirling, dizzying array of opinions on whether its a good or bad idea to use Cash Value Life Insurance policies as investment vehicles.

If you get information from a seller of insurance policies (or a person sponsored by them) , be aware of a potential conflict of information situation (i.e. advice might be given to benefit them and not you).

Some key questions to help you decide are:

- Do I want to get more than just a death benefit from my life insurance policy?

- Do the differences in premiums between Term and Permanent Life Insurance seem reasonable and manageable ?

- How do other tax advantaged investment options like IRAs and 401Ks compare to Cash Value policies with respect to historical investment returns, etc.?

- When and how can you access the cash value account and what are the rules/costs/penalties for doing so? e.g. if you withdraw cash, is you death benefit affected?

- Do your beneficiaries have access to the cash account upon your death?

Here are some potentially useful resources:

- Investopedia on permanent life insurance

- Whitecoatinvestor – debunking the myths of whole life insurance

- Fool.com – here’s why you should avoid whole life insurance

- Kiplinger on whole life insurance

- SEC on variable life insurance

- Online articles by respected on line sites: Forbes, Money, Consumer Reports, other

- Insurance companies are regulated by your state. Check out state insurance department web sites for information.

Alternative Asset Classes – Annuities

According to iii.org , in the US, 2021 net written annuity premiums (the dollar amount of the policies underwritten by the insurer) amounted to 290 Billion USD.

Permanent (Cash Value) Life Insurance policies and Annuities are similar in that

- they are both sold by insurance companies.

- Annuities can pay death benefits although benefits pay out differently and may have different tax liabilities.

Their primary purposes , though, are, in a way, diametrically opposed.

- Life Insurance guarantees income for your beneficiaries if you die prematurely.

- Annuities are structured to pay you periodically throughout your expected (actuarial) lifetime (or through a prescribed period).

An Annuity is an insurance company financial instrument. It’s essentially a type of pension; you fund it and then it pays you a guaranteed series of income payments (AKA amortization).

- A Deferred Annuity is funded at an earlier date or over time and then produces a future series of payments

- An Immediate Annuity is funded now by a lump sum and then payments begin soon after.

Either type of Annuity earns (tax deferred) money

- at a guaranteed Fixed rate or a

- Variable rate (tied to some underlying price or index)

Annuities – Caveat Emptor (Buyer Beware)

If you thought Whole Life (Cash Value) Life Insurance options were complicated, Annuities are probably even more complicated. As you explore your options, keep the following in mind:

- Insurance agents are selling you these investments. Just be aware of potential conflict of interest issues. Use your state’s insurance department (e.g. in Texas its www.tdi.texas.gov on Annuities ) for general information and to check up on the companies and agents you are dealing with to make sure they are in good standing (also read SEC re annuities ).

- The investment might be sold to you with guarantees but payments will go to zero if the insurance company goes to zero. Make sure you are dealing with reputable and financially stable insurance companies.

- There are lots of conditions and riders and fees that could make these very expensive to own. Do your homework on fees and costs and penalties for various scenarios you might find yourself in.

- As a kind of longevity insurance, there might be a place for Annuities in your portfolio. See the nice article by the Whitecoatinvestor on SPIA, DIA, and MYGA Annuities.

- Do your homework by reading up on your options and the kinds of questions you should be asking before you work with any insurance agent. The Kiplinger, Motley Fool , Forbes, and Investopedia web sites are good places to start.

- If you want to read a slightly irreverent (mostly) negative view of Annuities (to at least give you some perspective), check out Bankers-anonymous.com on Annuities parts I, II, III. At the very least you’ll learn another application of the term “shit sandwich”!

Alternative Asset Classes – Collectibles

There are all sorts of collectibles you could invest in, including the following: art, wine, sports memorabilia, coins, stamps, cars, toys, sneakers, watches, comic books, Non Fungible Tokens, etc.

Note: Non fungible tokens (NFTs) might jump out as unfamiliar to you. These are digital tradeable assets (e.g. artwork or videos) that use blockchain technology to give them unique identifiers to prove authenticity and ownership. According to CNBC, NFT sales were about 17.6 Billion USD in 2021.

It depends on the collectibles you buy/sell, but ,in general,

- you’ll be potentially working in a less transparent and less regulated environment.

- you might incur storage and insurance costs.

- liquidity might be low. (i.e. you might not be able to sell quickly).

Physical auction and trading markets (and stores) or generic/specialized on-line platforms are ways you can invest in collectibles. I provide a few examples below for art and fine wine:

- Art – According to UBS ,global art sales topped 65 Billion USD in 2021. Using Masterworks, you can buy fractional shares in artwork that you hope to gain a fractional profit from at some time in the future.

- Fine Wine – According to Worldoffinewine.com ,global fine wine auctions totaled over 600 Million USD in 2021. On line platforms like Vinovest (you own the actual bottles) and Vint (you own fractional shares) are two interesting investment options.

For most of us, collectibles are probably more of a hobby than a serious investment.

Asset Nomenclature Revisited

Thus far, we’ve described, albeit very superficially, several Asset Classes. Namely:

- Cash

- Debt

- Equity

- Real Estate

- Infrastructure

- Commodities

- Currency

- Insurance

- Derivatives

- Collectibles

Most people will describe the first three (Cash, Debt, Equity) as the core, traditional Asset Classes. Everything else is covered under the term “Alternatives”.

Keep in mind, If you do any research on the web or elsewhere, you’ll find that different people define Alternative asset classes differently.

For example, I’ve included infrastructure as a separate class of investment but you could have just included infrastructure under one of the stock sectors in the GICS (see Appendix 1) classifications we discussed.

Have we discussed all the Alternative investments? Of course not.

Before we mention a few more Alternative investments, let’s take a few steps back and get more crisp and clear on some nomenclature.

Real vs Financial vs Intangible Assets

I like Investopedia‘s description of asset types so lets start there. Assets can be categorized into three types:

- Real Assets – Physical. Has intrinsic worth. (e.g. property, silver bullion, a trading card, etc. )

- Financial Assets – Derives value from a contractual right or ownership claim (e.g. cash, stocks, bonds, ETFs, etc.)

- Intangible Assets – Patents, copyrights, trademarks (e.g. The Shell Oil Company Pectin Symbol)

Combinations of Assets

An “investment” can be defined as an asset or assets that are used with the intent to generate income and profit.

Some of the reasons we have so many investment options is that

- these asset types are not mutually exclusive. The majority of investments most people use are Financial Assets and often Real Assets are invested through Financial Assets (e.g. an ETF that trades in commodities).

- you can combine multiple assets using one investment vehicle (hybrids, allocation funds, etc.)

- the way you trade the investment can vary (through broker or platform or other, individually or pooled with others etc.)

Investment Companies

I can conveniently group several investment options into a type I’ll call “Pooled”.

All of these pooled investments collect money from people and then invest the monies in various assets using different tools and techniques.

Investment Companies pool investor money and invest in, well, just about any investment or combinations of investments you could imagine:

- Equities by market and/or size and/or theme and/or style and/or sector (e.g. Asset Allocation funds, MLP funds, Commodity funds, etc.)

- Money Market

- Commodities: energy, metals, currency, agricultural

- Other: strategies mimicking private equity, venture capital, hedge funds etc.

According to ICI , in Q2 2022, global assets in open ended funds (Mutual Funds and Exchange Traded Funds or ETFs) amounted to about 60 Trillion USD (about 8.5 Trillion in ETFs).

Build Diversified Portfolios Easily

With a relatively small amount of money, you can use these to build a properly diversified portfolio.

For example, you might decide you want your money to be split 50/50 between stocks and bonds.

With the stock portion you might want about 30% to be invested in international stocks.

With the Remaining 70% of the domestic stocks, you might want 80% in large US companies , with the remaining in small stocks.

Using a handful of Mutual Funds (or Exchange Traded Funds) you can easily build this portfolio.

Trusts, Open End Funds, Closed End Funds

Investment Companies are regulated by the SEC and and have structural and legal differences:

- Unit Investment Trusts (UITs): fixed portfolio; redeemable units; expire after fixed period of time

- Mutual Funds (Open End): floating number of shares (units) that can be bought or sold

- Closed End Funds : shares are fixed and not redeemable; share price and net asset value can differ

Private Equity and Hedge Funds

Private Equity and Hedge Funds are also pooled type of funds where managers take the collected monies and invest them in different ways. These funds are

- typically available to institutional investors and accredited investors (high net worth).

- are not regulated by the Securities and Exchange Commission (SEC) and so will be much riskier for the average, unsophisticated investor. They are typically considered alternative investments for knowledgeable , savvy, and “well-heeled” (i.e. wealthy) investors. (see the SECs writeups on Private Equity Funds and Hedge Funds ).

A small diversion: Consider looking up the very interesting etymology of the term “well-heeled”!

Private_Equity Characteristics

- According to Mckinsey (See Exhibit 3), global Private Equity 2021 assets under management were about 6.3 Trillion USD.

- Invest in private companies typically. Venture Capital is a subset of Private Equity which invests in startups.

- Can use leverage (borrowing) and other sophisticated tools.

- Less liquid then Hedge Funds (your capital will typically tied up for some time)

- Less regulated than other investments like Mutual Funds

Hedge Fund Characteristics

- According to Statista , global Hedge Fund 2021 assets under management were about 4.53 Trillion USD.

- Hedge funds invests in numerous assets using many techniques and tools (e.g. derivatives, leverage, etc.).

- They are very liquid with the intent of maximizing profits in relatively short time frames.

- They are less regulated than other investments like Mutual Funds

General Information Sources for Private Equity and Hedge Funds

Crowdfunding

With the advent of the the 2012 JOBS Act, the U.S. government made it easier for small businesses to raise capital in much smaller amounts from the general investor population; effectively raising money from the crowd or Crowdfunding.

The 2012 JOBS Act loosened SEC (Securities and Exchange Commission) regulations on small businesses. According to Investopedia, this Act

- reduces administrative requirements (reporting, disclosure) of small companies.

- expands access to funding from small investors (crowdfunding).

- allows more companies to offer stock without going through SEC registration.

This is a rapidly growing area where business between the investor and the investment occurs via regulated web based platforms.

By having fractional ownership of various investments and projects, the “small investor” can access markets that were traditionally too expense or regulatorily cumbersome (e.g. company startups or real estate).

Sometimes the investor must be accredited (must meet net worth requirements) in order to invest but this is not always the case.

Initial investment requirements can be very manageable in some cases (with as little as 1000 USD or less).

According to Statista , Crowdfunding has a 13.64 Billion USD Worldwide Market Value in 2021.

According to Zipia , there were 1,478 crowdfunding organizations in the United States in 2021.

Types of Crowdfunding

Donation (fundraising) or Rewards (get perks for donations) based Crowdfunding are not really investment vehicles.

As investors we’d be more interested in Equity, Debt, or Real Estate Crowdfunding.

There are several other niche Crowdfunding platforms that don’t neatly fall in these categories as well (e.g. collectables and lots of others).

To learn more about your options (almost seems like too many choices!) you need to start by fully reading the information provided in the web sites.

Equity Crowdfunding

You invest in the equity of small businesses.

Traditionally this is the playground of private equity/venture capital and other organizations that work with high net worth individuals.

Check out a platform like Seedinvest to see how these types of investments operate.

Debt Crowdfunding

This type of investing is sometimes called Peer to Peer lending (See Prosper as an example).

Basically you choose lending projects that you invest in and then you receive periodic interest payments.

Real Estate Crowdfunding

You can lend (debt) or directly invest (equity) in numerous types of real estate investments.

These are typically private real estate deals (collections of them or single opportunities). Two popular Real Estate Crowdfunding platforms are:

Other Crowdfunding Opportunities

We mentioned a few Crowdfunding platforms in the collectibles section of this post (Masterworks and Vint and Vinovest).

Or Checkout a platform like Yieldstreet which offers multiple investment types (Real Estate, Venture Capital, Private Equity, Private Credit, Crypto, Short Term Notes, Structured Notes, Diversified Funds, Transportation, Art).

Understand the Product Before you Invest

Obviously you really need to do a lot of due diligence to see if these will work for you. You need to understand the risks, the costs, the tax implications etc. For example,

- Some of the Real Estate Crowdfunding sites require you to submit K-1 forms as part of your tax reporting. These can be a big pain to manage so just make sure you know what you are getting into.

- Some of these investment will be illiquid. You need to understand the ease of withdrawing funds.

- Asset transfer to beneficiaries might be tricky so we you need to understand this as well.

- These typically will be less regulated than other types of investments so be realistic about the risks and your tolerance for loss.

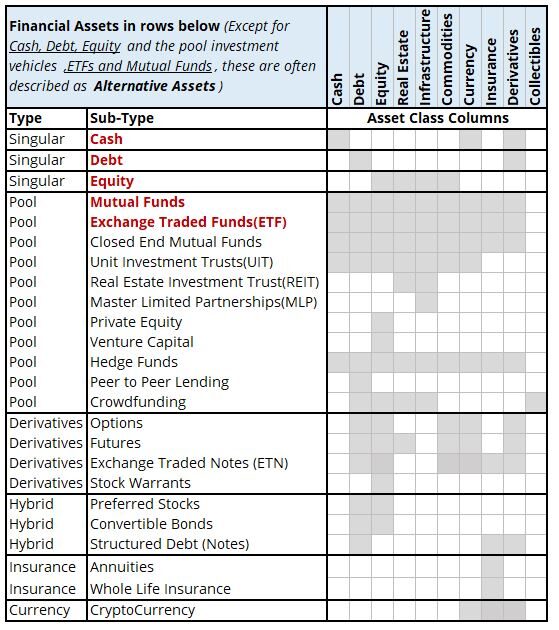

Many Investment Options

Table 8 below is my attempt to show the many different investment options that are available.

I’m sure I’ve missed some things but I think the table probably captures (at least generally) the majority of investment options available.

This table shows Financial Assets listed in the rows and Asset Classes listed in the columns.

There is duplication (redundancies) in the rows and columns but since the investment options often combine items, I thought the format of the table would be useful.

As you go down each row item, you can look across and see what Assets are (possibly) part of that Financial Asset.

Obviously if you look at the cash row, for example, you will see it aligns with the cash column (not useful) but you see that currency trading can be interpreted as a cash trade.

You also see that Cash or Cash Equivalent derivative investments exist.

Table 8 Observations

In the Financial Asset rows, I’ve made an attempt to categorize these by Type.

- Notice all the “Pool” type investments. These Financial Assets can all be generally described as investment vehicles that pool peoples money and invest in various businesses.

- Derivatives derive their values from underlying assets or price markers. This in itself is a huge category (options, futures, and combinations with other assets)

- Hybrids combine different types of Asset but remember these categories are fluid (they will overlap). e.g. Hedge Funds invest in all sorts of financial instruments.

- People are still trying to figure out how to categorize Cryptocurrencies like Bitcoin. “Digital Currency” seems reasonable.

Table 8 – Asset Class Composition Table

The big thing to take away from Table 8 is, beyond the “traditional investments” (Stocks, Bonds, Mutual Funds, Exchange Traded Funds) , there are multitudinous ways to make (and lose!) money.

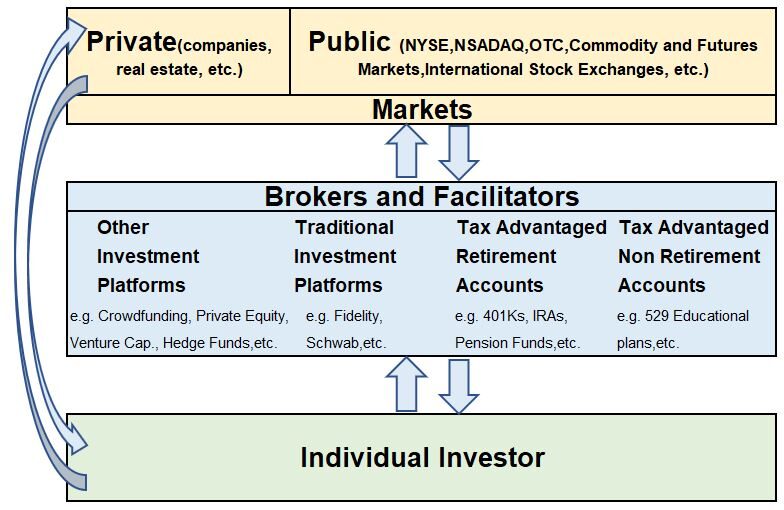

Investment Money Flow

Another way to look at investments is by how the money flows.

Graphic 6 shows that ,typically, there are three players in each investment transaction:

- the investor,

- the broker/facilitator,

- and the market or exchange.

Graphic 6 – Flow of Investment Money

Obviously , there are some investments where the investor is the broker and the transaction does not need a platform (for example , buying a rental house).

But generally, investors will work through some kind of investment platform which facilitates the buying , selling and administration of the investment.

For example, an investor might have a taxable investment platform via Schwab in which he/she can buy stocks through a brokerage system.

The markets in which the actual trades are made can be public markets (namely the large , regulated exchanges) or private markets.

An example of a private market would be private real estate which could be purchased/sold via Crowdfunding Platforms.

Notice that there are Tax Advantaged accounts which are various investments grouped together and managed separately due to their tax status (401ks, IRAs, etc.).

Notice also that there are Tax Advantaged educational investments like 529b plans (college investment plans which allow you to invest in various stock Mutual Funds for example).

Conclusion

You now know that your investment options are quite broad.

- You could invest in Cash, Bonds, Stocks, or Alternatives, and, in general, your risk of losing money will increase as you go from left to right through this list.

- Alternative Assets include real estate, commodities, derivatives, and others.

- In addition to buying individual investments , you can also buy combinations of investments via Mutual Funds and Exchange Traded Funds.

- These pooled investments can also give you access (with sometimes very reasonable minimum investment amounts) to Alternative Asset classes that might otherwise be too complicated or expensive to participate in.

- Since the passage of the JOBs Act in 2012 which loosened SEC regulations, private enterprises are now soliciting money directly from small investors via Crowdfunding internet platforms.

- Private real estate Crowdfunding, for example, has become increasingly popular these days.

With so many choices, how do we decide what our investment portfolio is going to look like?

What assets should we use and how should we allocate them?

A Reasonable Strategy

Assuming you are ready and able to invest—meaning your high-interest debt is under control and your financial foundation is solid—the most effective path for new investors is often to keep things simple.

A widely respected strategy is the Bogleheads approach, which advocates for avoiding the complexity of individual stock picking in favor of a few low-cost, broad-market index funds.

https://www.bogleheads.org/wiki/Getting_started

This method focuses on capturing the steady growth of the entire market over the long term, proving that you don’t need a complicated system to build significant wealth.

The “Three-Fund Portfolio” Example

One of the most common ways to implement this strategy is through a Three-Fund Portfolio.

This setup provides exposure to nearly every publicly traded company in the world and the entire investment-grade bond market.

Fund_1

- Asset Class: Total US Stock Market

- Purpose: Growth from US companies

- Common Example (Vanguard): VTSAX (Fund) or VTI (ETF)

Fund_2

- Asset Class: Total International Stock

- Purpose: Global diversification

- Common Example (Vanguard): VTIAX (Fund) or VXUS (ETF)

Fund_3

- Asset Class: Total Bond Market

- Purpose: Stability and income

- Common Example (Vanguard): VBTLX (Fund) or BND (ETF)

Appendix 1 – GICS (Stock Sector, Industry Classifications)

- Return to Industry and Sector Section

- Return_to Infrastructure Section

- Return to Commodities Section

- Return_to Menu

MSCI , S&P Global Industry Classification Standard

Appendix 2 – MSCI Country Classifications

Source: https://www.msci.com/our-solutions/indexes/market-classification

MSCI utilizes several criteria to differentiate countries as Developing, Emerging, Frontier, or Standalone:

Categorization Criteria: (Source: https://www.msci.com/documents/1296102/8ae816b1-fa03-bae3-0bb4-1a3b2bf387bf?t=1656972645260)

- Sustainability of Economic Development

- Size and Liquidity Requirements

- Market Accessibility Criteria (openness to foreign ownership, ease of capital inflows/outflow, efficiency of operational framework, availability of investment instruments, stability of the institutional framework)

Disclaimer: The content of this article is intended for general informational and recreational purposes only and is not a substitute for professional “advice”. We are not responsible for your decisions and actions. Refer to our Disclaimer Page.