Last Update: November 6, 2022

The Power of Personal Financial Statements

This post describes two very important tools that every person should utilize: The personal Balance Sheet (Financial Position) and the personal Income/Expense (Cash Flow) Sheet (or Statement).

You cannot improve your financial situation if you don’t track and measure it. Recall from my Accounting Primer that corporations use Balance Sheets to estimate their financial condition for a specific moment in time and they use Income Sheets to track their cash flows over different periods. The individual investor can use these same constructs to monitor and analyze their finances.

Your personal Balance Sheet and Income/Expense Sheet allow you to capture and track all the key categories that will impact your (your family’s) financial life, namely,

- Assets, Liabilities and Net Worth

- Income/s

- Taxable Savings

- Tax Free Savings

- Tax Free Education Costs

- Home, Auto, Educational, and Credit Debts

- Living Expenses

- Insurance Costs

- City, State, Federal Taxes

- Other

Compiling and tracking all the items listed above allows you to assess and adjust your overall financial plan which will typically comprise the following categories:

- Debt Plan (Housing, Auto, Education, other)

- Insurance Plan

- Estate Plan

- Education Plan

- Investment Plan

The following sections describe the basic structure of the Balance and Income/Expense Sheets.

The Personal Balance Sheet

You need to create a personal Balance Sheet tool that you can update on some frequency. Recall from my Accounting Primer that the Balance Sheet is defined by the Accounting Equation:

Assets – Liabilities = Equity = Net Worth

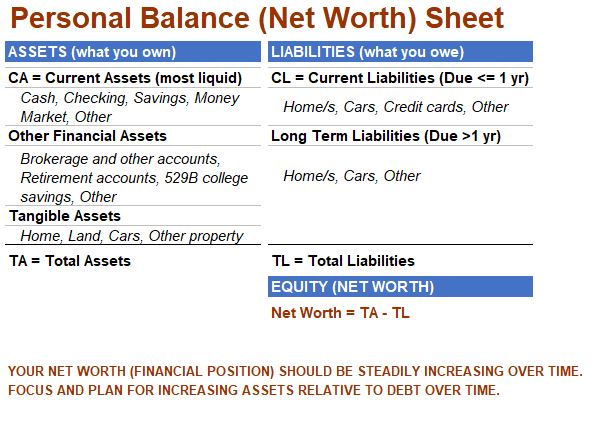

Graphic 1: Personal Balance (Net Worth) Sheet

Your personal Balance Sheet will show your Net Worth (your financial position) at a specific time. If your Net Worth is negative or not substantial, then you need to figure out how to increase assets and/or reduce liabilities. By tracking this on some frequency you can make the adjustments and future plans needed to ensure your Net Worth continues to grow.

It’s very important that you provide as much detail as possible. This will allow you to do a more thorough analysis of the data (see later section on Personal Financial Ratios).

Create Your Personal Balance Sheet

So, create a detailed and periodically updatable Net Worth template or sheet so you can track your Net Worth growth over time (perhaps quarterly or yearly). Follow the general design of Graphic 1.

Make a discrete and descriptive listing of everything of value that your family owns. You can do this manually on a sheet of paper but I’d recommend you do this electronically so you can easily manipulate, analyze, and update the numbers. The listing should include

- all financial accounts including retirement accounts,

- all hard assets (e.g. home, cars, other property),

- all insurance policies with cash value

- all liabilities (credit, loans, other debt)

- a computation of Net Worth = Sum (assets) – Sum (liabilities)

If you want to save time and effort, download a free template from the internet and then you can modify and adjust it as needed over time. For example, Vertex offers free downloadable templates (see note below).

Note: You can use free internet software tools to do this. My favorites are Google (Google Sheets, Google Docs) and LibreOffice (Writer Document, Calc Spreadsheet). It will cost you to use Microsoft, but their Word and Excel programs are the most widely used today. I strongly recommend you learn how to use Google Sheets or Microsoft Excel since you will then have access to powerful financial calculations that will come in handy for financial planning.

Personal Income/Expense Sheet

Whereas your Balance Sheet will give you a snapshot in time of your Net Worth, your Budget (Income/Expense Sheet) will allow you to track and adjust your saving and spending behavior.

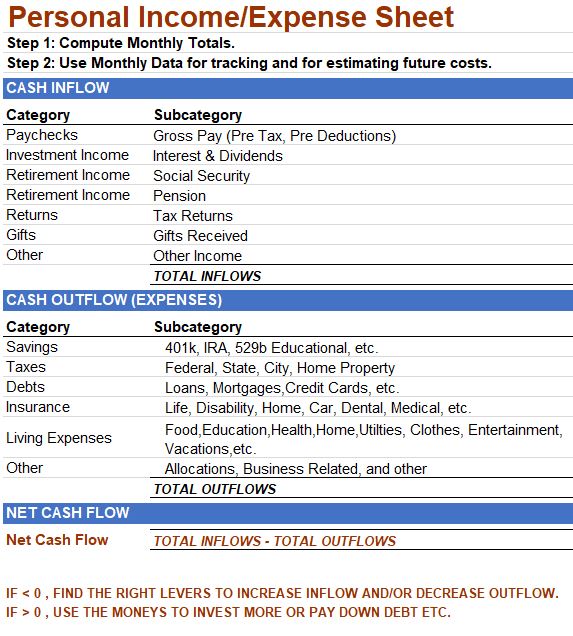

So, you need to build a Budget template or sheet that you can update periodically. This is very important. The structure of the Budget will look like Graphic 2 below.

Graphic 2: Personal Income/Expense Sheet

How to Use Your Budget

How to Use your Budget:

- Record all cash inflows (income) on some frequency (I would recommend monthly to begin with, and then perhaps quarterly or every 6 months after you get a good understanding of your typical monthly numbers).

- Record all cash outflows (expenses).

- Notice that savings are considered expenses.

- Compute your Net Cash Flow = Income – Expenses. The number should be usually positive. The higher the better.

- Make adjustments where possible to income and expenses to ensure that you are typically positive Net Cash Flow.

- Since you will probably have non-monthly income and/or expenses, it’s good to review the budget on a quarterly or semi-annual basis as well.

It’s very important that you provide as much detail as possible. The details will allow you to do a more thorough analysis of the data (see section on Personal Financial Ratios) and will keep in front of you all the possible levers for adjustment or improvement.

The internet has several free templates you can download. A few of many online resources are listed below:

Personal Financial Ratios

Once you have Balance Sheet and Income/Expense data captured, you can begin to track, analyze and plan. There are several financial ratios that can be computed from these two sheets. See Table 1 below for a listing of some of these ratios and associated rule of thumb targets.

Table 1: Personal Financial Ratios

Name | Formula | Typical Target | Source | Ref. |

|---|---|---|---|---|

| Liquidity Ratio: Emergency Funds | Current Assets / (Essential Monthly Living Expenses) | 3-6 months | Bal. Sheet and Inc./Exp. Sheet | Ref 1 Note 1 |

| Liquidity Ratio: Current Ratio | Current Assets / Current Liabilities | > 1 | Bal. Sheet | Ref 2 Note 1 |

| Liquidity Ratio: Current Assets/ Net Worth | Current Assets/ Net Worth | >15% | Bal. Sheet | Ref 3 Note 1 |

| Debt Ratio: Basic Housing (Front End) Ratio | Housing Costs / Gross Pay | <= 28% | Inc./Exp. Sheet | Ref 1 Note 2 |

| Debt Ratio: Debt to Income Ratio | Total Debt / Gross Pay | <=36% | Inc./Exp. Sheet | Ref 2 |

| Savings Rate | (Savings + Employer Match) / Gross Pay | 10% ok 20% great | Inc./Exp. Sheet | Ref 1 |

| Debt Ratio: Debt to Total Assets | Total Debt / Total Assets | 10%-50% | Bal. Sheet | Ref 1 |

| Net Worth Ratio (Solvency Ratio) | Net Worth / Total Assets | 20% young 90% old | Bal. Sheet | Ref 1 |

| Return on Investments | (Ending Investments - (Beginning Investments + Savings)) / Beginning Investments | 8%-10% | Bal. Sheet and Inc./Exp. Sheet | Ref 1 |

| Investment Assets to Gross Pay Ratio | (Investment Assets + Cash) / Gross Pay | .2 young 20 old | Bal. Sheet and Inc./Exp. Sheet | Ref 1 |

| Mortgage Ratio | (Mortgage Payment) / (Primary Income) | 2.5 | Inc./Exp. Sheet | Ref 2 |

| Retirement Savings | (Yearly Living Expenses) x 25 (x30) | 4% Rule (3.3%) | Inc./Exp. Sheet | Ref 3 Note 4 |

| Investment Assets to Total Assets Ratio | (Investment Assets) / (Total Assets) | 20s:>10% 30s:11%-30% 40s+:>31% | Bal. Sheet | Ref 3 |

| Millionaire Next Door Ratio (Targeted Net Worth) | (Age x Gross Income)/10 | bad: .5 good: 1 great: 2 | Inc./Exp. Sheet | Ref 3 Note 5 |

| 50/30/20 Budgeting Ratio | 50% Essential 30% Non Essential 20% Savings | Inc./Exp. Sheet | Ref 3 Note 3 |

Table 1 Notes and References:

Reference 1: usnews.com article on personal financial ratios

Reference 2: thecentsofmoney.com article on personal financial ratios

Reference 3: financeoverfifty.com article on personal financial ratios

Reference 4: Fundamentals of Financial Planning 6th Edition Dalton, Dalton, Gillice, Langdon; 2019; Money Education

Note 1: Current Assets = Cash and Cash Equivalents = Monetary Assets

Note 2: Housing Costs include principal + interest + taxes + insurance

Note 3: Elizabeth Warren and Amelia Warren Tyagi popularized the 50/30/20 rule in their book All Your Worth: The Ultimate Lifetime Money Plan.

Note 4: Motley fool article on the 4 % Rule.

Note 5: The Millionaire Next Door: The Surprising Secrets of America’s Wealthy – November 16, 2010 by Thomas J. Stanley (Author), William D. Danko

Conclusion

You will improve your chances of being financially successful if you organize and regularly monitor your financial data.

Use the personal Balance Sheet and personal Income/Expense Sheet to do this. You can find ready to use templates on the web.

These tools allow you to get all the data in front of you in a reasonably organized fashion. Use them to

- help you initially formulate your financial goals.

- periodically analyze and revise your financial goals (as needed).

Disclaimer: The content of this article is intended for general informational and recreational purposes only and is not a substitute for professional “advice”. We are not responsible for your decisions and actions. Refer to our Disclaimer Page.