Understand Your US Federal Taxes

Last Update: May 6, 2024

Menu

- Introduction

- Introducing the Embedded Tax Calculator

- Embedded Tax Estimating Tool

- Pay Stub and Form W-2 Basics

- Taxes and Post Tax Deductions

Example Using the Embedded Tax Calculator

- Example of a Tax Filing

- Example_step_1. Setup

- Example_step_2. Collect Relevant Data

- Example_step_3. Update Tax Brackets

- Example_step_4. Update FICA Taxes

- Example_step_5. Enter Income and Adjustments

- Example_step_6. Qualified Dividends and Long Term Capital Gains

- Example_step_7. Ordinary Income Tax

- Example_step_8. Tax Adjustments (Debits)

- Example_step_9. Tax Adjustments (Credits)

- Example_step_10. Net Taxes Due

- Example_step_11. Penalties and Tax Rate Summaries

- Example_step_12. Summary

Summaries

Understand How You Are Taxed

- reducing your fear and helping you gain confidence when dealing with taxation issues. You’ll become less intimidated by the whole tax filing process.

- understanding and therefore maximizing (or at least optimizing) tax reducing benefits.

- understanding how your various investments and resultant incomes are impacted by various types of taxes.

- incorporating this knowledge when making short term and long term financial decisions.

- confidently interacting with and maximizing the benefits of working with financial advisors (including tax experts).

Benjamin Franklin and others before him referred to the certainty of taxes being almost equivalent to death.

Regardless, why not make the best of a situation you know you will have to deal with on an annual basis (Federal Taxes are due in Mid April of each year). Try to develop a decent working knowledge of the taxation process, enhance your personal finance skills, and try to have a little bit of fun with it!

We’ll Keep Things Simple(ish)

Hopefully this post conveys the rudiments of US based Federal income taxation without overwhelming you with too much detail.

My intended target reader is someone who needs to gain a rudimentary working knowledge of US Federal personal income tax filing and tax payments.

It might be someone embarking on their first job or it might be someone who has relied too heavily on others (tax software, tax professionals) and now seeks deeper understanding etc.

- Taxes on what you earn (e.g. pay and investment income)

- Buying related Taxes (e.g. sales tax etc.)

- Taxes on what you own (e.g. property taxes etc.)

Introducing the Tax Calculator

In the following section below, I’ve embedded a tax calculating spreadsheet tool (Microsoft Excel) that you can run from this post. If you have and use Microsoft Excel and want to ‘peak under the hood’, you can download the tool here: Tax_Estimating_Tool

This post walks you through a tax filing using the embedded calculator. I strongly recommend you bounce back and forth between my text and the sequence in the calculator that I am referring to. (Note: The computation for Long Term Capital Gains plus Qualified Dividends is simplified and not 100% accurate in this version of the Tax Estimating Tool. This will be updated eventually).

Tax Calculator General Description

The Tax Estimator in the following section is an educational tool that is designed to be roughly consistent with how an actual personal US tax filing would be done. It does not account for all the potential complexities of an actual return.

It is designed for personal taxes and not corporate or business taxes. Simply update the blue fonted values and work top to bottom.

So, don’t use this tool to submit your actual taxes. Use it as a learning tool to (1) familiarize your self with the sequential tax filing/computation process and to (2) learn key tax terms and concepts.

The sections following the embedded calculator use an example of a couple filing jointly to teach you the basics of how a US personal income tax filing is done.

(Note: The computation for Long Term Capital Gains plus Qualified Dividends is simplified and not 100% accurate in this version of the Tax Estimating Tool. This will be updated eventually).

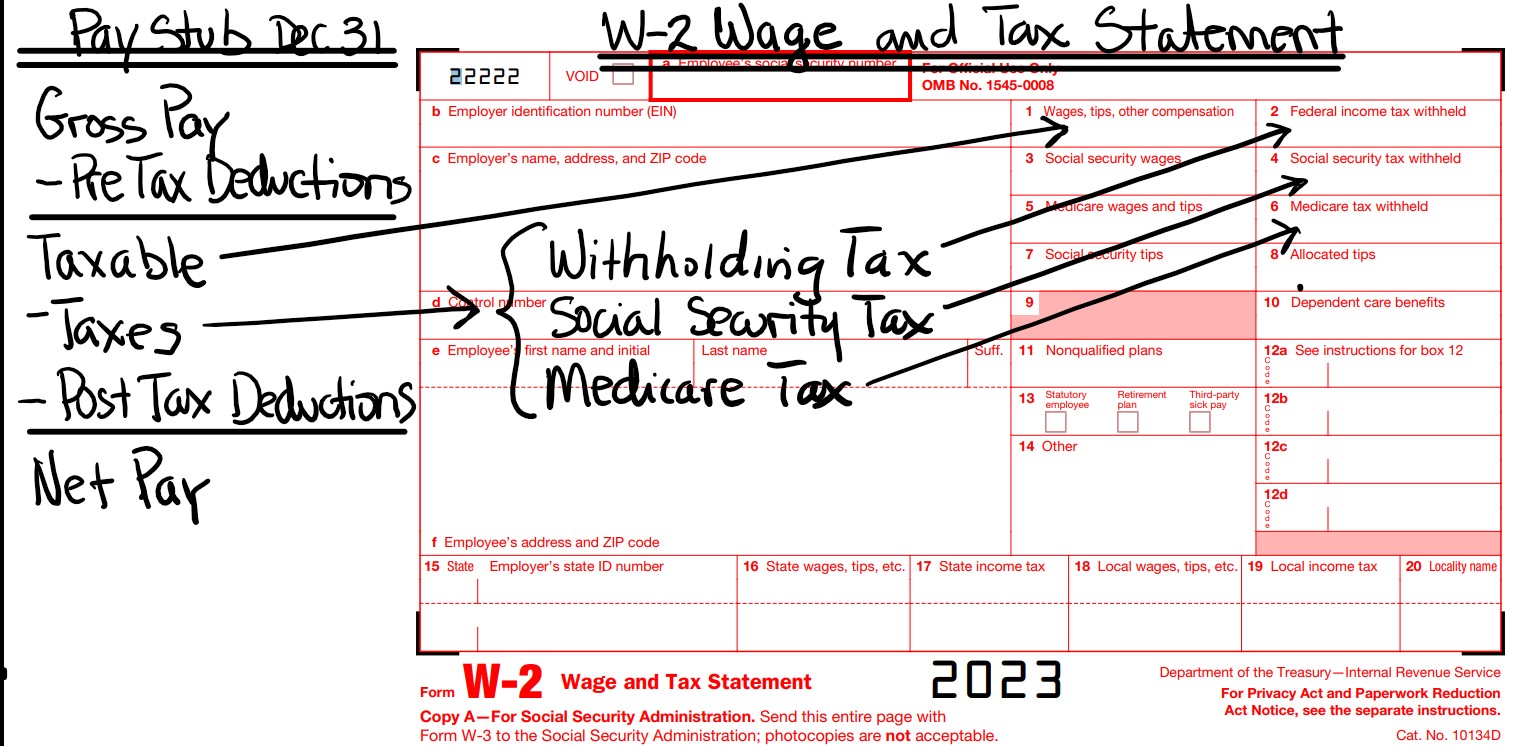

Pay Stub and Form W-2 Basics

Let’s review some key aspects of your Pay Stub or Pay Slip first. I think Pay Stub might be the more commonly used term in the USA but it has the same meaning as Pay Slip.

A Pay Stub is effectively an accounting summary of your pay. It starts with your Gross Pay and then adjusts it downwards by taxes and deductions to arrive at your Net Pay (your take home pay).

Your company should send you a Pay Stub each time you are paid. Your company will also issue you a yearly summary of your reportable tax information via IRS Form W-2 (Wage and Tax Statement).

As we work through the Pay Stub, we will note where some of the Form W-2 values come from.

Pay Stub Definition of Gross Pay vs Taxable Pay

Ideally each Pay Stub will show the pay period values but also the year-to-date cumulative values. This makes the last Pay Stub of the year a useful document to match against your W-2 form.

You should see the following items listed in each Pay Stub:

Gross Pay: The total amount of income you make. Everything is included here.

Taxable Pay: This will be the Gross Pay reduced by various pre-tax deductions including

- Medical/Dental Insurance payments,

- Retirement/deferred contribution deductions e.g. 401(k) (see the last 2 paragraphs in this section for more on this ).

- Other insurance payments (e.g. accident insurance)

- Other income adjustments

So,

Taxable Pay = Gross Pay – Pre-Tax Deductions.

If you are trying to reconcile your Pay Stub numbers (i.e. arrive at the same numbers shown on the Pay Stub), make sure you review all your income breakdowns and see if any adjustments have been made.

Talk to your company HR representative if you cant reconcile the numbers.

What does Taxable Pay Actually Mean Here?

Taxable Pay as defined by your Pay Stub is a little misleading.

When we are talking about the Federal Graduated Income Taxes, then your Pay Stub Taxable Pay is indeed the basis to use. However, Social Security and Medicare Taxes (Payroll or FICA taxes) are levied against your pay as well.

The tax basis for these tax calculations (based on flat rates) is actually the Pay Stub Taxable Pay with any 401(k) or (other elective deferrals) ADDED BACK.

That is,

Taxable Pay (for purpose of Payroll Taxes) will be the Gross Pay reduced by various pre-tax deductions including

- Medical/Dental Insurance payments,

- Note: does not include Retirement/deferred contribution deductions e.g. 401(k)

- Other insurance payments (e.g. accident insurance)

- Other income adjustments

To summarize, your elective deferrals like your 401(k) or 403(b) etc. are not taxed as ordinary income (i.e. no graduated income tax applied) but are subject to Social Security and Medicare taxes. We’ll cover this again in the FICA tax section below.

Employer Tax Deferred Plans (e.g. 401ks, 403bs,and 457bs)

Employer (Private, Public, or Government) tax deferred plans (for example 401k, 403b,457b plans) are an excellent way to save tax deferred money. In 2023, the IRS allows employees under one of these plans to save as much as $22,5002023 (and another $7,5002023 if older than 50).

This amount would be deducted from your Gross Pay before you pay Federal ordinary income taxes (Payroll taxes, however do include these deferred amounts. We review this in more detail in later sections).

This money grows tax deferred in investments of your choice until retirement (where you will pay taxes…cant escape it…but you delay it and let compounding work for you). Often, the employer will match some component (or perhaps do a 1:1 match if you’re fortunate).

Also be aware that some employers will not match unless you contribute, so you are throwing free money away in this situation if you don’t participate.

The earlier you put money away to grow exponentially (compounding growth) , the more money you are going to have at retirement (see my power of compounding post to see why putting money in early is so beneficial).

Taxes and Post Tax Deductions

Now we describe how your income gets reduced by taxation.

Remember that we will not discuss the impact of state and local taxes on your taxes. For example if you live and get paid in New York, you pay city, state, and Federal taxes! Different states employ different tax rules and sometimes your state and local tax payments affect your Federal tax payment.

The goal is to convey key taxation concepts without overwhelming you with the many potential nuances and complexities that might apply to your situation.

So, back to business; Let’s start with your Taxable Pay. Your total Taxable Pay for the year is shown as the cumulative value in your last Pay Stub of the year. The same exact number should be shown in Box 1 of your W-2 Form.

The W-2 form is sent to you by your employer early in the following year, so you have sufficient time to file your previous year tax paper work in April (typically).

Generally, income is automatically taxed in two general ways:

- FICA (Federal Insurance Contribution Act) Taxes (AKA Payroll taxes)

- Withholding Tax

FICA Taxes

FICA Taxes are also known as Payroll Taxes or Social Insurance Taxes. The Federal Insurance Contribution Act, FICA, mandates that taxes that fund Social Security and Medicare be levied from your Gross Income. There are two tax components to FICA.

- Social Security Tax (Up to a certain threshold limit on income shown in W-2 Box 3, you and your employer each pay a social security tax (e.g. in 2023 it was 6.2% and 6.2% respectively). W-2 Box 4 shows the amount of SS tax paid.

- Medicare. In 2023, you pay 1.45% on your income but you pay an extra .9%(in 2023) if your income exceeds a certain income threshold (depends on your tax filing status). Your employer also pays the same amount (1.45% in 2022). W-2 Box 5 shows the wages subject to Medicare taxes and W-2 Box 6 shows how much was paid through the year.

Note that your W-2 Box 5 might not match your W-2 Box 1 Wages (it can be higher for example). This is because wages subject to Medicare taxes will be your Gross Pay minus all of your pre-tax benefits except for any deferred contribution deductions (401(k) plans for example).

Note! Elective Deferral Amounts (e.g. 401k and other deferrals) Are Taxed for Social Security and Medicare

I mentioned this in a previous section but it’s good to review again.

FICA or Payroll Taxes are applied to Gross Income after some adjustments are made. Before FICA taxes, your Gross Income is adjusted down (reduced) by medical/dental insurance payments and accident insurance payments (for example) but not by any money you elected to defer into your tax free 401k account (for example).

What did you say? Yes, your “tax- free” elective deferral (401(k) or 403(b) or 457(b)) is (typically) not really fully tax free. It’s free from the graduated income tax brackets for ordinary income, but it still flat-taxed at the Medicare and Social Security tax rates.

See IRS publication 15 to understand what portion of your Gross Pay is taxed for Social Security and Medicare ( see section in publication 15 titled “Special Rules for Various Types of Services and Payments”).

This is why, on your W-2, you actually have three tax basis numbers provided:

- Box_1 matches your Taxable Pay on your Pay Stub and is the basis for the ordinary income tax tax brackets.

- Box_3 is the basis for your Social Security taxes (same basis definition as Medicare but it is capped).

- Box_5 is the basis for your Medicare taxes (not capped and adds an additional tax if you make more then a certain threshold).

Withholding Taxes

The amount of taxes already paid (withheld) for the year is shown in form W-2 box 2. Your cumulative end of year Pay Stub shows this value as well.

Withholding taxes are supposed to cover all taxes owed (except the FICA taxes which are paid separately using flat tax rates). Examples of types of taxable income would be:

- Pay: taxed as Ordinary Income

- Stock Dividends from stocks owned for less than 60 or 90 days (for preferred stocks): taxed as Ordinary Income

- Asset short term capital gains (owned less than one year): taxed as Ordinary Income

- Asset long term capital gains (owned more than one year): taxed as Long Term Capital Gains

- Stocks dividends from stocks owned at least 60 or 90 days (for preferred stocks): taxed as Qualified Dividends

- Others

We’ll cover the tax implications for Ordinary Income vs Long Term Capital Gains and Qualified Dividends when we run through our example in a later section.

Your employer, with information provided by you via an IRS form W-4 , automatically takes out a certain percent of your taxable pay based on guidance from the Internal Revenue Service (see IRS publications 505 and 15-T).

From one year to the next you have the ability to adjust for additional withholding amounts (through your employer) if you significantly underpaid the amount owed.

Estimated Tax Payments

Remember that your Federal income tax is a pay-as-you-go tax, so you are supposed to pay when you receive the income.

The IRS also allows you to submit periodic Estimated payments if you have non periodic income, hard to predict income, and/or very large income streams.

For example, the income you make from stock or other investments each year might produce hard to predict income or you might have received a windfall amount of income. In this case, you might have to make estimated tax payments to ensure you don’t get late payment penalties.

Post-Tax Deductions

There are additional post-tax deductions that your Pay Stub accounts for. These might be items like company insurance benefits or stock purchase benefits among other things.

Net Pay

Your net pay is what remains after all the adjustments are made. It is what is sent to you as your “take-home” pay.

Net Pay = (Gross Pay) – (Taxes Paid) – (Post and Pre Tax Deductions)

Summary

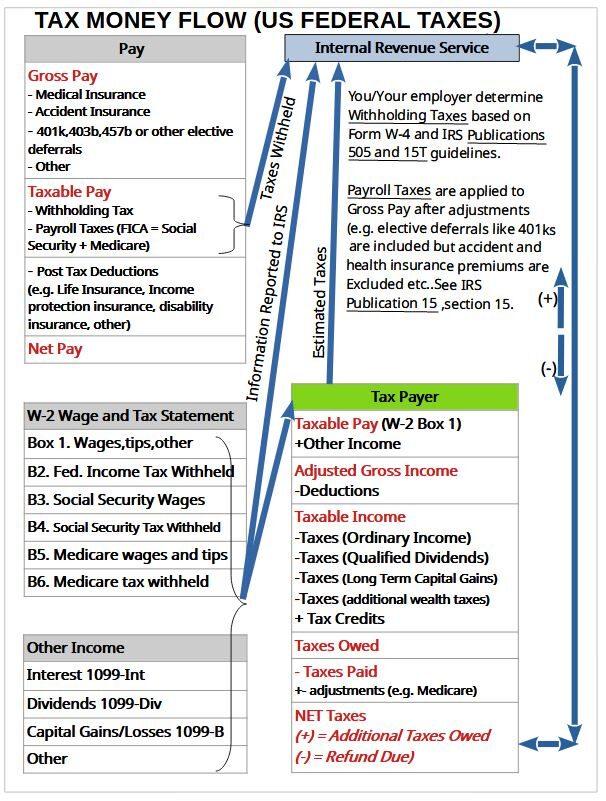

Schematic_1 shows you the interconnectivity of your Pay Stub and your IRS form W-2.

Schematic 1: Pay Stub and IRS Form W-2

So, in summary, given that (1) US Federal income taxes are a pay-as-you-go system and (2) a potentially big component of what you paid is based on an estimated withholding amount, the US government expects you to reconcile what you have already paid with what you owe.

Filing your taxes essentially is the process of reconciling what you’ve already paid with what is actually due.

You might get a refund back if you overpaid or you might owe additional monies. The IRS wants you to stick to the rules of pay-as-you-go which means, if you underpay by too much (less than 90% of what you owe), you will pay a penalty on top of what you owe.

Example of a Tax Filing

You should now be familiar with your Pay Stub and your IRS W-2 form. You also understand that filing your taxes is a reconciling exercise to ensure that you have paid sufficient taxes throughout the year.

We are now ready to start our tax filing example. Refer to the embedded tax estimator tool above as you go through the example. (or download the tool if you have Microsoft Excel software… whatever is better for you).

Note: Instructions in the example below are preceded by the symbol ⇒

Example Tax Filing

(Tax Example) 1. Setup

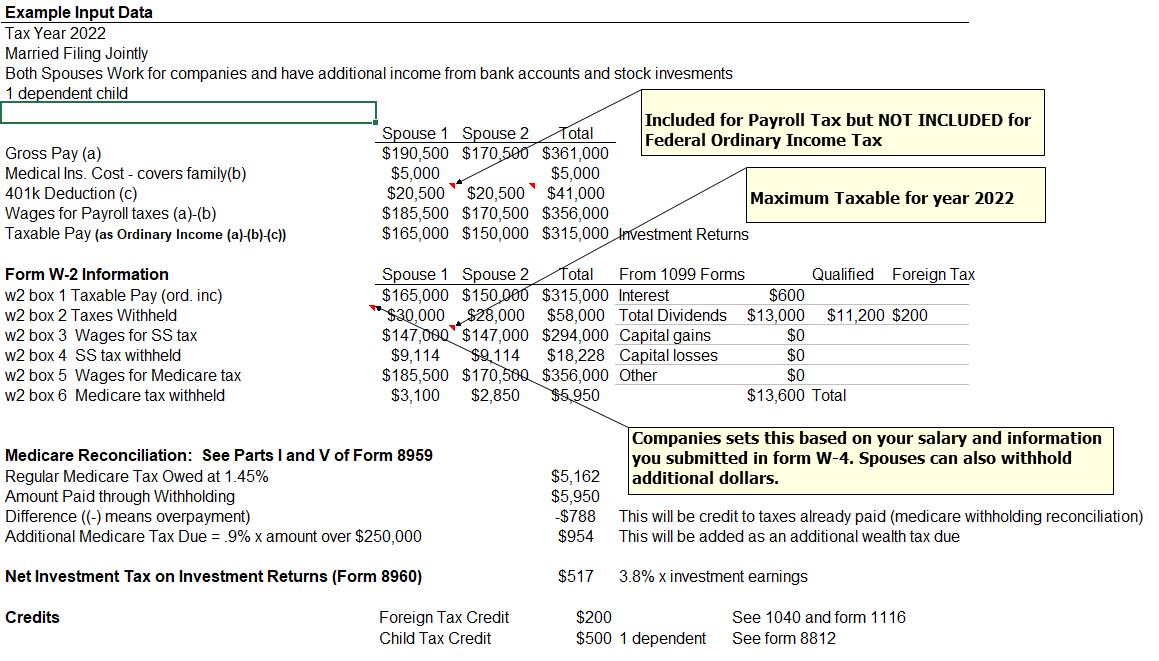

For our example, we have a middle aged couple, with one dependent child, who will file their taxes jointly. There is no State Income Tax.

Assume the following:

- Gross Pay (a) $361,000

- Medical/Dental Ins. Cost (b) $5,000

- 401k Deductions (c) $41,000

- Wages for Payroll taxes (a)-(b) $356,000

- Taxable Pay (as Ordinary Income (a)-(b)-(c)) $315,000

- W-2_box 1 Taxable Pay (ord. inc) $315,000

- W-2_box 2 Taxes Withheld $58,000

- W-2_box 3 Wages for SS tax $294,000

- W-2_box 4 SS tax withheld $18,228

- W-2_box 5 Wages for Medicare tax $356,000

- W-2_box 6 Medicare tax withheld $5,950

- Interest $600

- Total Dividends $13,000; $11,200 (Qualified); $200 (foreign taxes paid)

- Capital gains $0; Capital losses $0; Other $0

If you download the calculator spreadsheet , you can see more details on the input data in the “Example Input” tab. I’ll take you through the example step-by-step in the following sections of this post ,so you don’t really need this to understand the example.

Example Input Summary

(Tax Example) 2. Collect all income related documents

The couple needs to first collect all relevant data. Note that many of the forms and statements they have, the IRS has received as well (W-2 and the 1099 forms for example).

- End of year Pay Stub/s

- W-2 form/s

- (1099-Int) Interest statements

- (1099-Div) Dividend statements

- (1099B) Stock sale/gains/losses statements

- Statements of income from pensions, retirement plans, social security, and other

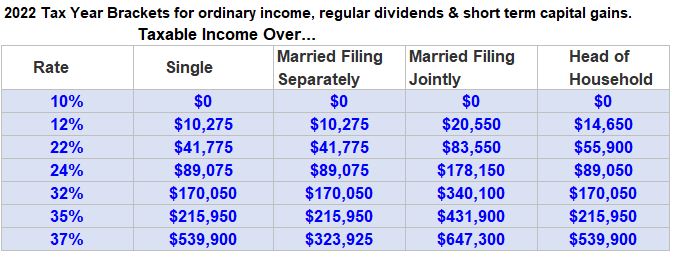

(Tax Example) 3. Update Tax Brackets and Filing Status

Embedded Calculator Sections 1, 2, and 3

We now want to start going through and updating the Federal Tax Estimator Tool (embedded above in this post or you may want to download it here).

Start at the top and work down sequentially. All Blue Fonted cells have to be updated (or at least reviewed to ensure they are up to date).

⇒ Enter the tax year (this will be 2022 in our example)

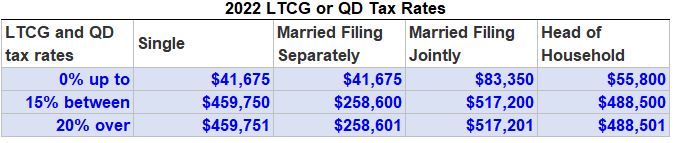

⇒ Update the Tax Year Tax Brackets ( find via the web. Try IRS.gov or Turbo Tax or H&R Block web sites to get these). The numbers for 2022 are shown in Table 1.

⇒ Enter your Filing Status from the lookup list. In our example, we have a married couple that is filing jointly.

Table 1: 2022 US Federal Ordinary Income Tax Brackets

Tax Bracket Observations

- They don’t apply to longer held investment income (Qualified Dividends and Long Term Capital Gains)

- Tax Brackets apply to Ordinary Income (like your pay), Short term Dividends (from investments held less than 60 or 90 {for preferred stocks] days), and short term Capital Gains (from assets held less than 1 year).

- They are graduated or progressive, meaning, your income is broken into sequential amounts (or tranches) that are taxed at higher and higher tax rates.

- As you make more money you are taxed more. I’m guessing that for most people, the perceived fairness of this system is inversely proportional to the amount of money the perceiver is making!

- There are 7 progressive tax rates today (10%, 12%, 22%, 24%, 32%, 35%, and 37%). When you hear the term Marginal Tax Rate, it is referring to one of the above tax rates.

- Note that if you are in the highest tax rate of 37% for example, that does not mean that you are paying 37% taxes on all your money. The 37% would only apply to the tranche of money in that 37% tax bracket.

- So, if you’re a single filer and you make $150,000/year, you’re in the 24% marginal tax bracket and you’ll pay 24% taxes on $60,925 ($150,000 – $89,075 = $60,925).

- Your Effective Tax Rate (Tax Paid/Taxable Amount) might be a more valid way of quantifying the amount of taxes you actually paid (in total).

- The basis for this Effective Tax Rate should always be defined (e.g. is it based on Taxable Income or Adjusted Gross Income?).

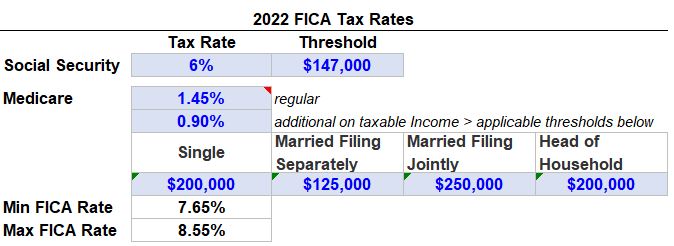

(Tax Example) 4. Update FICA Taxes

Embedded Calculator Section 4

Recall that, the Federal Insurance Contribution Act, FICA, mandates that taxes that fund Social Security and Medicare be levied from your Gross Income. There are two tax components to FICA: Social Security and Medicare.

⇒ Update the FICA (SS and Medicare tax) rates from the web.

I obtained this information from a web site called benefitsattorney.com but you can find several others online (e.g. in ssa.gov , search for Social Security and Medicare taxes).

Notice the additional tax of .9% on income over a filing status threshold.

For 2022, the FICA taxes are shown in Table 2 below.

Table 2: 2022 FICA Tax Rates

Note that the embedded Tax Calculator doesn’t use these tables to do any FICA tax calculations.

But it’s useful information you can use to check against your Pay Stub and your W-2 form to understand how your FICA taxes were calculated.

The calculator does, however, reconcile Medicare taxes you have paid and we’ll discuss this more in later steps.

⇒ Enter your total W-2 box 4 (Social Security tax withheld) and box 6 (Medicare tax withheld).

We’ll use these to compute the total true tax rate you are paying in Section 12 of the calculator.

Please note that elective employee contributions and deferrals (like amounts you put in your 401(k) or equivalent plan) ARE TAXED for Social Security and Medicare.

You often hear these described as pre-tax deductions but this is only true when referring to the Federal ordinary income graduated tax rates (based on Taxable Pay which does not include deferred contributions).

(Tax Example) 5. Enter Income and Adjustments

Embedded Calculator Section 5

⇒ Enter your Taxable Pay from W-2 Box 1, wages, tips, other compensation.

This is your total cumulative taxable pay on your end of year Pay Stub. It is your Gross Pay adjusted for pre tax deductions like medical/dental insurance , accident insurance, elective deferrals like 401(k)s etc.

⇒ Enter all your interest income, total dividends (form 1099-Div 1a), capital gains (short and long term), and capital losses (enter as negative value)

⇒ Update all your retirement type incomes (pensions, 401Ks, 403b, 457b).

Use Form 1099R for these entries.

⇒ Enter any other incomes (or losses). Make sure to input all negative adjustments as negative values.

The calculator will add these all up to give you your Adjusted Gross Income (AGI). This should match your Form 1040 AGI value.

In our example, our hypothetical couple made $315,000 of Taxable Pay, $600 of interest from their bank account, and $13,000 of dividends from their mutual fund investments. Their Adjusted Gross Income is therefore $328,600

AGI = $315,000+$600+$13,000= $328,600

There is an additional adjustment I included called QBI (Qualified Business Income).

These are deductions you might get if you have Qualified REIT (Real Estate Investment Trusts) Dividends (199A Div) or publicly traded partner income (use form 8995-A).

It’s not included in the definition of AGI but it does reduce your taxable income. We’ll keep this $0 in our example.

Standard Deduction vs Itemized Deduction

See IRS.gov for guidance on Itemized Deductions versus the Standard Deduction.

⇒ Update the Standard Deduction Table in 5b.

You can find this information at IRS.gov among other web sites.

The Standard Deductions in 5b are not valid if the taxpayer is blind or above a certain age limit. In our example we will assume our taxpaying couple is middle aged and has no handicaps.

⇒ Enter Itemized Deductions or the Standard Deduction (whichever is greater) in 5d.

In our example, our couple will take the Standard Deduction of $25,900. Enter this as a negative value in the calculator.

The Calculator can now compute the Taxable Income (This should match the Taxable Income line in your Form 1040). For our example:

Taxable Income = AGI – QBI – Standard Deduction = $328,600-0-$25,900 = $302,700

(Tax Example) 6. Qualified Dividends and Long Term Capital Gains

Embedded Calculator Sections 6 and 7

Let’s define two useful terms here.

Earned Income: Your Paycheck income is considered Earned Income. It’s Taxed as Ordinary Income (i.e. the Federal tax brackets apply).

Unearned Income: Almost all other forms of income including pensions, retirement income, social security payments, and investment income (interest, dividends, capital gains).

Depending on what type of Unearned Income it is, these could be taxed as Ordinary Income, Qualified Dividends, or Long Term Capital Gains.

- Pensions, Social Security, and other Retirement Income – Taxed as Ordinary Income

- Short Term Investments Income – Taxed as Ordinary Income. Recall that short term investments are based on how long the underlying investment was held.

- For Dividends, short term refers to less than 60 or 90 days depending on the type of stock. For Capital Gains, short term refers to less than one year.

- Long Term Investment Income – Taxed as Qualified Dividends (held > than 60 or 90 days) or Long Term Capital Gains (held > 1 year). The same tax rates apply to both.

Note: There could be other forms of income from real estate or other investments that might require special treatment.

Calculate Long Term Capital Gain and Qualified Dividend Taxes

⇒ Update the LTCG and QD Tax Rate table in section 6b of the Tax Calculator.

You could use hrblock.com among many on-line sources to obtain this information. See Table 3 below for 2022 tax rates for Long Term Capital Gains (LTCG) and Qualified Dividends (QD).

Table 3 – 2022 LTCG and QD Tax Rates

In our example , the income for Married Filing Jointly is between $83,350 and $517,000 so a 15% percent tax rate will apply for Qualified Dividends and Long Term Capital Gains.

⇒ Update the Qualified Dividend amount in section 7a. A lookup calculation should select 15% from the table above.

We’ll assume that from form 1090-Div 1b, that the Qualified Dividends are $11,200. So the couple in our example will owe taxes of $1,680 on their Qualified Dividend earnings.

⇒ We’ll assume no Long Term Capital Gains for our example, so section 7c input is 0.

The calculator can now compute the portion of the Taxable Income that is going to be taxed via the Federal ordinary tax brackets.

Taxable Incomenot including QD or LTCG = Taxable Income – QD – LTCG = $302,700-$11,200-$0 = $291,500.

(Tax Example) 7. Ordinary Income Tax

Embedded Calculator Section 8

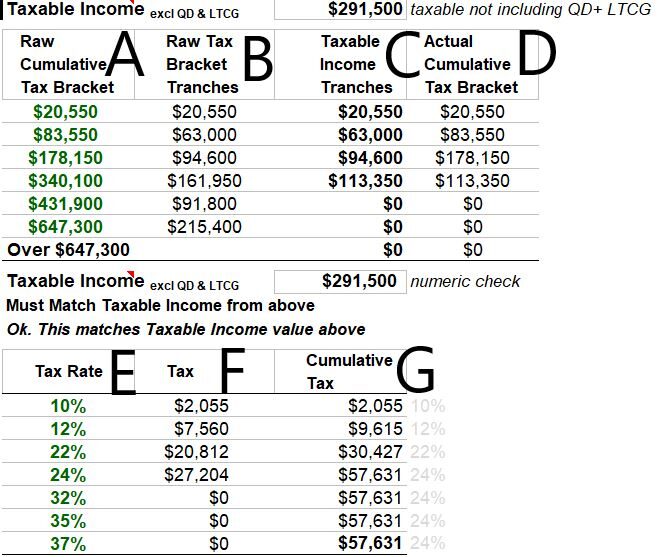

So the Ordinary Income in our example is $291,500. The calculator will use the Federal graduated income tax brackets to compute the taxes owed on this amount. Refer to Table 4 below.

Table 4 – Income Tax Calculation Table for Ordinary Income

Column C in Table 4 is computed from data in Columns A, B, and D. In column C, the total taxable amount of 291,500 is broken up into sequential tranches (groups) of income.

If you sum all the numbers in Column C you will get $291,500. Now each tranche is taxed at its marginal tax (see Column F). So,

- The first $20,550 is taxed at 10% = $2,055

- The second $63,000 is taxed at 12% = $7,560

- $94,600, the third tranche, is taxed at 22% = %20,812

- The Fourth and final $98,350 is taxed at 24% = $27,204

The total tax (on Ordinary Income) owed will be the sum of these taxes (see Column G) which is $57,631. 24% was the highest marginal tax rate used.

Note that only a portion of the income was taxed at this highest rate. For this reason this kind of taxation is called a progressive or graduated.

(Tax Example) 8. Tax Adjustments (Debits)

Embedded Calculator Sections 8, 9

Let’s continue with our example and add up taxes owed so far:

- Ordinary Income Tax = $57,631

- Qualified Dividend Tax = $1,680

- Long Term Capital Gains Tax = 0

Adding these up we get total taxes owed so far ($59,311.).

Now we have to make adjustments to this number based on how much income we made and what credits we might get (that will reduce our taxes).

We make additional taxes owed adjustments in section 9 of the calculator.

⇒ Enter additional Medicare taxes owed.

In our example, this couple made enough money that additional Medicare taxes are owed. See Form 8959 Part I. Additional tax for 2022 is (.9%) x (W2 box 5 – threshold amount). In our example this amount will be .9% x (356,000-250,000)= $954. So we will add this as an additional tax.

Note that your total Medicare tax owed will be the regular amount (1.45% x $356,000= $5162) + additional owed ($954). According to W-2 Box 6 you already paid $5950. The tax forms interpret this as meaning you overpaid the regular amount due by $5950 – $5162 = $788.

In section 11, we will take credit for this overpayment of $788.

⇒ Enter additional tax called the Net Investment Income Tax.

See Form 8960. If your income is high enough you will have to pay an additional tax called the Net Investment Income Tax (AKA Medicare Contribution Tax). In 2022 this tax is 3.8% x investment returns.

In our example, the additional tax will be 3.8% x ($13,000+$600)= $517

Total additional taxes from above are $1,471 ($954+$517) and we need to add this to the total taxes from the top of this section: $1,471+$59,311 = $60,782. Now we need to add any credits to this amount.

(Tax Example) 9. Tax Adjustments (Credits)

Embedded Calculator Section 10

There are several credits you might be eligible for that will reduce your taxes. In our example, we cover two, the Foreign Tax Credit and Child Tax Credit.

⇒ Input any Foreign Tax Credit.

You might have already paid some foreign taxes on portions of your investments (for example , mutual funds that hold foreign stocks or ADR stocks). You should be able to use the amount you paid as credit here. Form 1099-Div will show any foreign tax paid. You’ll have to fill out form 1116.

⇒ Input any Child Tax Credit.

According to the IRS, “You can claim the Child Tax Credit by entering your children and other dependents on Form 1040, U.S. Individual Income Tax Return, and attaching a completed Schedule 8812, Credits for Qualifying Children and Other Dependents.”

In our example, our couple has a Foreign Tax Credit of $200 and a Child Tax Credit of $500 (for one dependent child) for total credits of $700. We reduce our taxable amount by this much to get $60,782-$700 = $60,082

(Tax Example) 10. Net Taxes Due (or Refund Amount)

Embedded Calculator Sections 11 and 12

⇒ Enter taxes already paid by Withholding.

Get this from your W2 form (Box 2: Federal income tax withheld). Remember that W-2 Box 2 does not include FICA Social Security and FICA Medicare taxes withheld (those values are found in W-2 boxes 4 and 6). For our example, our couple has withheld $58,000.

⇒ Enter any Medicare Withholding Reconciliation credit.

See form 8959 part V. This is the amount of Medicare related tax you actually paid over the regular Medicare tax due. So you add this as tax already paid, to offset the extra Medicare Tax listed in section 9. In our example couple’s return, the Medicare numbers break down as follows:

- Total amount Medicare taxes from W2 Box 6 = $5,950

- Regular Medicare tax owed = 1.45 % x $356,000 = $5,162

- Amount Overpaid = $5,950-$5,162 = $788 (list as credit in Section 11 of the calculator)

- Extra amount due = ($356,000-$250,000) x .9% = $954 (listed as a debit in Section 9 of the calculator)

So, the total tax already paid will be $58,000 + $788 = $58,788 and and the total amount due is $60,082 so the net tax is $60,082 – $58,788 = $1,294 (Additional Taxes Owed to the IRS).

(Tax Example) 11. Penalties and Tax Rate Computations

Remember that the US Federal tax system is a pay-as-you-go tax system i.e. you need to pay up when you receive the income. If you underpay your taxes owed by more than 10%, you will be penalized.

In our example, our couple underpaid what they owed but only by 2.2% (100%-97.85%= 2.2%) , so no penalty applies .

It’s a good idea to quantify how much tax the couple actually paid. There are a few ways this can be meaningfully expressed.

Effective Tax Rate

The Effective Tax rate = taxes owed/taxable amount

= ($60,082/328,600 AGI = 18.3% if the taxable amount is the AGI and

= ($60,082/302,700 Taxable Income = 19.8% if the taxable amount is the Taxable Income.

Marginal Tax Rate

The couple’s Marginal Tax Rate or more accurately, the Highest Ordinary Income Marginal Tax Rate = 24%. Always remember this does not reflect the total tax rate.

It’s the rate that applies to that last tranche (as defined by the marginal tax rate table for ordinary income) of ordinary income you made

Total Tax Rate

⇒ Enter your Gross Income in this last section so you can compute your overall tax rate.

In our example, this is $374,600.

Payroll Taxes (Social Security and Medicare) are not being included in the taxes-owed value used in the Effective Tax Rate calculations. If we want to get an understanding of the overall impact of taxes on our income, we can compute a Total Tax Rate which can be computed follows:

Total Tax Rate on Gross Income =

($60,082taxes on ordinary income + qualified income + net long term capital gains + 18,228 Social Security Taxes + 5950Medicare Taxes) / $374,600 = 22.5%

(Tax Example) 12. Summary

We are done with the example! Our couple has gone through the tax filing processes (tax reconciliation) whereby they have determined

- an additional $1,294 is owed to the IRS.

- they underpaid by less than 10%, so they won’t be assessed additional penalty fees.

- they are in the 24% ordinary income Marginal Tax bracket.

- their Effective Tax Rate relative to their Adjusted Gross Income = 18.3%.

- their Effective Tax Rate relative to their Taxable Income = 19.8%.

- the overall tax rate on all income = 22.5%.

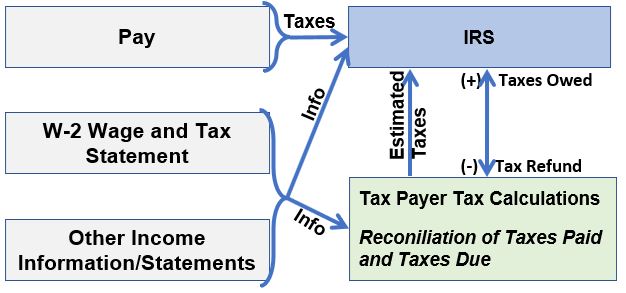

Tax Reconciliation Process Flow Diagram

The diagram below gives you a picture of the various aspects of a tax filing (reconciliation) process that we walked through in our example.

It shows the relationships among sources of information , tax payer calculations, and the IRS.

Schematic 2: Tax Reconciliation Process Flows

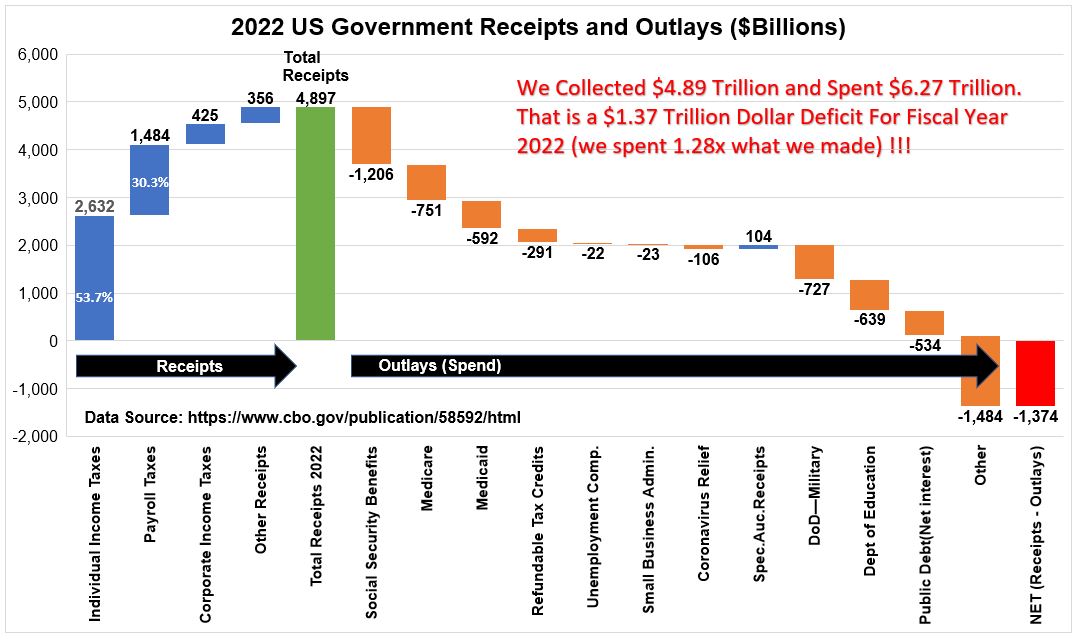

2022 US Tax Receipts and Outlays

In this section we’ll show how your tax contributions figure into total US Government receipts (taxes) and outlays (spend).

If we assume that Payroll taxes are split evenly between corporations and individuals, individuals contribute to about 68.9% of total government receipts.

See Graph 1 below for a detailed breakdown of what the US Government brings in versus what it spends. Does anything about this chart give you any concerns?

You can see that in 2022 the US Government ran a deficit (they spent more than they made). You wouldn’t want to run a budget deficit personally because you wouldn’t want to go broke and run out of money.

The government’s budgeting tasks are obviously way more complicated than your budget (they ) but on a fundamental level does this feel right to you?

Well, I think the answer to my somewhat rhetorical question is…it will depend.

Your answer and your point of view will probably depend on your personal financial condition, your educational background, your family background and history, your wealth, and myriad other variables.

Graph 1: 2022 US Government Receipts and Outlays.

Are you curious about how common it is for our Federal Government to run a deficit? Answer: The US Government has run yearly deficits since 2001.

See Graph 2 below, which is a copy from fiscaldata.treasury.gov. According to fiscaldata.treasury.gov, “From FY 2019 to FY 2021, Federal spending increased by about 50 percent in response to the COVID-19 pandemic.”

Note: the $1.38 Trillion from Graph 2 and $1.374 Trillion from Graph 1 are meant to represent the same number (assume the difference is due to round-off error).

Graph 2: US Government Yearly Federal Deficits Since 2001

Conclusion

Hopefully you’ve gained a deeper understanding of how a typical US Federal income tax filing is done. Remember that your yearly tax filing is the reconciliation component of a pay-as-you-go tax system.

See Schematic 3 for a high level schematic of the relationships and flows among the data sources, the tax payer, and the IRS.

Schematic 3: Generalized Tax Process Flow Blocks

Caveat Emptor Regarding Use of this Post and the Embedded Tool

Summary of Key Concepts and Methods Related to Tax Filing

Process Learnings

- The IRS (Internal Revenue Service) employs a pay-as-you-go tax system. That is, taxes are expected to be paid at the time you receive your taxable income.

- If you underpay by more than 10%, you will have to pay a penalty fee.

- There are two primary means of tax payments to the IRS: Automatic Withholdings from your paycheck and Estimated Tax payments.

- Withholdings are determined by your company, your W-4 information, and your adjustments for additional withholdings.

- Once a year (typically due on Tuesday of 3rd week in April) ,you must reconcile your taxes-paid with taxes-owed.

- You will either send the IRS the additional taxes owed or receive from the IRS your refund.

- The IRS levies a Flat Payroll Tax on your company pay. This funds the Federal Social Security and Medicare programs.

- The_Payroll_tax_basis will be your Gross Pay adjusted down by some health and accident insurance benefits (but not by your elective 401(k) deferrals).

- The IRS levies a Graduated (Progressive) Tax on ordinary income (e.g. pay and investment income from short term holdings).

- The_ordinary_income_tax basis will be Gross Pay adjusted down by health and accident insurance but also any elective deferral payments (e.g. 401(k)s).

- The IRS levies Capital Gains (Qualified Dividend) Taxes on dividends or capital gains from investments held for longer durations.

- How you quantify how much tax you paid relative to your pay depends on the definition you use.

- The Marginal Tax Rate is the highest applicable tax rate, but it’s only applied to the tranche of taxable income that is in that bracket.

Your Actual Tax Filing

- Your actual tax income streams, the amount of money you make, your age, your health, where you lived and worked, the types of company benefits you receive and myriad other details that only apply to you could render the embedded tax tool very inaccurate.

- Use the embedded tool and information provided in this post , therefore, for educational purposes only.

- I do my taxes using easy to use Tax Software. You can do your own research on the top software packages to use.I’ve used H&R Block and Intuit Turbo Tax before and they both seem to work fine for me.

- Your tax situation might be much more complicated than mine so you might be using third parties to help you complete/submit your taxes.

Disclaimer: The content of this article is intended for general informational and recreational purposes only and is not a substitute for professional “advice”. We are not responsible for your decisions and actions. Refer to our Disclaimer Page.