Menu (linked Index)

The FY2022 US Federal Budget (Last Update: February 12, 2024)

- Introduction

- FY2022 US Federal Budget (USFB) Totals

- Federal Budget Receipts: Category Details and Data Sources

- FY2022 USFB Receipts: Income Tax/SIRR

- FY2022 USFB Receipts: Misc and Other Taxes(Customs & Duties/Excise/Gift & Estate)

- Federal Budget Outlays: Category Details and Data Sources

- FY2022 USFB Outlays: Social Security

- FY2022 USFB Outlays: Health

- FY2022 USFB Outlays: Income Security

- FY2022 USFB Outlays: National Defense

- FY2022 USFB Outlays: Medicare

- FY2022 USFB Outlays: Education, Training, Employment, Social Services

- FY2022 USFB Outlays: Interest

- FY2022 USFB Outlays: Veteran Benefits

- FY2022 USFB Outlays: General Government

- FY2022 USFB Outlays: Transportation

- FY2022 USFB Outlays: International Affairs

- FY2022 USFB Outlays: Justice Administration

- FY2022 USFB Outlays: Community and Regional Development

- FY2022 USFB Outlays: Natural Resources and Environmental

- FY2022 USFB Outlays: General Science and Technology

- FY2022 USFB Outlays: Agriculture

- FY2022 USFB Outlays: Energy

- FY2022 USFB Outlays: Commerce and Housing

- FY2022 USFB Outlays: Undistributed Offsetting Receipts

- FY2022 USFB Outlays by Agency

- FY2022 USBF Outlays by Agency/Bureau

- Conclusion

- Appendix 1 – Receipt Codes & Sub-Codes

- Appendix 2 – Super-Functions, Functions, Sub-Functions

- Appendix 3 – Agencies

- Appendix 4 – US Federal Budget Document Listing

- Appendix 5 – US Debt to GDP Charts

- Appendix 6 – Payroll Taxes

- Appendix 7 – Glossary

- Appendix 8 – FY2022 Miscellaneous Receipts

- Appendix 9 – FY2022 Income Security Other Outlays

- Appendix 10 – FY2022 National Defense Account Outlays

- Appendix 11 – FY2022 International Affairs Account Outlays

- Appendix 12 – FY2022 Agricultural Bureau and Account Outlays

- Appendix 13 – FY2022 Energy Agency/Bureau/Account Outlays

- Appendix 14 – FY2022 Commerce and Housing Credit Bureau and Account Outlays

- Appendix 15 – US Government Organization

- Appendix 16 – Agency/Bureau designation per outlays.xlsx

Introduction

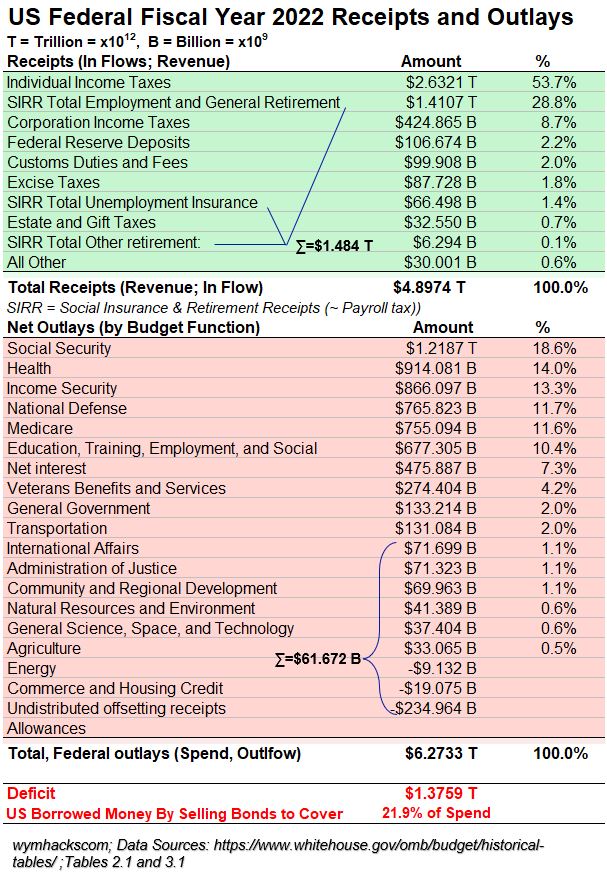

This article provides a detailed breakdown and analysis of the Fiscal Year (FY) 2022 US federal budget (October 1, 2021 to Sept 30, 2022) . I’ve mainly used data files provided by whitehouse.gov where the most recent finalized historical data is for Fiscal Year 2022.

However, there is another data set of government receipts and outlays that gets updated monthly (but is less detailed than the whitehouse.gov data set). It’s called the Monthly Treasury Statement or MTS , and ,in the conclusion section of this article, I use it to compare FY2023 totals (Oct 1, 2022 – Sept 30,2023) to FY2022 totals.

Number Nomenclature

When you see numbers in this article, remember the meaning and nomenclature.

T = Trillion (1 Trillion = 1,000,000,000,000 = 1 Thousand Billion)

B = Billion (1 Billion = 1,000,000,000 = 1 Thousand Million)

M = Million (1 Million = 1,000,000 = 1 Thousand Thousand)

Fiscal Year(FY) 2022 Overall US Federal Budget Balance

In my article on the US Federal Budget Process ,we learned that the US Federal Budget balance can be represented by Schematic 2.1. Receipts from taxes (mostly) are collected and outlays (expenditures) are made to cover all obligations.

We observed that almost always, outlays exceed receipts; so each year the Government has to borrow money by selling bonds. This (almost always) yearly Deficit accumulates year after year and is called the Federal Debt.

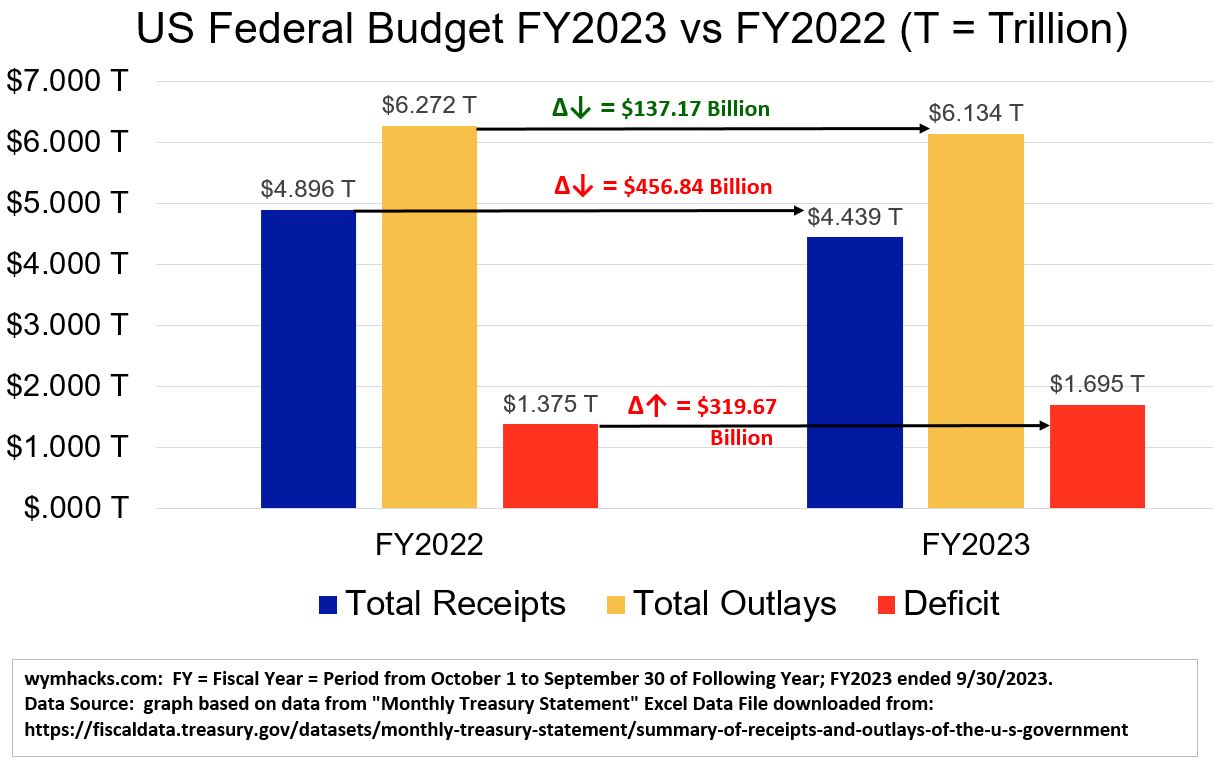

Schematic 2.1 – FY2022 US Federal Budget Balance

![]()

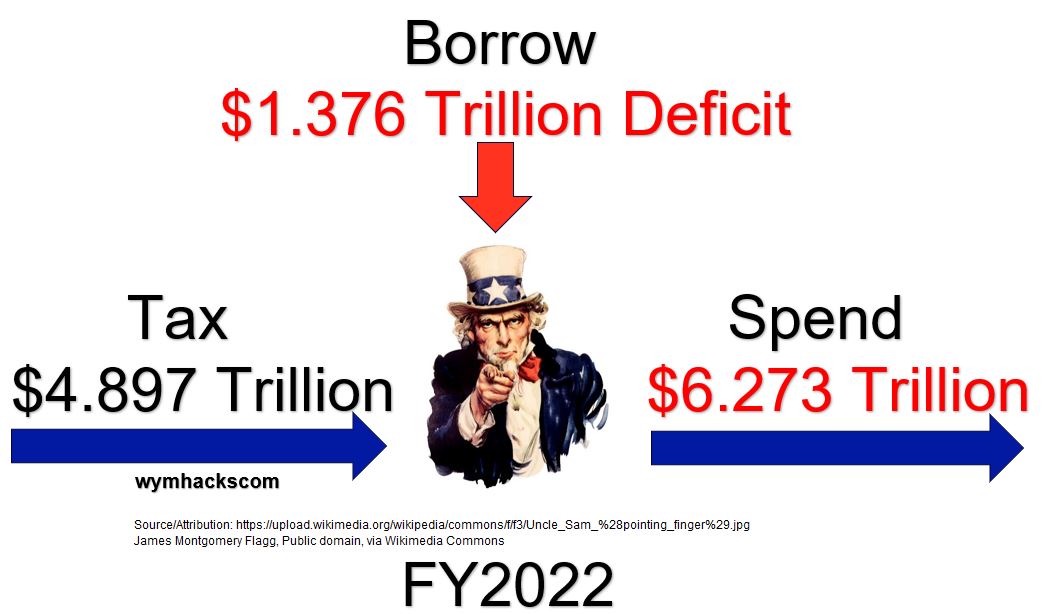

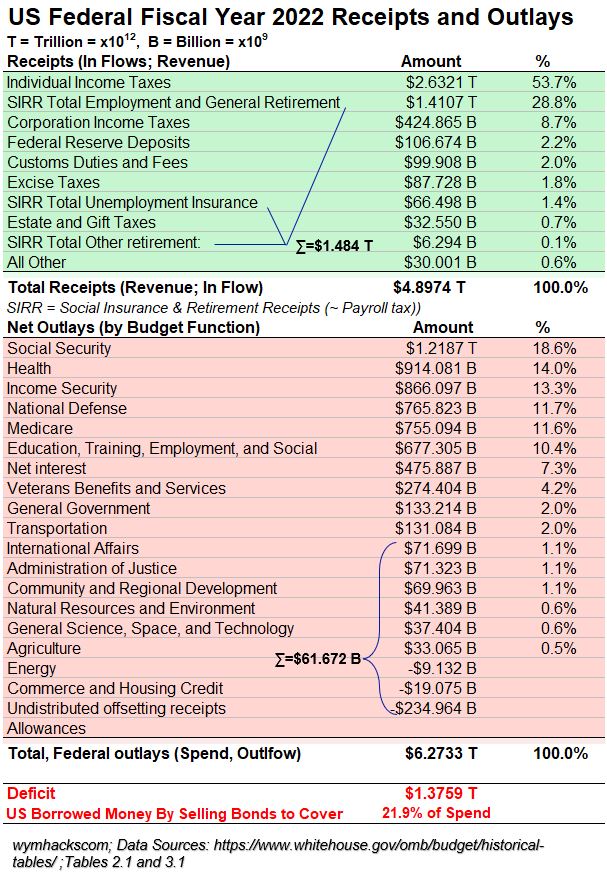

Look at Schematic 2.2 below to see what the numbers looked like for Fiscal Year (FY) 2022. The Government spent $4.897 Trillion ($4,897,000,000,000) and borrowed another $1.376 Trillion ($1,376,000,000,000) in order to spend $6.273 Trillion ($6,273,000,000,000). If you want to see some creative pictures and videos on how big these numbers are you can read my article on numeracy.

Schematic 2.2 – FY2022 US Federal Budget Balance

That $1.376 Trillion deficit is huge, but this is actually less than the previous two years (Due to the Covid Pandemic).

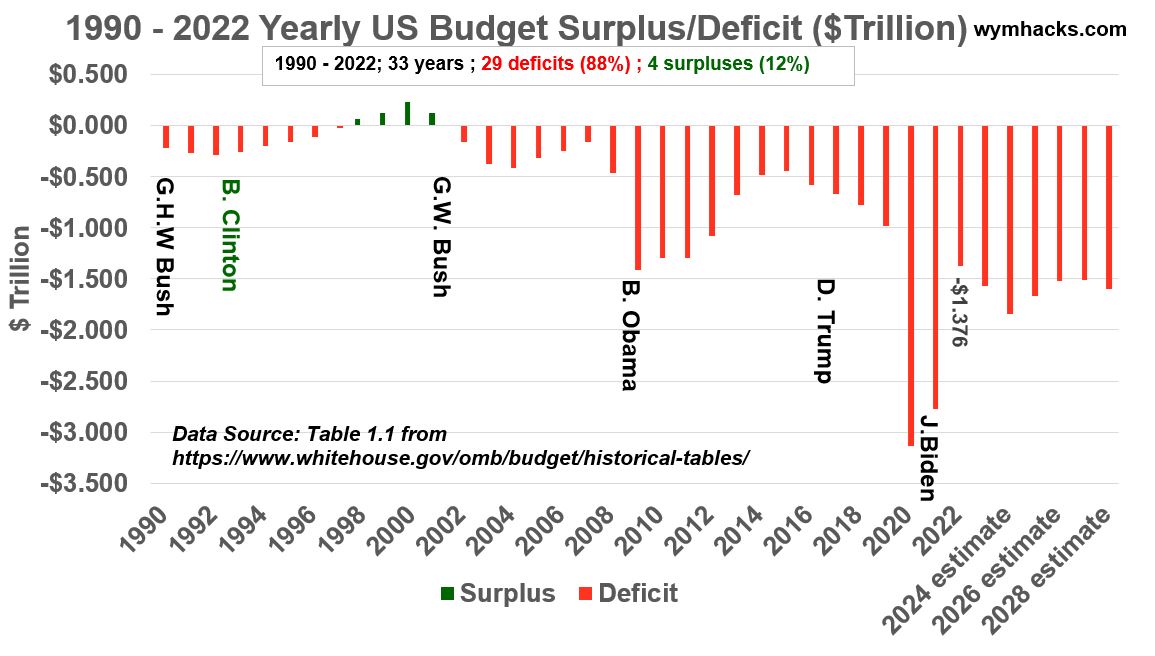

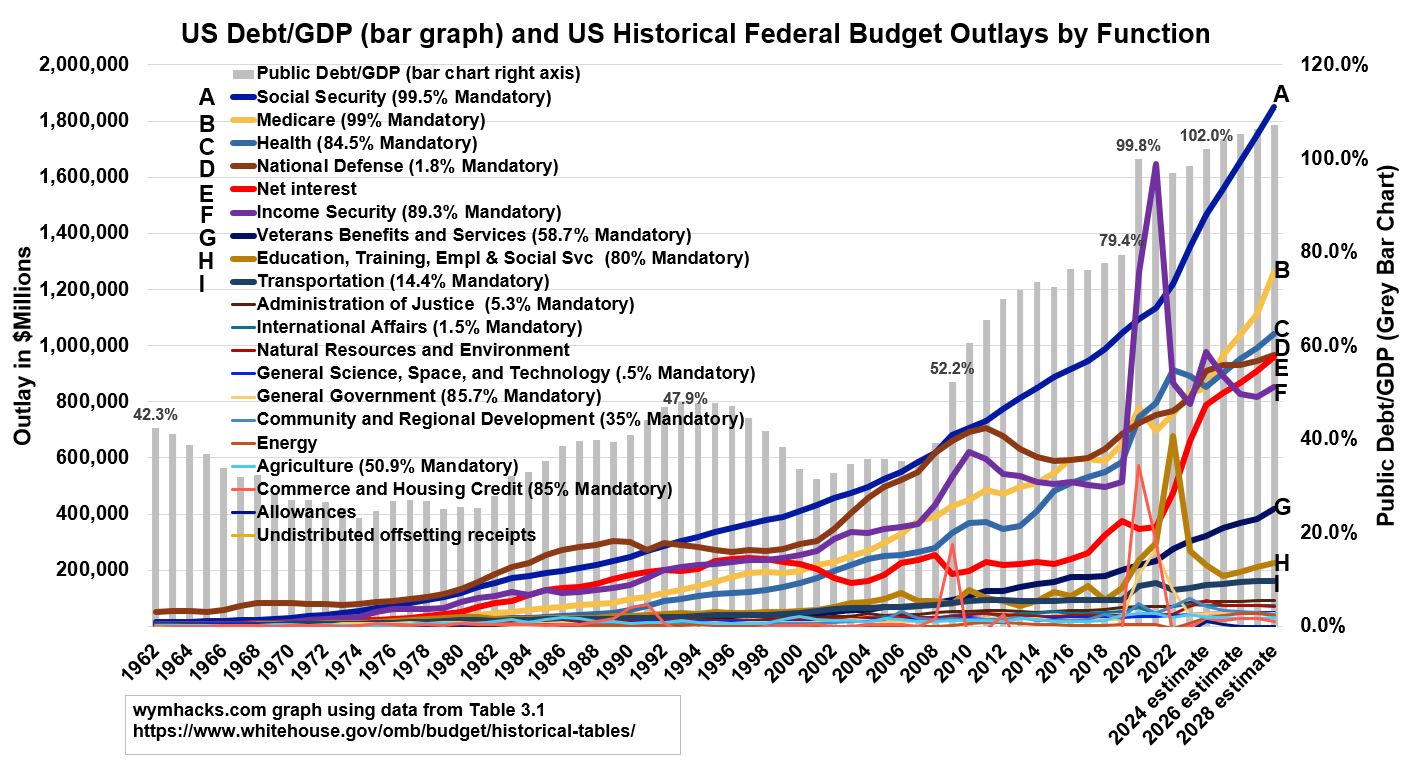

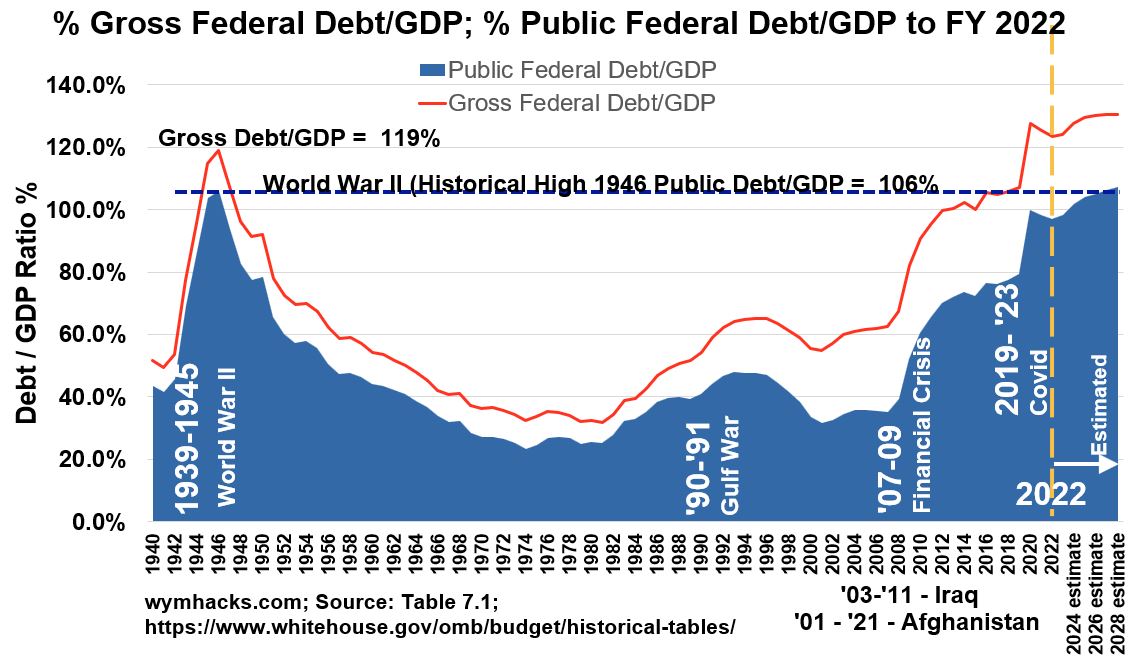

Historical US Yearly Deficits and Debt/GDP

Schematic 2.3 below shows yearly US deficits since 1990. There were deficits 88% of the time. Deficits going forward are estimated to be in the mid Trillions each year as well !

Schematic 2.3 – 1990 – 2022 US Federal Government Deficits

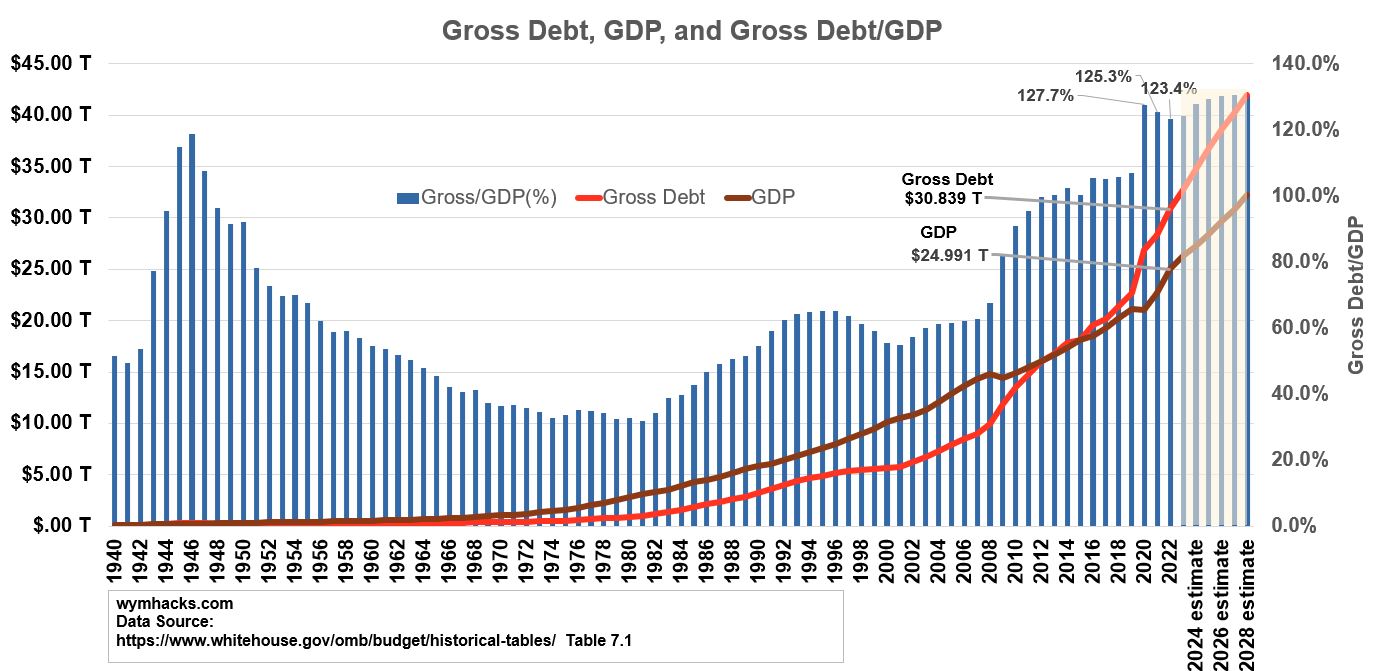

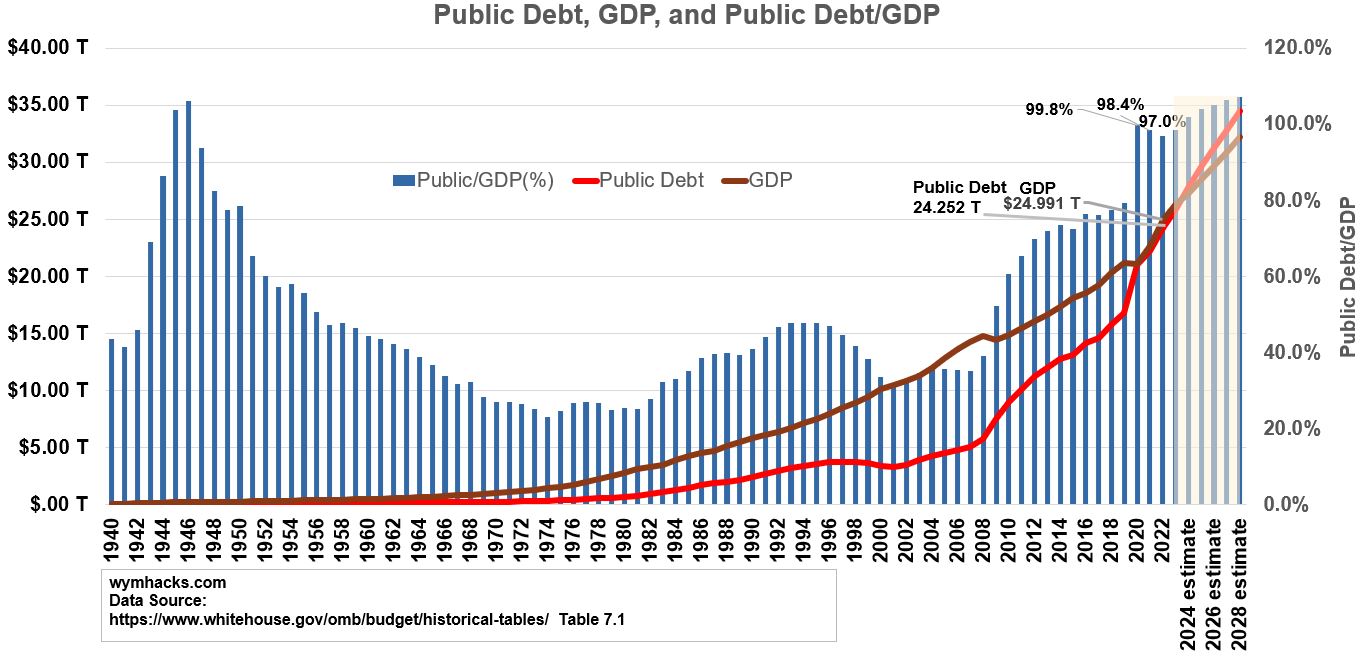

With each deficit, the Public Debt (owed to others) and National Debt (includes debt owed to government) increases. According to fiscaldata.treasury.gov (1/11/2024) , the National Debt is about $34 Trillion.

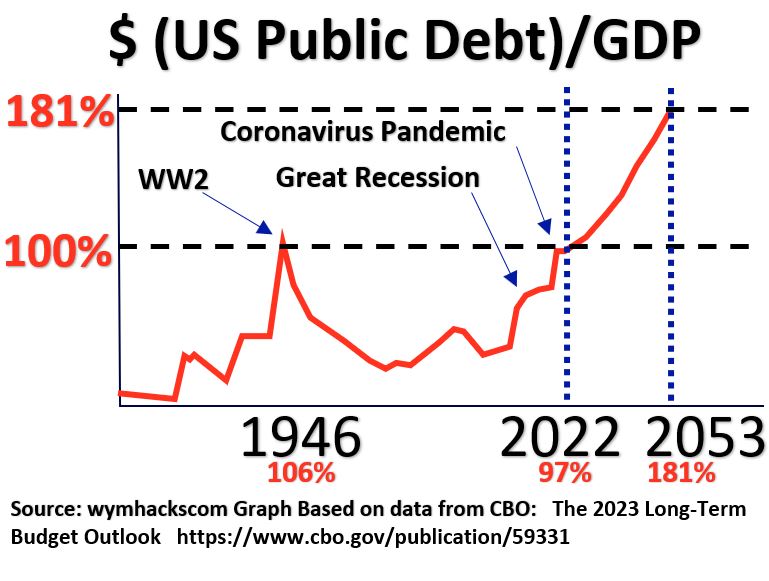

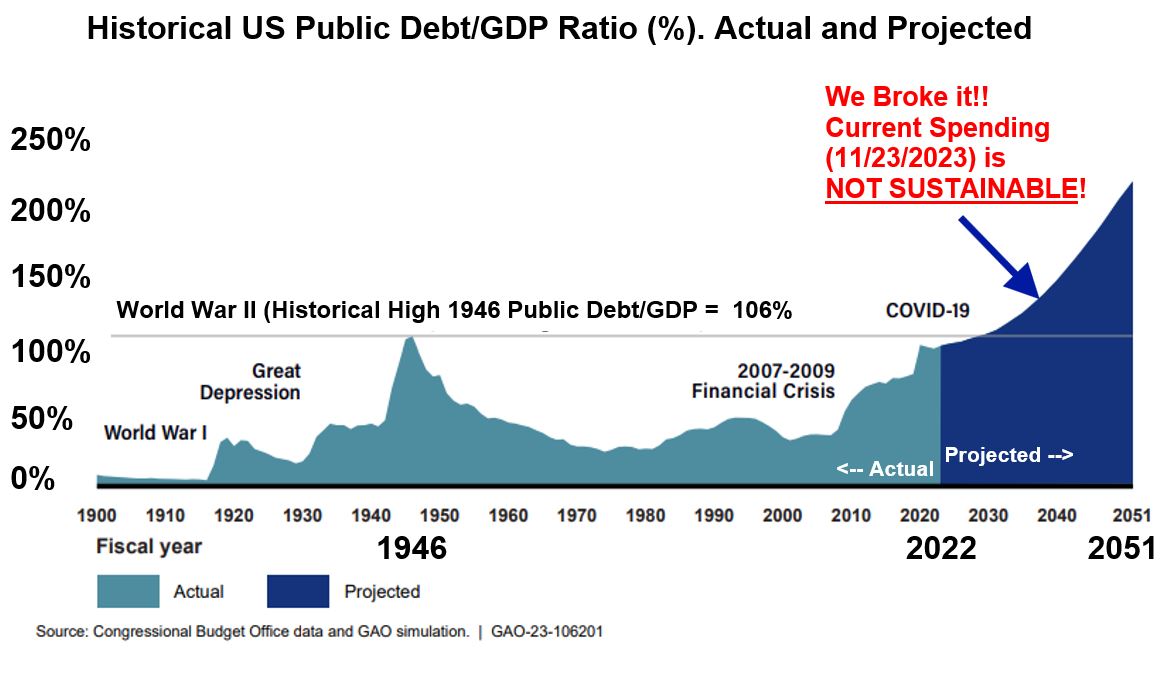

A reasonable way to analyze the debt is to look at debt relative to the country’s economic growth (the GDP, Gross Domestic Product). Schematic 2.4 shows that the US Public Debt/GDP has recently been very close to the peak ratio achieved during the World War 2 years.

If we assume taxing and spending policy stay the same, the future ratio is estimated to grow exponentially (i.e. the red line between the two dotted blue vertical lines in the chart). This is what the GAO (Government Accountability Office) means when they say the current budget policy is not sustainable. Refer to Appendix 5 for a few more versions of this Debt/GDP trend.

Schematic 2.4 – Historical US Debt/GDP

The main causes of unsustainable spending are:

- Demographics: The last of the 73 million Baby Boomers will reach full retirement age by 2031 (i.e. will retire into Social Security and Medicare benefits). The ratio of workers paying taxes to retirees (Workers / Retirees) is shrinking going from 5/1 in the 1960s to 2/1 in the next decade or so (see podcasts with or articles on Brian Riedl for example).

- When Social Security was enacted in 1934 , life expectancy was about 65 years (it’s much higher today). So people are living longer and continuing to draw on benefits.

- Related to the above, health costs are growing much higher than GDP growth.

- Interest on Debt is growing exponentially.

- Other potential reasons are: (1) taxes are too low (2) social benefits are too generous (3) too many “pork” programs (4) too much military related spending (5) too much foreign aid (too much external charity not enough internal charity) etc…

Rapidly Accumulating US Debt will Force Changes

Ok, I think it’s pretty obvious changes are a-coming.

In the meanwhile why not familiarize yourself with some of the details of what a typical recent US Federal Budget looks like? You’re going to be hearing more and more about this in the coming years, and it’s probably going to be a major Federal election topic sooner than later.

Data Sources/Tools

In the following sections we’ll take a closer look at the receipts and outlays that make up a “typical” US Federal Budget. I’ve chosen the FY2022 budget as our example because it’s the most recent government publication of a “completed or final” actual budget . You can find this data at govinfo.gov:

- https://www.govinfo.gov/app/collection/budget/2024/BUDGET-2024-PER (Table 24-1, Historical Tables, Public Budget Database)

or you can find some of the same data at the OMB web site:

- https://www.whitehouse.gov/omb/budget/historical-tables/ (Historical Tables)

- https://www.whitehouse.gov/omb/budget/supplemental-materials/ (Public Budget Database)

You can also download an Excel Workbook (see link below), in which I’ve combined the key sheets described above into one workbook. The Dark Blue and Red Tabs contain the key receipt and outlay files. The Yellow Tab contains historical Debt to GDP data.

Ready, Set, Go

So, let’s open the FY2022 US Federal Budget “Hood” and take a look at what’s inside.

FY2022 US Federal Budget Totals

Overall FY2022 US Federal Budget Totals

Remember that Fiscal Years span from October 1 to September 20 of the following year.

Schematic 3.1 below shows a Sankey Diagram (Chart) of the FY2022 US Federal Budget Receipts (incoming money from taxes mostly) , Outlays (expenditures), and Deficit (the amount spent over what was collected). I created this using an easy-to-use free on-line tool called Sankeymatic.

The green shaded incoming money streams, the Government receipts, sum up to $4.897 Trillion (A trillion means you have to move the decimal point 12 places to the right to show the full number i.e. $4,897,000,000,000). The light red shaded outgoing streams are Government outlays or expenditures. They sum up to $6.273 Trillion. The amount spent over what was collected is the difference between these two numbers (represented by the red bar in the chart): $1.376 Trillion

Schematic 3.1 – FY2022 US Federal Budget Sankey Chart – Receipts & Outlays

Schematics 3.2 and 3.3 below show the receipts and outlays in tabular form. Remember that when you see a “T” or a “B” or a “M” after the listed dollar value, that means the actual number is in Trillions (i.e. to fully write out the number, move the decimal to the right 12 places), Billions (…move the decimal to the right 9 places), and Millions (…move the decimal to the right 6 places).

Schematic 3.2 – FY2022 US Federal Budget Table – Receipts & Outlays

Schematic 3.1 and 3.2 Observations (for FY2022 Budget):

- SIRR or Social Insurance and Retirement Receipts fund programs that provide benefits (retirement, disability, unemployment) to individuals based on their working year contributions. About 95% of the funding for these programs comes from Payroll Taxes. See Appendix 6 or Appendix 7.

- About 91% of all receipts come from Individual Income Taxes, Payroll Taxes, and Corporate Income Taxes.

- About 9% of all receipts come from the Federal Reserve earnings deposits, fees, duties, gift/estate taxes , excise taxes etc.

- Outlays are categorized into 20 Budget Functions. See Appendix 2 or Appendix 7 for more on Budget Functions.

- Not really an observation because you cant see it! → Medicaid outlays are hidden in the Health Budget Function (about $591.9 Billion).

- Social Security, Medicare, and Medicaid Entitlement Programs (Mandatory spending) total about $2.566 Trillion = 41% of total outlays.

- Net Interest (the net payments the Government makes on borrowed money (the Debt)) is $475.887 Billion = 7.3% of total outlays.

- The FY2022 deficit was $1.3759 Trillion. This is 21.9% of the total spend of $6.2733 Trillion.

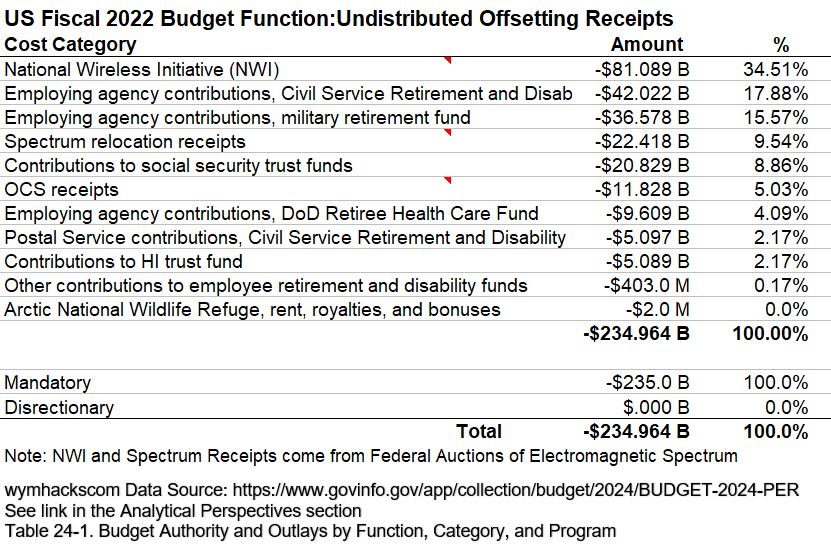

- Undistributed Offsetting Receipts are receipts (payments, income, fees, etc.) that offset outlays. Note that each Budget Function can also have distributed offsetting receipts.

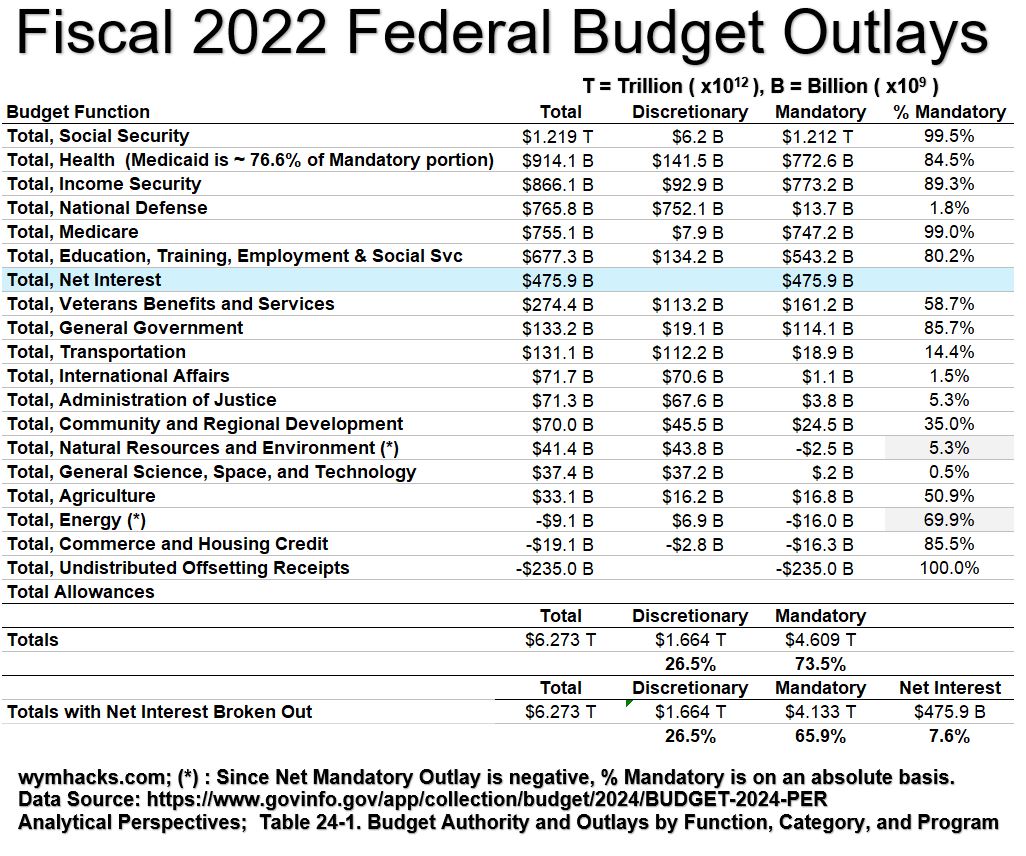

In Schematic 3.3 below, I show the FY2022 outlays, broken down as either Discretionary or Mandatory. You can refer to my US Federal Budget Process article or Appendix 7 for more information on these spending types. Basically, Discretionary outlays need to be authorized and appropriated each year as part of the annual US Federal Budget Process.

On the other hand, Mandatory outlays are permanent outlays in the sense that their authorizing laws do not have to be approved on a yearly basis (they keep going until laws are changed; think Entitlement programs like Social Security or Medicare etc.)

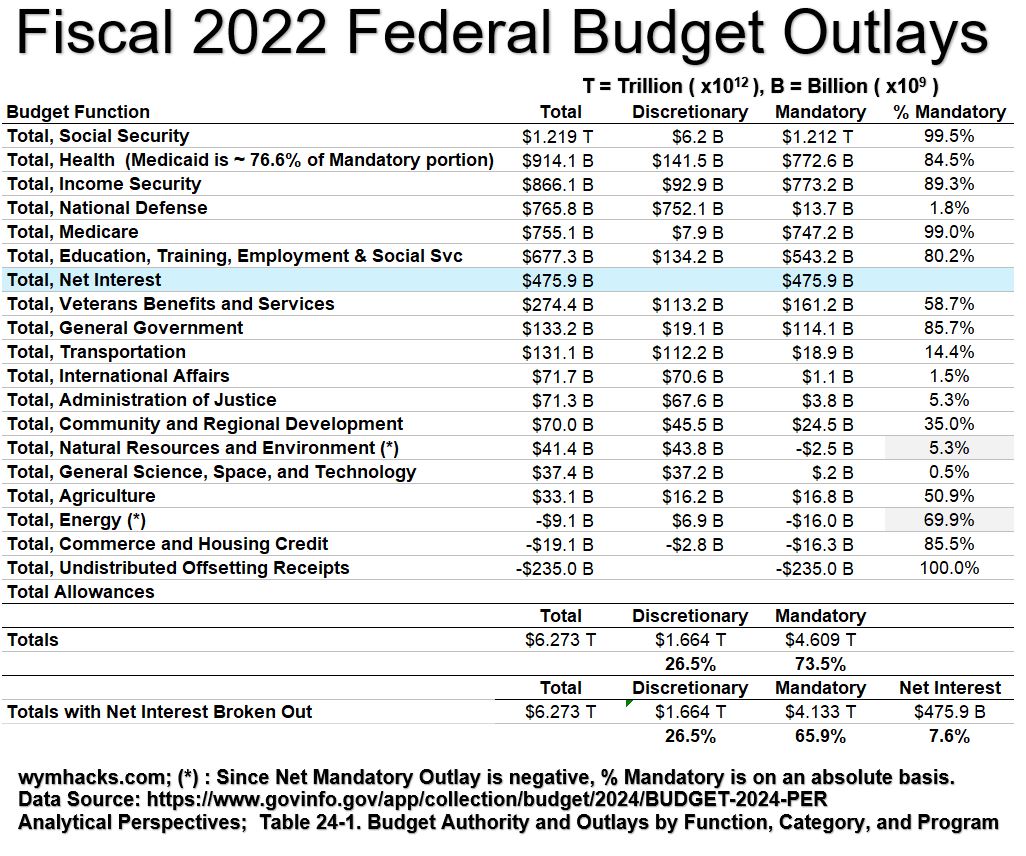

Schematic 3.3 – FY2022 US Federal Budget Table – Outlays ($6.2733 Trillion)

Schematic 3.3 tells you a few important things:

- Mandatory spending, that might not even get a yearly review or vetting as part of the Federal Budget Process, represents almost 74% (including interest) of the total spending (for FY2022).

- Net interest, the overall interest paid on the cumulative money the Government has borrowed to cover the (almost always) yearly over-spending (the Deficit), represents 7.6% of the total spend!

- With Net Interest broken out, the % breakdowns of the $6.273 Trillion in outlays (for FY2022) are 26.5% Discretionary, 65.9% Mandatory, and 7.6% Net Interest.

Net Interest reflects the Government’s cost of borrowing money to finance its operations. Net Interest = Interest paid on Treasury Bonds (and other securities) issued minus receipts from Government income (e.g. income from Government small business or student loans).

Interest on cumulative borrowing is a nasty thing due to the double edged sword of compounding ( it’s good for cumulative savings but bad for cumulative borrowings).

Introducing Circle Packing Charts

A very useful data visualization tool is the Circle Packing Chart where category values of different magnitude can be compared via circles of different sizes. Just like with Sankey charts, it will be difficult to create these kinds of charts in Excel.

For you do-it-yourselfers, here’s how you can do it: (1) Copy your raw data values with proper table formatting via excel or other data tool. (2) Paste the data into RAWGraphs and create a circle packing chart as a .svg (vector graphics file). (3) Then edit the file to your liking using a vector graphics editor like Inkscape. (remember to “ungroup” layers when you initially open the file in Inkscape).

Check out circle packing chart Schematics 3.4 and 3.5 below. These give you a nice size perspective in a single picture. It’s clear that Income, Payroll, and Corporate taxes are the big receipt sources.

Schematic 3.4 – FY2022 US Federal Budget Circle Packing Chart – Receipts ($4.8974 Trillion)

Schematic 3.5 , on the other hand, shows that there are lots of big spending programs. Recall these are categorized into 20 Budget Functions and that offsetting receipts (negative outlays) are split into a standalone number you see (the Undistributed Offsetting Receipts) and other offsetting receipts that are applied to specific programs in certain Budget Functions.

Schematic 3.5 – FY2022 US Federal Budget Circle Packing Chart – Outlays ($6.2733 Trillion)

US Federal Budget Receipts:

Category Details and Data Sources

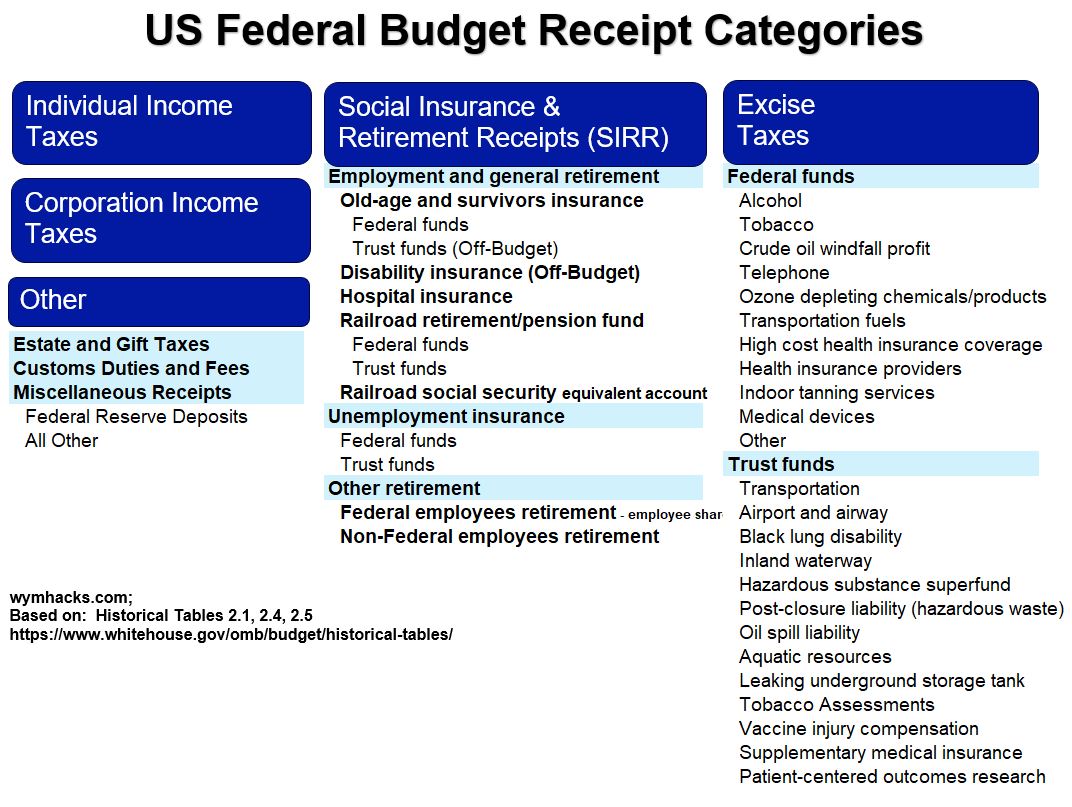

Schematic 4.1 breaks down the major receipt categories into a little more detail.

Schematic 4.1 – US Federal Budget Receipt Categories

OMB data Supplemental Materials:

- find receipts.xlsx located at: https://www.whitehouse.gov/omb/budget/supplemental-materials/

- or open it directly via: https://www.whitehouse.gov/wp-content/uploads/2023/03/receipts_fy2024.xlsx

Historical Excel Tables:

- From: https://www.whitehouse.gov/omb/budget/historical-tables/

- Table 2.1—Receipts by Source: 1934–2028

- Table 2.4—Composition of Social Insurance and Retirement Receipts and of Excise Taxes: 1940–2028

- Table 2.5—Composition of “Other Receipts”: 1940–2028

- Or from https://www.govinfo.gov/app/collection/budget/2024/BUDGET-2024-PER

Excel Download

You can also download an Excel Workbook (see link below), in which I’ve combined the key sheets described above into one workbook. The Dark Blue Tab contains the key receipt data.

FY2022 Receipt Details:

Individual Income Taxes / Social Insurance & Retirement / Corporate Income Taxes

Individual Income Taxes ($2.632 Trillion – 53.74% of total receipts)

The OMB breaks this total down into three parts:

- Individual Income Taxes ($2.632 T): Dear citizen, this is what you gave Uncle Same for FY2022.

- Private Collection Agent Program ($154 Million): This is money owed and collected by private agencies working for the US Government.

- Presidential Election Campaign Fund ($23 Million): This is the total sum of money collected from you taxpayers who checked off the “Do you want $3 of your federal tax to go to the Presidential Election Campaign Fund?” on your tax form.

FY2022 Corporate Income Taxes ($424.865 Billion- 8.7% of total receipts)

People in general don’t think corporations pay enough taxes. See this article: Pew Research- Top tax frustrations for Americans (April 7,2023).

Historically and relative to GDP, US corporate tax rates seem to be pretty low. In addition, there is evidence that some large US corporations pay effective tax rates much less than the current statutory tax rate of 21%. See this article: Peter G Peterson Foundation – Six Charts…Show How Low Corporate Tax Revenues Are (April 7,2023).

Do you think corporate taxes should be raised?

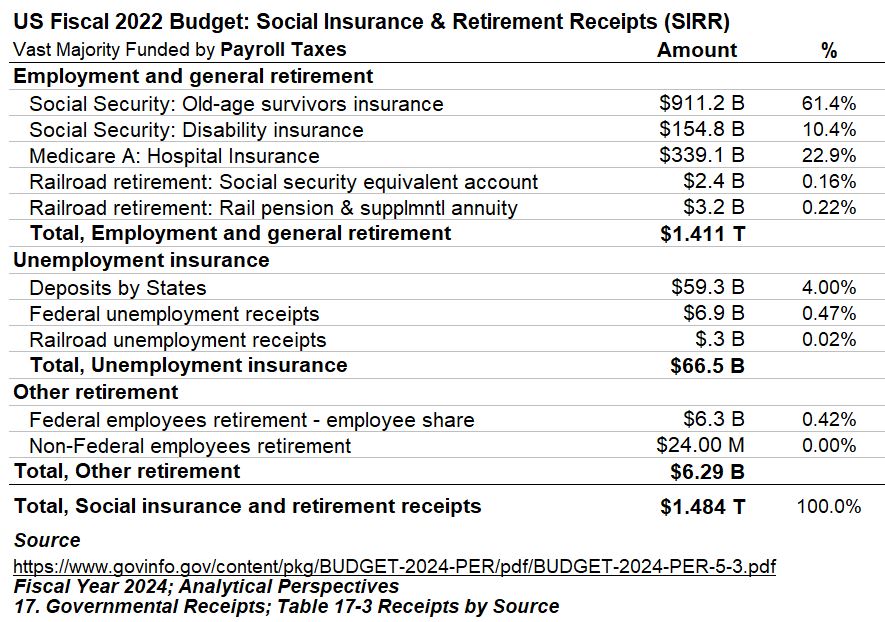

FY2022 Social Insurance & Retirement Receipts (SIRR; $1.484 Trillion)

SIRR programs provide benefits (retirement, disability, unemployment) to individuals based on their working year contributions. The main SIRR programs are:

- Social Security (71.8% of SIRR) : This provides benefits to retired workers, their dependents, and disabled individuals.

- Medicare Part A (22.9% of SIRR) : Primarily provides Hospital insurance to individuals aged 65 and older.

- Unemployment Insurance (4.49% of SIRR): According to the Department of Labor, this provides “unemployment benefits to eligible workers who become unemployed through no fault of their own and meet certain other eligibility requirements.”

- Railroad Retirement and Unemployment Insurance (.4% of SIRR): For people who work for railroads.

Federal Payroll Taxes fund about 95% of SIRR programs (See Appendix 6 or Appendix 7):

- Federal Payroll Taxes = FICA Taxes (Social Security{OASI + DI} + Hospital Insurance{HI} Medicare) + SECA taxes + FUTA taxes

- FICA (Federal Insurance Contributions Act of 1935) is the law that requires employees/employers to pay taxes to fund Social Security and part of Medicare.

- OASI (Old-Age, Survivors Insurance) is a FICA Social Security tax.

- DI (Disability Insurance) is a FICA Social Security tax

- HI (Hospital Insurance – part of Medicare part A) is a FICA Medicare tax

- SECA (Self-Employment Contributions Act of 1954) imposes a payroll tax on self employed individuals.

- FUTA (Federal Unemployment Tax Act of 1939) requires employers to pay a payroll tax to fund federal-state unemployment programs.

Schematic 5.1 below shows that Social Security (OASI), Social Security (DI), and Medicare Part A (HI) are the three largest SIRR receipts.

Schematic 5.1 – FY2022 US Federal Budget Circle Packing Chart – Social Insurance & Retirement Receipts

Schematic 5.2 shows OMB’s tabulation of SIRR receipts into three categories:

- Employment and General Retirement

- Unemployment Insurance

- Other Retirement

Schematic 5.2 – FY2022 US Federal Budget Table – Social Insurance & Retirement Receipts

Return to Menu

FY2022 Receipt Details:

Miscellaneous Receipts / Customs & Duties / Excise Taxes / Gift & Estate Taxes

FY2022 Federal Reserve Deposits ($106.674 Billion – 2.2% of total receipts)

These are earnings deposits from the Federal Reserve. This category is often lumped into a Miscellaneous Receipts category.

FY2022 Other Miscellaneous Receipts ($30.001 Billion – .6% of total receipts)

There are 82 separate miscellaneous receipt accounts listed by the OMB and they are a hodgepodge of various items (see Appendix 8 for a full list for FY2022). The 5 largest are listed below (B = Billion):

- Department of Health and Human Services Receipts, Risk Adjustment Program $8.12 B

- Federal Communications Commission Universal Service Fund $7.70 B

- Department of Justice Forfeited Cash and Proceeds from the Sale of Forfeited Property, Assets Forfeiture Fund $1.71 B

- Federal Communications Commission Contributions for Telecommunications Relay Services, Telecommunications Relay Services Fund $1.27 B

- Department of the Treasury Forfeited Cash and Proceeds from Sale of Forfeited Property, Treasury Forfeiture Fund $1.21 B

- Department of the Treasury Fines, Penalties, and Forfeitures, not Otherwise Classified $1.05 B

FY2022 Customs Duties and Fees ($99.908 Billion – 2% of total receipts)

According to “Customs duty info-cbp.gov”, “A Customs Duty is a tariff or tax imposed on goods when transported across international borders. The purpose of Customs Duty is to protect each country’s economy, residents, jobs, environment, etc., by controlling the flow of goods, especially restrictive and prohibited goods, into and out of the country.”

- The Harmonized Tariff Schedule of the United States (HTS) establishes tariff rates on all merchandise imported into the United States.

- Cbp.gov publishes a report called the “CBP Trade and Travel Report” which provides some information on customs duties imposed for a particular fiscal year. Some significant revenue can come from what are called Section 201, 232, and 301 duties (in 2022 these included duties on aluminum, steel, solar panels, and China Products).

Listed below are the FY2022 custom duty accounts:

- Governmental Receipts / Other Federal Fund Customs Duties / $66.30 Billion

- Department of Agriculture / 30 Percent of Customs Duties, Funds for Strengthening Markets, Income and Supply (section 32) / $31.27 Billion

- Corps of Engineers–Civil Works / User Fees, Harbor Maintenance Trust Fund / $1.91 Billion

- Department of Agriculture / Transfers from General Fund of Amounts Equal to Certain Customs Duties, Reforestation Trust Fund /$262.00 Million

- Department of Homeland Security / Customs Duties, Aquatic Resources Trust Fund / $98.00 Million

- Department of the Interior / Custom Duties on Arms and Ammunition / $76.00 Million

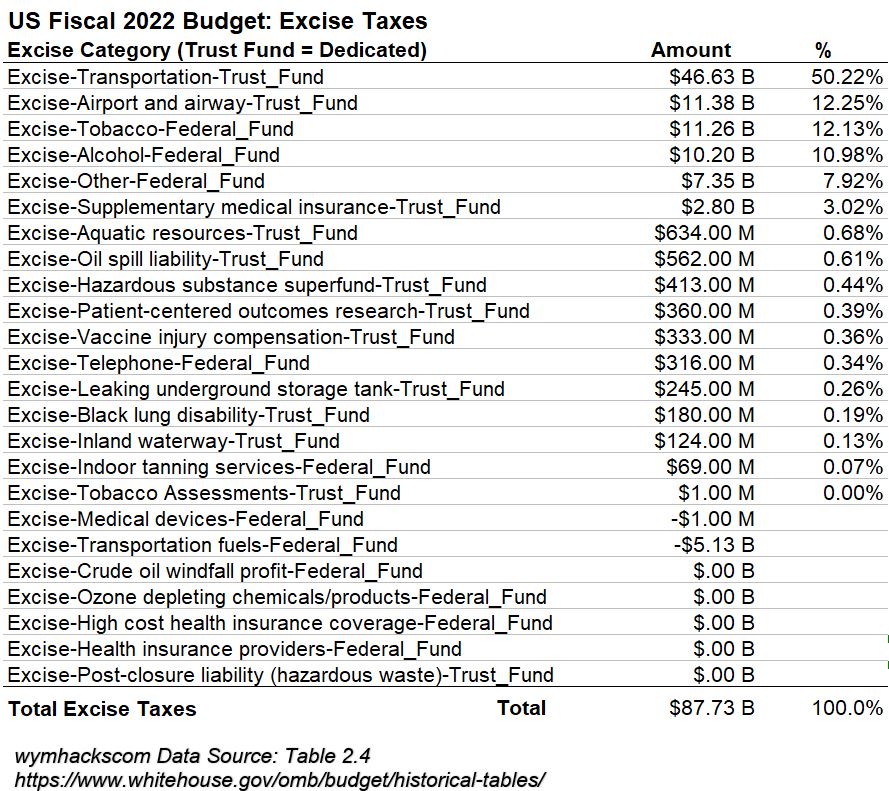

FY2022 Federal Excise Taxes ($87.73 Billion – 1.8% of total receipts)

According to Google Bard, “A federal excise tax is a tax that is levied on the production, sale, or consumption of certain goods or services” and according to CRS-R43189/4 , “Excise taxes are selective taxes on specific forms of consumption or behavior (compared to general sales taxes which tend to apply to all forms of consumption, with some exceptions).

Today, federal excise taxes apply to a wide variety of consumer goods and economic activities, such as alcohol, tobacco, firearms and ammunition, gasoline, the industrial use of ozone-depleting chemicals, and indoor tanning services…”

- According to CRS-R43189/4: “There are four common purposes of excise taxes:

- (1) sumptuary (or “sin”) taxes,

- (2) regulatory or environmental taxes,

- (3) benefit-based taxes (or user charges), and

- (4) luxury taxes.

- Sumptuary (or “sin”) taxes were traditionally imposed for moral reasons, but are currently rationalized, in part, to discourage a specific activity that is thought to have negative spillover effects (or externalities”) on society… Economists also refer to taxes applied to an activity generating negative externalities as a “Pigovian tax.” This type of tax is named after economist Arthur Pigou, who developed the concept of economic externalities.”

- According to taxfoundation.org, the first US excise tax was on the manufacture of whiskey in 1791. Excise taxes today are a small part of total federal taxes (20% in 1950 versus 1.8% in FY2022).

Excise Taxes are funded through dedicated collections (Trust Funds) or non-dedicated collections (Federal Funds). You can more detailed definitions of these fund terms in the Glossary in Appendix 7 .

- Examples of FY2022 Excise Tax types organized as Federal Funds:

- Alcohol,

- Tobacco,

- crude oil windfall profit,

- Telephone ,

- Ozone depleting chemicals/products ,

- Transportation fuels,

- High cost health insurance coverage ,

- Health insurance providers,

- Indoor tanning services,

- Medical devices,

- Other.

- Examples of FY2022 Excise Tax types organized as Trust Funds:

- Transportation,

- Airport and airway,

- Black lung disability,

- Inland waterway,

- Hazardous substance superfund,

- Post-closure liability (hazardous waste),

- Oil spill liability,

- Aquatic resources,

- Leaking underground storage tank,

- Tobacco Assessments,

- Vaccine injury compensation,

- Supplementary medical insurance,

- Patient-centered outcomes research

Schematics 6.1 and 6.2 are data visualizations of the FY2022 US Federal Excise Taxes.

Schematic 6.1 – FY2022 US Federal Budget Circle Packing Chart – Excise Tax Receipts

Schematic 6.2 – FY2022 US Federal Budget Table – Excise Tax Receipts

Additional Breakdown of the FY2022 Excise-Other-Federal Tax ($7.35 Billion):

- Other Federal Fund Excise Taxes $5.59 B

- Excise Taxes, Federal Aid to Wildlife Restoration Fund $1.22 B

- Deposits, Internal Revenue Collections for Puerto Rico $414.00 M

- Aviation User Fees, Overflight Fees $94.00 M

- Recovery from Airport and Airway Trust Fund for Refunds of Taxes $27.00 M

- Land and Water Conservation Fund, Motorboat Fuels Tax, $1.00 M

FY2022 Excise Tax Observations:

- 85.58% ($79.47 Billion) of Excise taxes come from fuel, tobacco, or alcohol.

- Fuel Taxes (Gasoline, Diesel, Jet) taxes represent about 62.5% of total Excise Taxes ($58 Billion – 62.5% of total Excise Taxes).

- Tobacco and Alcohol taxes represent 22.1% of total Excise Taxes ($21.5 Billion – 23.1 % of total Excise Taxes).

- $69 Million for indoor tanning services?

FY2022 Estate and Gift Taxes ($32.55 Billion – .7% of total receipts)

According to the IRS, “Gift and estate taxes apply to transfers of money, property and other assets. Simply put, these taxes only apply to large gifts made by a person while they are alive, or large amounts left for heirs when they die.”

How does the tax paid compare to the total amounts of wealth transfer?

According to Cerulli Associates (Jan. 20,2022):

- Through 2045, total wealth transferred will be about $84.4 Trillion.

- About $72.6 Trillion of this will go to heirs, and

- $11.9 Trillion will go to charities.

- $53 Trillion will be transferred from Baby Boomer (born between 1946 and 1964) households, and

- another $15.8 Trillion will be transferred from Silent Generation (born between 1928 – 1945) households and older.

- About $35.8 Trillion (42% of the $84.4 Trillion) will come from high-net-worth and ultra-high-net-worth households (only 1.5% of all households).

Let’s simplify and assume that the Cerulli Associate wealth transfer estimates occur evenly over the 23 years from 2022 to 2045. That translates into about $84.4 Trillion/23 years = $3.83 Trillion/year in wealth transfers. FY2022 taxes paid represent 32.55E9/3.83E12 = .85% (i.e. less than 1%) of the total estimated yearly wealth transfer number.

Think about these relative amounts and make your own conclusions about what these numbers imply for the future.

One last thing on this: On January 1, 2026 and afterward (unless new laws are passed) the current lifetime estate and gift tax exemption of $12.92 million for 2023 will be cut in half, and adjusted for inflation. This means (possibly) that quite a bit more revenue will flow into Government coffers from high net worth individuals.

US Federal Budget Outlays:

Category Details and Data Sources

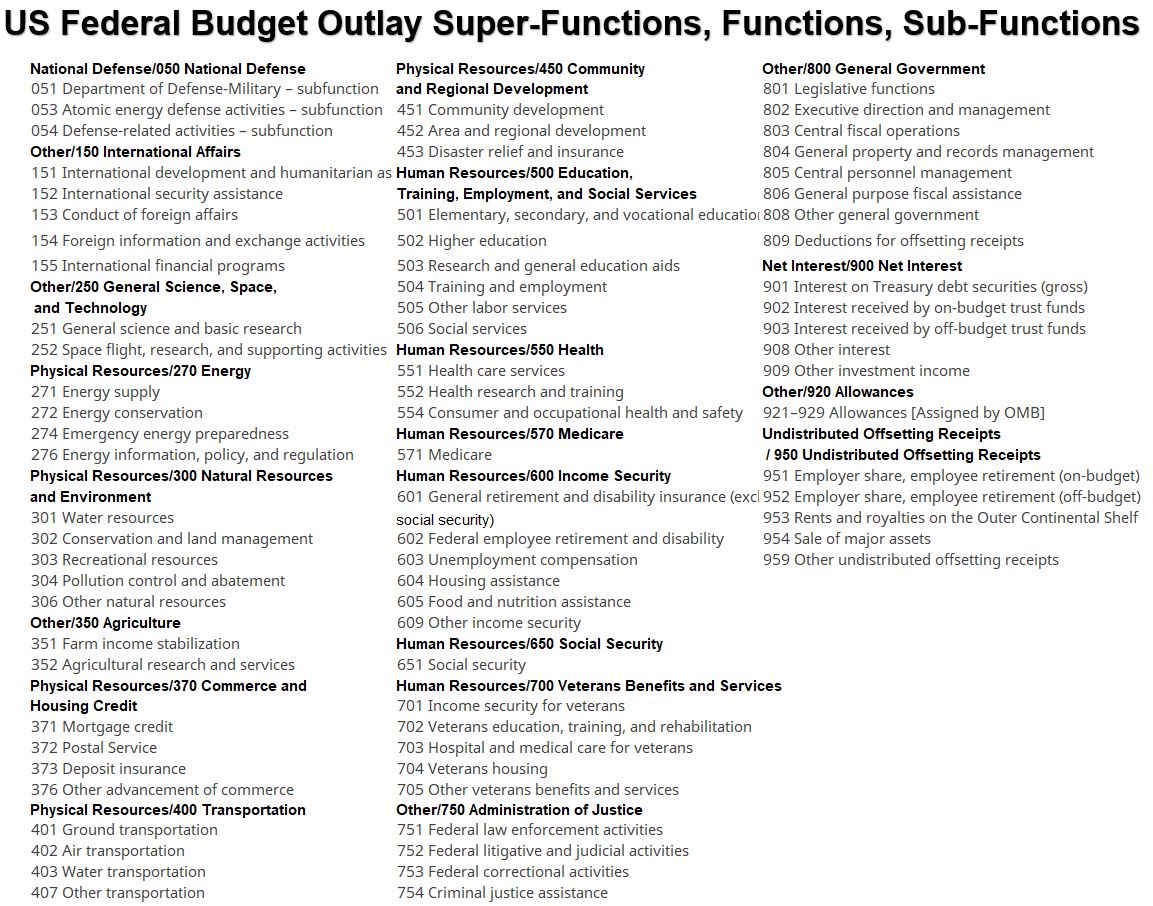

Budget Outlay Functional Classification

The OMB (Office of Management and Budget) organizes budget outlays into Super-Functions, Functions and Sub-Functions according to “the major purpose the spending serves“. There are 6 Super-Functions, 20 Functions, and 77 (or more) Sub-Functions. There will be one or more program accounts under each Sub-Function.

For example, the Human Resources Super-Function contains 6 Functions which are:

- Education, Training, Employment, and Social Services (Code 500)

- Health (Code 550)

- Medicare (Code 570)

- Income Security (Code 600)

- Social Security (Code 650)

- Veterans Benefits and Services (Code 700)

Each of these Functions can then be broken down into multiple Sub-Functions. For example, Veterans Benefits and Services has the following Sub-Functions:

- Income security for veterans (Code 701)

- Veterans education, training, and rehabilitation (Code 702)

- Hospital and medical care for veterans (Code 703)

- Veterans housing (Code 704)

- Other veterans benefits and services (Code 705)

Each Sub-Function can be broken down into one or more Accounts. For example, Veterans housing had the following accounts for FY2022:

- Veterans Housing Benefit Program Fund

- Native American Veteran Housing Loan Program Account

- Native American Veteran Housing Loans, Negative Subsidies

- Housing Liquidating Account

- Housing Negative Subsidies

- Housing Downward Re-estimates

Check out Appendix 2 or Appendix 7 for more information on Functions. See the GAO Glossary Appendix IV for Function and Sub-Function Definitions.

On Budget vs Off Budget

Some of the Sub-Functions use On and Off Budget terminology. According to GAO-05-734SP , Off-Budget accounts refers to “those budgetary accounts (either federal or trust funds) designated by law as excluded from budget totals.”

The two Social Security trust funds (the Old-Age and Survivors Insurance, OASI, Trust Fund and the Disability Insurance, DI, Trust Fund) and the transactions of the Postal Service (wym: some not all) are off-budget accounts.

- For Fiscal Year 2022 budget , there were only three off-budget Accounts: (1) OASI Trust Fund (2) DI Trust Fund (3) Postal Service Fund (wym: some not all)

Schematic 7.1 tabulates all the Budget Functional Classifications.

Schematic 7.1 – US Federal Budget Outlay Super-Functions, Functions, and Sub-Functions

Budget Outlay Data Sources

OMB Table 24-1

Fiscal Year 2024 (will contain 2022 actual and 2023+ estimated numbers). Go to Analytical Perspectives → Detailed Functional Tables → Table 24-1. Budget Authority and Outlays by Function, Category, and Program (Choose the xlsx download button).

Table 24-1 (xlsx file) displays outlays by Sub-Function/Discretionary or Mandatory/Category (or Program) Outlay. Table 24-1 was used to create the Circle Packing Charts and associated tables in each of the sections describing the different outlays. This excel table contains about 1267 rows of data (including zero value data that might have had a number in previous years). For FY2022, Table 24-1 contains about 563 discrete outlays (including negative outlays) that sum up to $6.2733 Trillion.

OMB data Supplemental Materials:

- find outlays.xlsx located at: https://www.whitehouse.gov/omb/budget/supplemental-materials/

- or open it directly via: https://www.whitehouse.gov/wp-content/uploads/2023/03/outlays_fy2024.xlsx

The outlays.xlsx file displays outlays more comprehensively than Table 24-1 (more details but same grand total). The outlays are displayed by Account, each of which is associated with: Agency / Bureau/ Sub-Function/ Mandatory or Discretionary/ On or Off Budget descriptors.

This file lists about 5,580 separate accounts (some of which are zero and probably had values in previous years). For FY2022, outlays.xlsx lists 2,350 discrete outlays by account (both positive and negative outlays) which sum to $6.2733 Trillion. Remember that negative outlays simply mean credits or offsets that reduce the total expenses.

Historical Excel Tables:

- From: https://www.whitehouse.gov/omb/budget/historical-tables/

- Tables 3.1 and higher.

- Or from https://www.govinfo.gov/app/collection/budget/2024/BUDGET-2024-PER

Excel Download

You can also download an Excel Workbook (see link below), in which I’ve combined the key sheets described above into one workbook. The Dark Blue Tabs contain the key outlay data.

Outlay Data Source Attribution

Any tabulation or schematic displaying outlays should have a data source attribution: Most of these will be either Table 24-1 (xlsx file) or outlays.xlsx.

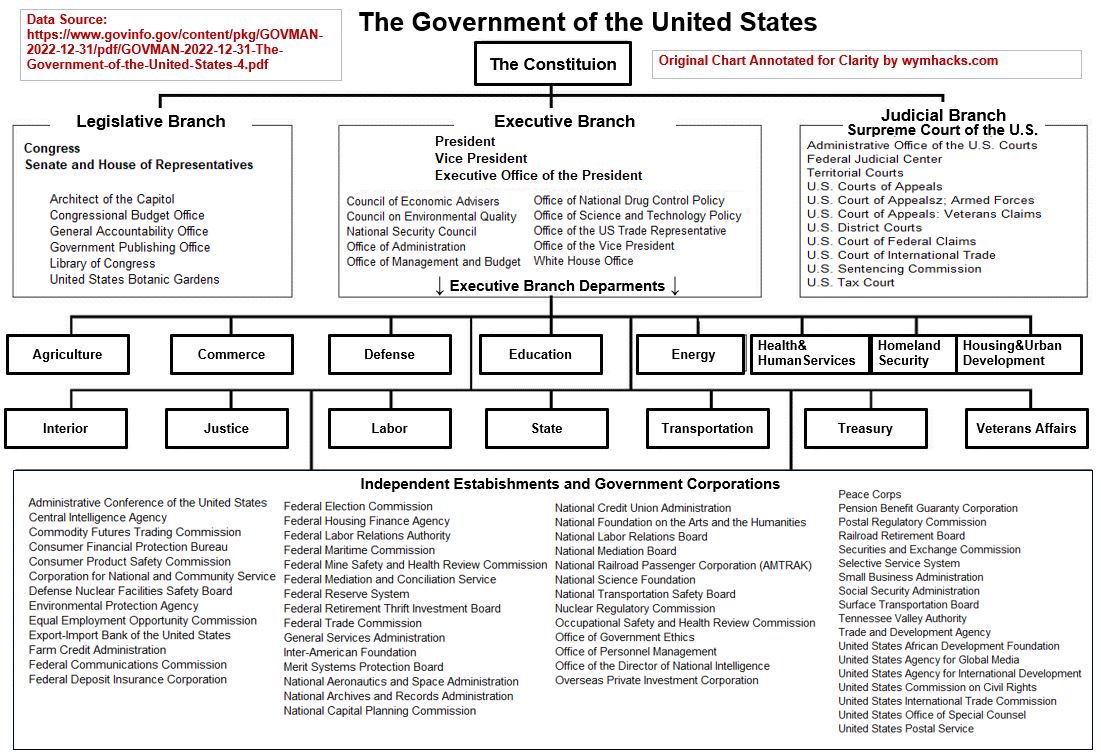

Agency Nomenclature

According to the US Tax Code (via Cornel LII): “18 U.S. Code § 6 – Department and agency defined. “

- “The term “department” means one of the executive departments enumerated in section 1 of Title 5, unless the context shows that such term was intended to describe the executive, legislative, or judicial branches of the government.”

- “The term “agency” includes any department, independent establishment, commission, administration, authority, board or bureau of the United States or any corporation in which the United States has a proprietary interest, unless the context shows that such term was intended to be used in a more limited sense.”

So, the term agency is really a catch all phrase. It might also include the following organizations: institute, association, center, bank, court, panel, service, library, office, council, directorate, etc.

If you try to match outlay values row for row between Table 24-1 and outlays.xlsx you wont always be able to do it. Table 24-1 often combines various accounts (as shown in outlays.xlsx) into its program/category value. I found it a little easier to create the circle packing charts using the table 24-1 categories but in many of the sections I also show breakdowns by Agency, Bureau, Account etc.

If you want a more accurate listing of departments and agencies, check out “usa.gov’s A-Z index of U.S. Government departments and agencies”. I count (in Dec 2022 when I looked at it) about 628 separate and distinct organizations (agency, department, or other) ! Also, An excellent source for understanding the Federal Government Organization is the United States Government Manual which you can view and download at www.govinfo.gov. (or see Appendix 15).

US FY2022 Federal Budget Outlays:

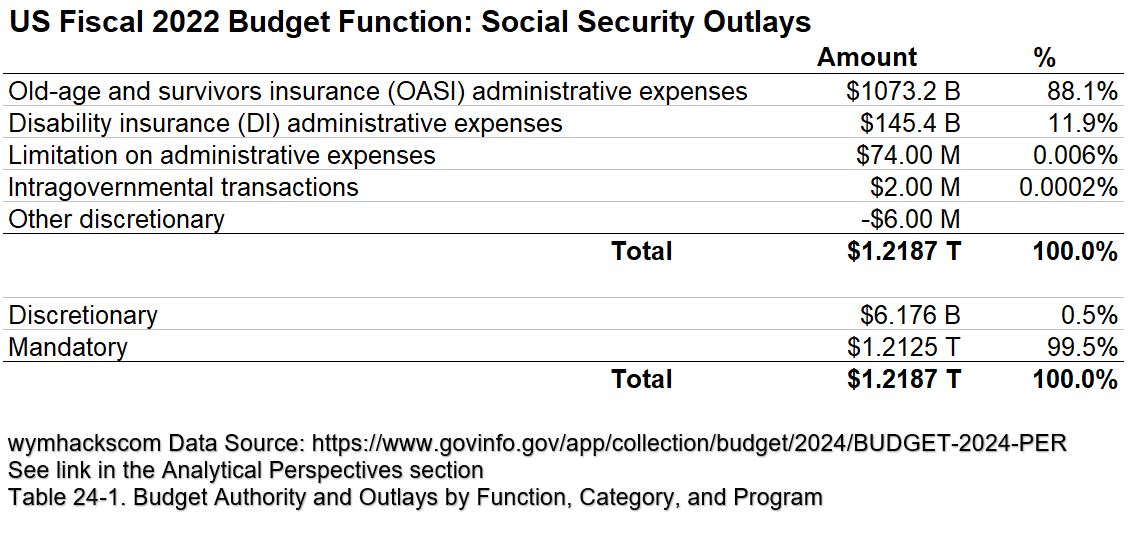

Social Security ($ 1.2187 Trillion; 18.6% of Total)

Function and Sub-Functions Code (650/651)

Social Security outlays were $1.2187 Trillion in FY2022 (18.6% of the total $6.2733 Trillion outlays). Social Security mostly comprises

- Federal Old-age and Survivors Insurance; OASI (1.073 Trillion; 88.1%) and

- Federal Disability Insurance; DI ($145.4 Billion; 11.9%)

Federal Payroll Taxes pay for Social Security (as well as parts of Medicare as well as Unemployment Insurance). (See Appendix 6 or Appendix 7):

- Federal Payroll Taxes = FICA Taxes (Social Security{OASI + DI} + Hospital Insurance{HI} Medicare) + SECA taxes + FUTA taxes

- FICA (Federal Insurance Contributions Act of 1935) is the law that requires employees/employers to pay taxes to fund Social Security and HI part of Medicare.

- OASI (Old-Age, Survivors Insurance) is a FICA Social Security tax.

- DI (Disability Insurance) is a FICA Social Security tax

- HI (Hospital Insurance – part of Medicare part A) is a FICA Medicare tax

- SECA (Self-Employment Contributions Act of 1954) imposes a payroll tax on self employed individuals.

- FUTA (Federal Unemployment Tax Act of 1939) requires employers to pay a payroll tax to fund federal-state unemployment programs.

Trust Funds

Trust funds are collections of revenues that are dedicated for a specific purpose (See Appendix 7 or my article here for more information on Trust Funds).

FICA (5.3% of taxable pay for OASI and .9% for DI for 2022 tax year) and SECA taxes are held in the Social Security Trust Fund (OASI + DI or OASDI).

A 1.45% FICA tax (2022 tax year) pays for Medicare Part A (Hospital Insurance) and this is held in the HI Trust Fund.

FUTA taxes are held in the Federal Unemployment Trust Fund.

Money from these trust funds flow to their respective programs. Any excess funds are invested in bonds, credited (with interest) to the trust funds, and used for future payments.

Status of the Social Security Trust Fund

According to the Summary of the 2023 Annual Reports by the Social Security and Medicare Boards of Trustees,

- “The OASI Trust Fund will be able to pay 100 percent of total scheduled benefits until 2033… At that time, the fund’s reserves will become depleted and continuing program income will be sufficient to pay 77 percent of scheduled benefits.” So OASI depletes (if nothing changes) in 10 years as of this writing and everyone eligible gets a 23% trim to their benefits.

- “The Disability Insurance (DI) Trust Fund is projected to be able to pay 100 percent of total scheduled benefits through at least 2097, the last year of this report’s projection period.

- Hospital Insurance is captured under the Medicare Function but information for it comes out of the same annual trustee report. “The Hospital Insurance (HI) Trust Fund will be able to pay 100 percent of total scheduled benefits until 2031… At that point, the fund’s reserves will become depleted and continuing program income will be sufficient to pay 89 percent of total scheduled benefits.

So, both OASI and HI benefits will be soon cut if changes aren’t made before the estimated fund depletion time.

Schematic 8.1 – FY2022 US Federal Budget Circle Packing Chart – Social Security Outlays

Schematic 8.2 – FY2022 US Federal Budget Table – Social Security Outlays

Social Security Outlays are almost all under the category of Mandatory spending. This means that the US Annual Federal Budget Process does not necessarily review or revise these programs. They only change if Congress changes the Authorizing Laws governing them.

Recall that the annual Federal Budget Process primarily focuses on Discretionary spending programs which need to be approved (appropriated) on a yearly basis. See the glossary in Appendix 7 for more information on Mandatory and Discretionary spending.

US FY2022 Federal Budget Outlays:

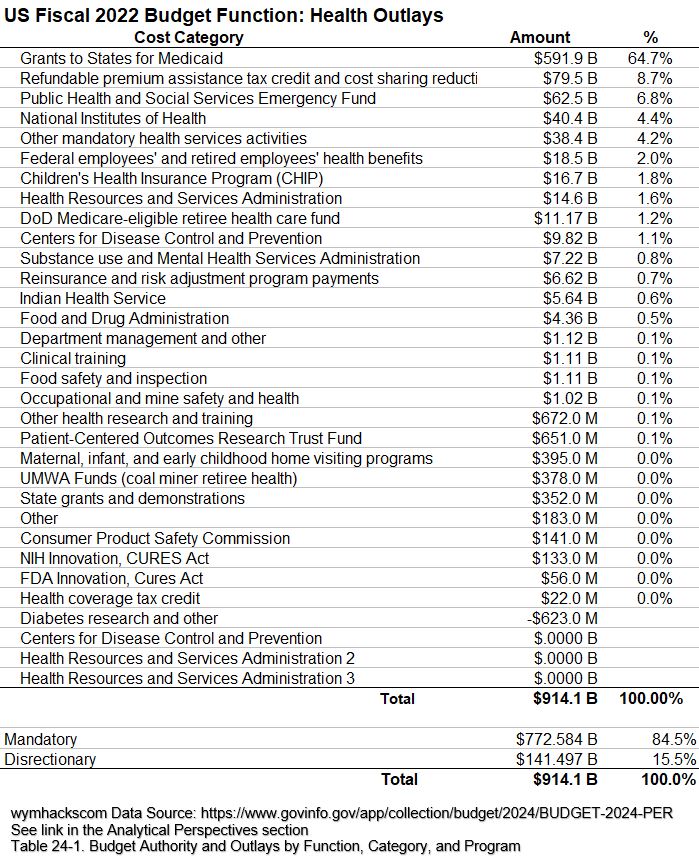

Health ($914.081 Billion; 14% of total)

Function and Sub-Functions Code (550/551,552,554)

For FY2022, there were roughly 120 separate budget accounts under Health budget Sub-Functions 551, 552, and 554 (including offsetting credits). Schematics 9.1 and 9.2 consolidate the 120 accounts into 29 categories. Health care outlays amounted to $914.018 Billion or 14% of total outlays.

According to cbpp.org, Medicaid was created in 1965 and provides health coverage to low-income families and individuals. It is funded by both the States and the Federal Government. Each state operates its own Medicaid program within federal guidelines. Federal Grants to States for Medicaid in FY2022 amounted to $591.9 Billion, which is 64.7% of the total Health outlays of 914.1 Billion.

- In addition to Medicaid, there were 23 other accounts whose budgets were in the Billions of dollars.

- There were 32 accounts with budgets greater than $100 Million and Less than $1 Billion.

- There were an additional 37 accounts with budgets between $1 and $95 million.

- According to the IRS, the Refundable Premium Assistance Tax Credit is a “refundable tax credit designed to help eligible individuals and families with low or moderate income afford health insurance purchased through the Health Insurance Marketplace, also known as the Exchange.” This Affordable Care Act product had a huge outlay of $79.5 Billion.

- Another big program is the Public Health and Social Services Emergency Fund. This is a reserve fund which can be be used to support responses to various public health emergencies ($62.5 Billion outlay).

- Notice that the NIH ($40.4 Billion), CDC ($9.8 Billion), and FDA ($4.36 Billion) are all funded under the Health Budget function.

Schematic 9.1 – FY2022 US Federal Budget Circle Packing Chart – Health Outlays

Schematic 9.2 – FY2022 US Federal Budget Table – Health Outlays

Schematic 9.2 shows that about 84.5% of “Health” related spending is Mandatory. (Medicaid spending is considered 100% Mandatory)

FY2022 US Federal Budget Health Outlays by Budget Sub-Function

See the GAO Glossary Appendix IV for Function and Sub-Function Definitions.

- 551/ Health care services/ $864.58 B

- 552/ Health research and training/ $42.64 B

- 554/ Consumer and occupational health and safety/ $6.86 B

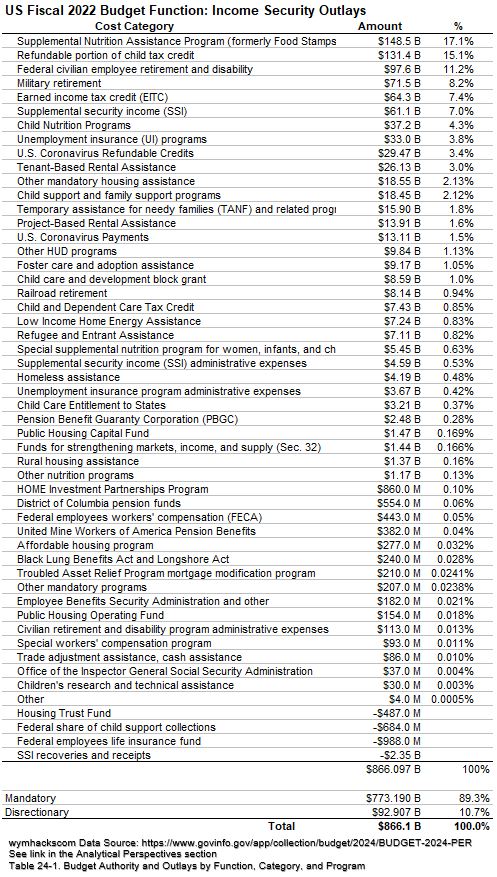

US FY2022 Federal Budget Outlays:

Income Security ($866.097 Billion;13.3% of Total)

Function and Sub-Function Codes (600/601,602,603,604,605,609)

The Income Security Budget Function provides cash and other benefits to people experiencing unemployment, disability, low income or other hardships. Almost 90% of the spending in this function is considered Mandatory.

I count total of 161 separate budget accounts in this function including offsetting accounts i.e. credits. The circle packing chart below is a bit overwhelming but you can still see the big ones (and big is relative….look at the top smallish circle that represents Refugee Assistance….that tab is $7.11 Billion!).

Schematic 10.1 – FY2022 US Federal Budget Circle Packing Chart – Income Security Outlays

Observations on FY2022 outlays:

- There were 40 separate budget accounts which each spent > 1 Billion dollars and an additional 35 accounts that each spent between $100 million to $1 billion.

- An additional 50 accounts spent (each) between $1 to 100 million.

- Food and nutrition assistance outlays amounted to $193.93 Billion (about 22% of total); The majority of this is the Food Stamp Program (SNAP) which paid out $148.5 Billion in FY2022.

- There are also big outlays in FY2022 for Federal employee retirement and disability, Housing assistance, Unemployment compensation, and General retirement and disability insurance (excluding social sec.). The numbers for these are given below Schematic 10.2.

Schematic 10.2 – FY2022 US Federal Budget Table – Income Security Outlays

FY2022 US Federal Budget Income Security Outlays by Budget Sub-Function

- 609/ Other income security/ $378.13 B (43.66% of total outlays). There is a lot under the hood in this Sub-Function. See the account details in Appendix 9.

- 605/ Food and nutrition assistance/ $193.93 B/ 22.39%

- 602/ Federal employee retirement and disability/ $168.69 B /19.48%

- 604/ Housing assistance /$76.46 B /8.83%

- 603/ Unemployment compensation / $36.80 B /4.25%

- 601/ General retirement and disability insurance (excluding social security) /$12.08 B /1.39%

- Total $866.10 B

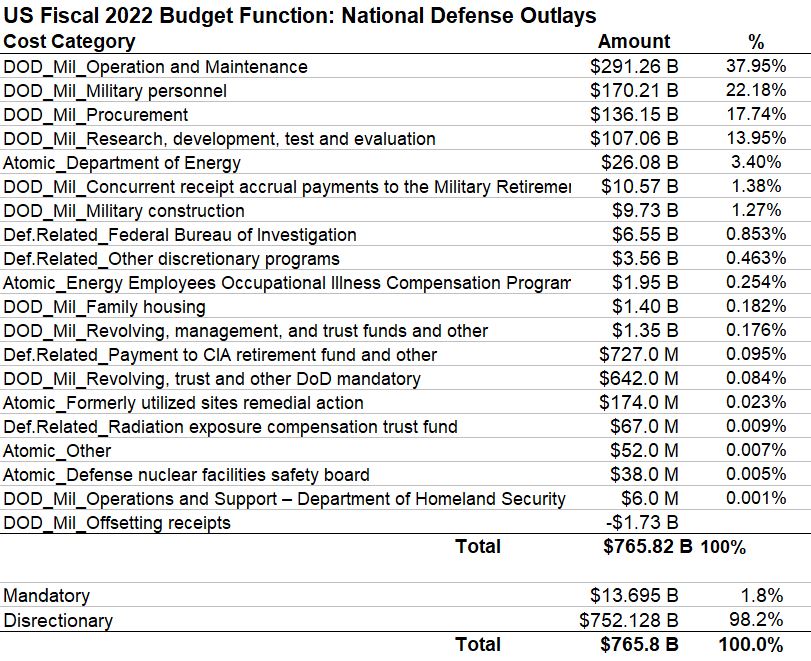

US FY2022 Federal Budget Outlays:

National Defense ($765.823 Billion, 11.7% of total outlays)

Function and Sub-Function Codes (050/051,053,054)

Almost all of Defense spending is Discretionary spending, meaning, Congress has to appropriate funds for it each year through the Federal Budget Process.

There were 64 accounts each with total outlays of greater than $1 Billion and 39 accounts each with total outlays greater than 100 million (and another 23 accounts each with total outlays of $1 million or more.

Schematic 11.1 – FY2022 US Federal Budget Circle Packing Chart – National Defense Outlays

Schematic 11.2 – FY2022 US Federal Budget Table – National Defense Outlays

Defense Outlays by Account

See Appendix 10.

Defense Outlays by Sub-Function and Bureau

Breaking down the Defense outlays by Sub-Function we get:

051 Department of Defense-Military $726.63 Billion

053 Atomic energy defense activities $28.29 Billion

054 Defense-related activities $10.90 Billion

See the GAO Glossary Appendix IV for Function and Sub-Function Definitions.

Breaking it down by Bureau, we get this sorted list (B = Billion, M = Million):

Operation and Maintenance/ $291.27 B

Military Personnel/ $180.77 B

Procurement/ $136.18 B

Research, Development, Test, and Evaluation/ $107.06 B

National Nuclear Security Administration/ $18.15 B

Military Construction/ $9.73 B

Environmental and Other Defense Activities/ $7.76 B

Federal Bureau of Investigation/ $6.55 B

Cybersecurity and Infrastructure Security Agency/ $2.15 B

Office of Workers’ Compensation Programs/ $1.95 B

Family Housing/$1.42 B

Revolving and Management Funds/ $1.35 B

Intelligence Community Management Account/ $595.00 M

Trust Funds/ $592.00 M

United States Coast Guard/ $527.00 M

Central Intelligence Agency/ $514.00 M

Maritime Administration/ $226.00 M

Corps of Engineers–Civil Works/ $174.00 M

Energy Programs/$173.00 M

Bureau of Industry and Security/ $81.00 M

Federal Emergency Management Agency/ $78.00 M

National Science Foundation/ $77.00 M

Radiation Exposure Compensation/ $67.00 M

Centers for Disease Control and Prevention/ $52.00 M

Defense Nuclear Facilities Safety Board/ $38.00 M

Selective Service System/$27.00 M

Privacy and Civil Liberties Oversight Board/ $11.00 M

Management Directorate/ $6.00 M

Department of Defense–Military Programs/ -$1747.00 M

Grand Total $765.82 B

The Bureau Totals Are Just for Defense Spending

The bureau totals above represent spending on Federal Defense only. There could be other charges. Consider the Coast Guard, FBI, and CIA.

The United States Coast Guard spent a total of $12.38 Billion across three Budget Functions:

- 403 Water transportation $11.77 B (under Transportation Function)

- 054 Defense-related activities $527.00 M

- 304 Pollution control and abatement $79.00 M (Under the Natural Resources… Function)

- Grand Total $12.38 Billion

The FBI spent about $10.28 Billion dollars in FY2022, $3.73 Billion of which was charged to the Sub-Function 751 (under Administration of Justice Function).

- 054 Defense-related activities/ $6.55 B

- 751 Federal law enforcement activities/ $3.73 B

- Grand Total: $10.28 B

The CIA, on the other hand, fully spent its FY2022 of $514 Million under the National Defense Function.

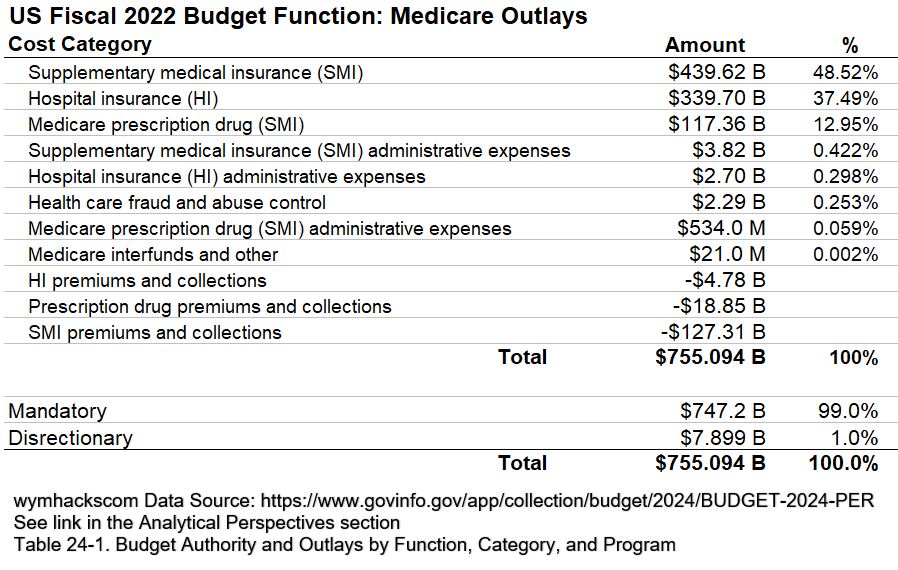

US FY2022 Federal Budget Outlays:

Medicare ($755.1 Billion; 11.6% of total outlays)

Function and Sub-Function Codes (570/571)

Medicare

Medicare is a federal health insurance entitlement program which is categorized by the Federal Budget as Mandatory Spending. Medicare was enacted in 1965 (part of President L.B. Johnson’s Great Society programs). Its purpose was to provide health insurance to people who were too old to be covered by private health insurance.

According to medicare.gov: Medicare is the “federal health insurance program for (a) People who are 65 or older (b) Certain younger people with disabilities (c) People with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a transplant, sometimes called ESRD).”

Medicare Parts A and B

Medicare Parts A and B are the original parts of the Medicare program.

- Ref23: (Medicare parts – ssa.gov): “Part A (Hospital Insurance). Part A helps pay for inpatient care at: Hospitals, Skilled nursing facilities, Hospice. It also covers some outpatient home health care. Part A is free if you worked and paid Medicare taxes for at least 10 years. You may also be eligible because of your current or former spouse’s work…

- Part B (Medical Insurance). Part B helps cover: Services from doctors and other health care providers, Outpatient care, Home health care, Durable medical equipment and Some preventive services. Most people pay a monthly premium for Part B. The exact premium depends on your income level.”

Medicare Parts C and D

- Ref23: (Medicare parts – ssa.gov): “Private companies run Parts C and D. The federal government approves each plan. Costs and coverage types vary by provider…

- Part C is known as Medicare Advantage. It’s an alternative to Parts A and B that bundles several coverage types, including Parts A, B, and usually D. It may also include: Vision, Hearing, Dental insurance…You must sign up for Part A or Part B before enrolling in a Medicare Advantage plan…

- Part D (prescription drug coverage). Part D helps cover prescription drug costs. You must sign up for Part A or Part B before enrolling in Part D.”

Medicare Funding

- Budgetary Funding for Medicare is considered Mandatory Spending. Part A (Hospital Insurance) is funded mainly through Payroll Taxes (~90%). Part B and Part D are funded mainly through Government general revenues and premiums. See this source for more data.

- Ref24: Medicare Funding – medicare.gov: “Medicare is paid for through 2 trust fund accounts held by the U.S. Treasury. These funds can only be used for Medicare…

- Hospital Insurance (HI) Trust Fund: Funded mainly (~90%) through Payroll taxes paid by most employees, employers, and people who are self-employed. Also funded by Income taxes paid on Social Security benefits ,Interest earned on the trust fund investments, and Medicare Part A premiums from people who aren’t eligible for premium-free Part A. It funds (a) Medicare Part A (Hospital Insurance) benefits, like inpatient hospital care, skilled nursing facility (SNF) care, home health care, and hospice care. (b) Medicare Program administration, like costs for paying benefits, collecting Medicare taxes, and fighting fraud and abuse

- Supplementary Medical Insurance (SMI) Trust Fund: Funded by: (a) Funds authorized by Congress (b) Premiums from people enrolled in Medicare Part B (Medical Insurance) and Medicare drug coverage (Part D) (c) Other sources, like interest earned on the trust fund investments. It funds (a) Medicare Part B (b) Medicare Part D (c) Medicare Program administration, like costs for paying benefits and for fighting fraud and abuse

Schematic 12.1 – FY2022 US Federal Budget Circle Packing Chart – Medicare Outlays

Schematic 12.2 – FY2022 US Federal Budget Table – Medicare Outlays

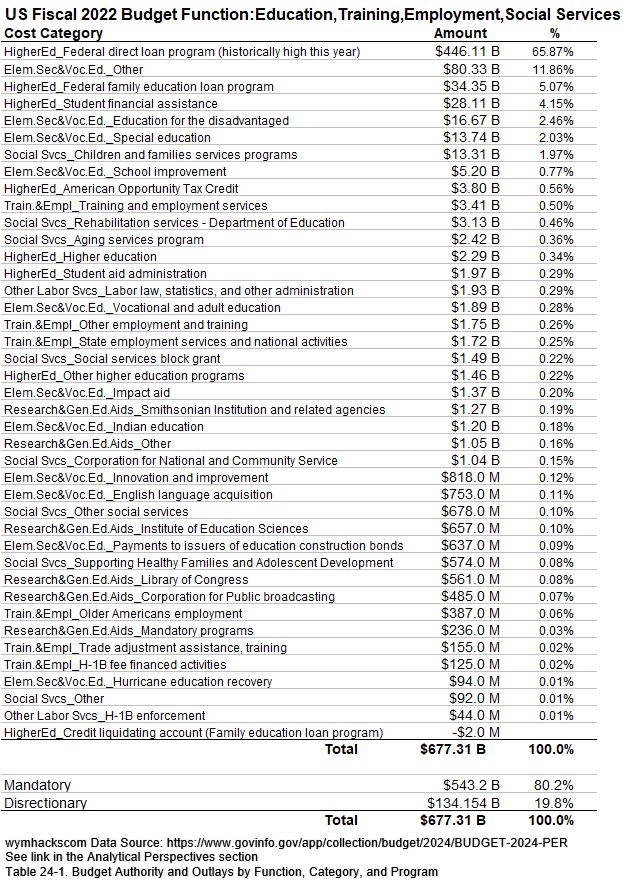

US FY2022 Federal Budget Outlays:

Education, Training, Employment, Social Services

($677.305 Billion; 10.4% of total outlays)

Function and Sub-Function Codes (500/501,502,503,504,505,506)

According to the GAO this Budget Function promotes “the extension of knowledge and skills, enhancing employment and employment opportunities, protecting workplace standards, and providing services to the needy.”

- This Budget Function in FY2022 contains 168 total accounts including offsets.

- Each of 23 accounts have > $1 billion outlays.

- Each of 46 accounts have between $100 million to $1 billion outlays.

- Each of 74 accounts have between $1 million to $100 million outlays.

Schematic 13.1 – FY2022 US Federal Budget Circle Packing Chart – Education, Training, Employment, Social Services Outlays

Schematic 13.2 – FY2022 US Federal Budget Table – Education, Training, Employment, Social Services Outlays

Outlays by Sub-Function

See the GAO Glossary Appendix IV for Function and Sub-Function Definitions.

502/ Higher education/ $518.09 B

501/ Elementary, secondary, and vocational education/ $122.70 B

506/ Social services/ $22.73 B

504/ Training and employment/ $7.55 B

503/ Research and general education aids/ $4.26 B

505/ Other labor services/ $1.98 B

Grand Total $677.31 B

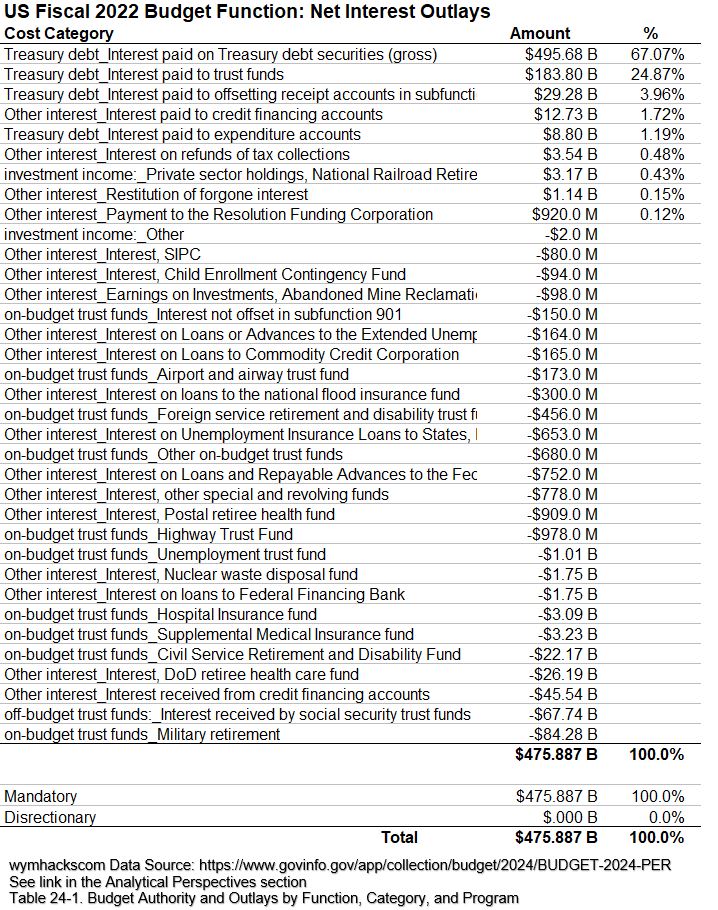

US FY2022 Federal Budget Outlays:

Net Interest ($475.887Billion; 7.3% of total outlays)

Function and Sub-Function Codes (900/901,902,903,908,909)

Net Interest, according to GAO, is “interest paid on the public debt, on uninvested funds, and on tax refunds, offset by interest collections.”

Schematic 14.1 – FY2022 US Federal Budget Circle Packing Chart – Net Interest Outlays

Schematic 14.2 – FY2022 US Federal Budget Table – Net Interest Outlays

Outlays by Sub-Function (Net Interest FY2022)

See the GAO Glossary Appendix IV for Function and Sub-Function Definitions.

901/ Interest on Treasury debt securities (gross)/ $717.57 Billion

909/ Other investment income/ $3.17 B

908/ Other interest/ -$60.90 B

903/ Interest received by off-budget trust funds/ -$67.74 B

902/ Interest received by on-budget trust funds/ -$116.21 B

Grand Total $475.89 Billion

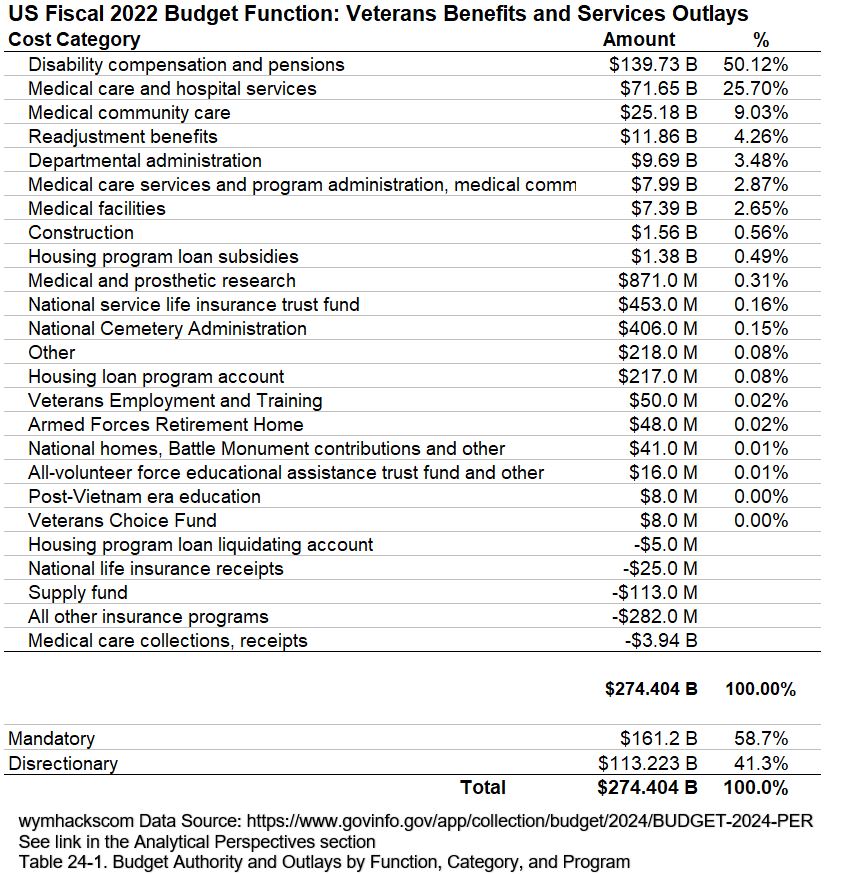

US FY2022 Federal Budget Outlays:

Veteran Benefits ($274.404Billion; 4.2% of total outlays)

Function and Sub-Function Codes (700/701,702,703,704,705)

There are 13 veteran benefit accounts each totaling more than $1 billion, 17 which each total between $100 million and $1 billion, and another 28 which each total between $1 million and $100 million.

Schematic 15.1 – FY2022 US Federal Budget Circle Packing Chart – Veteran Benefit Outlays

Schematic 15.2 – FY2022 US Federal Budget Table – Veteran Benefit Outlays

Outlays by Sub-Function (Veteran Benefits FY2022)

See the GAO Glossary Appendix IV for Function and Sub-Function Definitions.

701/ Income security for veterans $139.93 B

703/ Hospital and medical care for veterans $110.71 B

702/ Veterans education, training, and rehabilitation $11.94 B

705/ Other veterans benefits and services $10.25 B

704/ Veterans housing $1.59 B

Grand Total $274.404 B

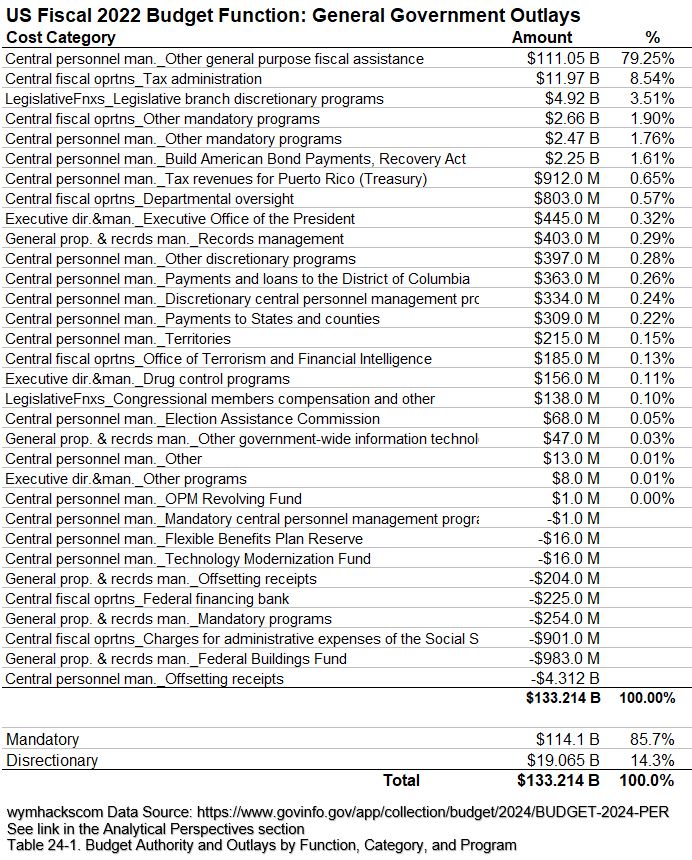

US FY2022 Federal Budget Outlays:

General Government ($133.214Billion; 2.0% of total outlays)

Function and Sub-Function Codes (800/801,802,803,804,805,806,808,809)

There were 10 accounts each with at least $1 billion in outlays, 40 each with outlays between $100 million and $1 billion, and another 121 accounts each with between $1 million and $1 billion. Almost 86% of these are Mandatory spending programs (not subject to the annual Appropriations process).

Schematic 16.1 – FY2022 US Federal Budget Circle Packing Chart – General Government Outlays

Schematic 16.2 – FY2022 US Federal Budget Table – General Government Outlays

Outlays by Sub-Function (General Government FY2022)

See the GAO Glossary Appendix IV for Function and Sub-Function Definitions. Because the Function titles are a bit vague, I’ve added the biggest outlays by account in each Sub-Function (not complete lists!).

804/ General purpose fiscal assistance $114.90 Billion (top 10)

- Coronavirus Relief Fund/ Mandatory/ $106.09 Billion

- Mineral Leasing and Associated Payments/ Mandatory/ $3.98 B

- Build America Bond Payments, Recovery Act/ Mandatory/ $2.25 B

- Payments in Lieu of Taxes/ Mandatory/ $550.00 Million

- Refunds, Transfers, and Expenses of Operation, Puerto Rico/ Mandatory/ $498.00 M

- Internal Revenue Collections for Puerto Rico/ Mandatory/ $414.00 M

- Forest Service Permanent Appropriations/ Mandatory/ $300.00 M

- Payments to the United States Territories, Fiscal Assistance/ Mandatory/ $297.00 M

- Federal Payment to the District of Columbia Courts/ Discretionary/ $282.00 M

- Payments to States in Lieu of Coal Fee Receipts/ Mandatory/ $97.00 M

803/ Central fiscal operations $14.50 Billion (Top 17)

- Internal Revenue Service/ Enforcement/Discretionary/ $4.50 B

- Internal Revenue Service/ Operations Support /Discretionary/$4.45 B

- Internal Revenue Service/ Taxpayer Services /Discretionary/ $2.76 B

- Fiscal Service/ Financial Agent Services /Mandatory/ $1.02 B

- Fiscal Service/ Federal Reserve Bank Reimbursement Fund /Mandatory/ $594.00 M

- Internal Revenue Service/ Operations Support /Mandatory/ $553.00 M

- Internal Revenue Service/ Taxpayer Services /Mandatory/ $411.00 M

- Fiscal Service/ Salaries and Expenses /Discretionary/ $373.00 M

- Internal Revenue Service/ Business Systems Modernization/Discretionary/ $269.00 M

- Departmental Offices/ Salaries and Expenses/ Discretionary/ $228.00 M

- Departmental Offices/ Office of Terrorism and Financial Intelligence/Discretionary/ $187.00 M

- Fiscal Service/ Debt Collection Fund /Mandatory/ $177.00 M

- Departmental Offices/ Treasury Inspector General for Tax Administration /Discretionary/ $169.00 M

- Fiscal Service/ Reimbursements to Federal Reserve Banks/ Mandatory// $153.00 M

- Alcohol and Tobacco Tax and Trade Bureau/ Salaries and Expenses/ Discretionary/ $128.00 M

- Internal Revenue Service/ Business Systems Modernization/ Mandatory/ $124.00 M

- Internal Revenue Service/ Private Collection Agent Program/ Mandatory/ $108.00 M

801/ Legislative functions $5.06 B (Top 25)

- House of Representatives/ Salaries and Expenses/ Discretionary/ $1.56 B

- Government Accountability Office/ Salaries and Expenses /Discretionary/ $670.00 M

- Senate/ Senators’ Official Personnel and Office Expense Account/ Discretionary/ $494.00 M

- Capitol Police/ Salaries /Discretionary/ $482.00 M

- Senate/ Salaries, Officers and Employees /Discretionary /$222.00 M

- Architect of the Capitol House/ Office Buildings /Discretionary/ $201.00 M

- Senate/ Inquiries and Investigations /Discretionary/ $155.00 M

- Architect of the Capitol/ Capitol Construction and Operations /Discretionary/ $138.00 M

- Senate/ Sergeant at Arms and Doorkeeper of the Senate /Discretionary/ $137.00 M

- Library of Congress/ Congressional Research Service, Salaries and Expenses /Discretionary/ $127.00 M

- Architect of the Capitol/ Capitol Power Plant /Discretionary/ $114.00 M

- House of Representative/s Compensation of Members and Related Administrative Expenses/ Mandatory /$104.00 M

- Architect of the Capitol/ Senate Office Buildings /Discretionary/ $101.00 M

- Capitol Police/ General Expenses /Discretionary/ $93.00 M

- Government Publishing Office Congressional Publishing /Discretionary/ $70.00 M

- Congressional Budget Office/ Salaries and Expenses /Discretionary/ $59.00 M

- Architect of the Capitol/ Library Buildings and Grounds /Discretionary/ $59.00 M

- Architect of the Capitol/ Capitol Building /Discretionary $47.00 M

- Architect of the Capitol/ Capitol Police Buildings, Grounds, and Security /Discretionary/ $39.00 M

- Architect of the Capitol/ Capitol Visitor Center /Discretionary/$25.00 M

- Senate /Compensation of Members, Senate /Mandatory/ $24.00 M

- Government Accountability Office/ Salaries and Expenses/ Mandatory/ $23.00 M

- Senate /Miscellaneous Items/ Discretionary/ $18.00 M

- Architect of the Capitol/ Capitol Grounds /Discretionary/ $16.00 M

- Botanic Garden/ Botanic Garden/ Discretionary/ $16.00 M

808/ Other general government $3.13 Billion (Top 14)

- Fiscal Service/ Claims, Judgments, and Relief Acts /Mandatory/ $2.76 Billion

- Insular Affairs/ Compact of Free Association /Mandatory/ $202.00 Million

- Bureau of Trust Funds Administration/ Federal Trust Programs /Discretionary/ $110.00 M

- Insular Affairs/ Assistance to Territories /Discretionary/ $80.00 M

- Federal Election Commission/ Salaries and Expenses /Discretionary/ $71.00 M

- Election Assistance Commission/ Election Security Grants /Discretionary/ $49.00 M

- Government Publishing Office/ Public Information Programs of the Superintendent of Documents, Salaries and Expenses /Discretionary/ $35.00 M

- Departmental Offices/ Cybersecurity Enhancement Account /Discretionary/ $24.00 M

- Insular Affairs/ Compact of Free Association/ Discretionary/ $22.00 M

- Government Publishing Office/ Government Publishing Office Business Operations Revolving Fund /Discretionary/ $19.00 M

- Election Assistance Commission/ Salaries and Expenses /Discretionary /$19.00 M

- Council of the Inspectors General on Integrity and Efficiency/ Pandemic Response Accountability Committee /Discretionary/ $19.00 M

- Insular Affairs/ Assistance to Territories /Mandatory/ $13.00 M

- Council of the Inspectors General on Integrity and Efficiency/ Pandemic Response Accountability Committee /Mandatory/ $10.00 M

802/ Executive direction and management $.61 Billion (Top 10)

- Federal Drug Control Programs/ Other Federal Drug Control Programs /Discretionary /$156.00 M

- Office of Management and Budget/ Salaries and Expenses /Discretionary/ $109.00 M

- Office of Administration/ Salaries and Expenses /Discretionary/ $93.00 M

- The White House /Salaries and Expenses /Discretionary/ $63.00 M

- Office of the United States Trade Representative/Salaries and Expenses /Discretionary /$58.00 M

- Unanticipated Needs/ Information Technology Oversight and Reform /Mandatory/ $34.00 M

- Office of National Drug Control Policy/ Salaries and Expenses /Discretionary/ $20.00 M

- Executive Residence at the White House/ Operating Expenses /Discretionary/ $14.00 M

- National Security Council and Homeland Security Council /Salaries and Expenses /Discretionary/ $12.00 M

- The White House /Salaries and Expenses Mandatory $8.00 M

805/ Central personnel management $.32 Billion (Top 6)

- Office of Personnel Management/ Payment to Civil Service Retirement and Disability Fund /Mandatory/ $46.38 B

- Office of Personnel Management/ Salaries and Expenses /Discretionary/ $205.00 M

- Merit Systems Protection Board/ Salaries and Expenses /Discretionary/ $45.00 M

- Office of Special Counsel/Salaries and Expenses /Discretionary/ $31.00 M

- Federal Labor Relations Authority/ Salaries and Expenses/ Discretionary/ $27.00 M

- Office of Government Ethics/ Salaries and Expenses /Discretionary/ $19.00 M

806/ General property and records management -$.99 B

809/ Deductions for offsetting receipts -$4.31 B

Grand Total $133.21 B

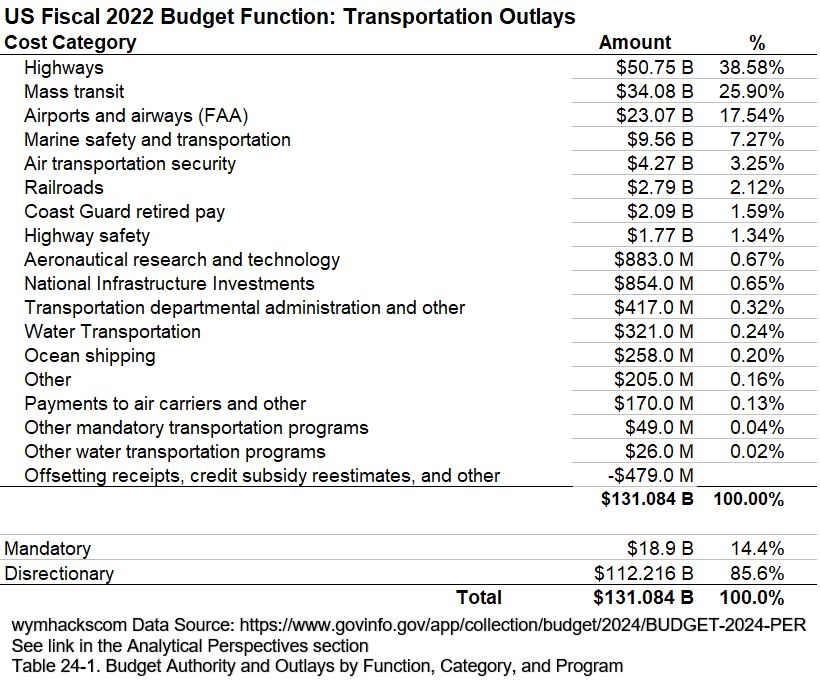

US FY2022 Federal Budget Outlays:

Transportation ($131.084 Billion; 2.0% of total outlays)

Function and Sub-Function Codes (400/401,402,403,407)

There were 18 accounts each with at least $1 billion in outlays, 31 each with outlays between $100 million and $1 billion, and another 69 accounts each with between $1 million and $1 billion. Almost 86 % of these are Discretionary spending programs (i.e. subject to the annual Appropriations process).

Schematic 17.1 – FY2022 US Federal Budget Circle Packing Chart – Transportation Outlays

Schematic 17.2 – FY2022 US Federal Budget Table – Transportation Outlays

Outlays by Sub-Function (Transportation FY2022)

See the GAO Glossary Appendix IV for Function and Sub-Function Definitions

402/ Air transportation $28.40 Billion

401/Ground transportation $89.96 B

407/Other transportation $.47 B

403/Water transportation $12.26 B

Grand Total $131.08 B

Outlays by Bureau (Transportation FY2022)

If we break it down by Bureau, we get the list proved below. Remember that for each of these bureaus, there might be additional outlays coming from another Budget Function.

For example, NASA total outlays were $23.079 Billion of which $883 Million ($.883 Billion) was spent under the Transportation Sub-Function.

- Federal Highway Administration $50.14 B

- Federal Transit Administration $34.08 B

- Federal Aviation Administration $23.07 B

- United States Coast Guard $11.77 B

- Transportation Security Administration $6.17 B

- Federal Railroad Administration $2.76 B

- Office of the Secretary $2.24 B

- National Highway Traffic Safety Administration $1.11 B

- National Aeronautics and Space Administration $883.00 Million

- Departmental Offices $715.00 M

- Federal Motor Carrier Safety Administration $703.00 M

- Maritime Administration $513.00 M

- Pipeline and Hazardous Materials Safety Administration $280.00 M

- National Transportation Safety Board $122.00 M

- Office of Inspector General $101.00 M

- Surface Transportation Board $37.00 M

- Great Lakes St. Lawrence Seaway Development Corporation $33.00 M

- Federal Maritime Commission $29.00 M

- National Railroad Passenger Corporation Office of Inspector General $26.00 M

- Department of the Treasury -$508.00 M

- Department of Transportation -$1.43 B

- Department of Homeland Security -$1.77 B

Grand Total $131.08 B

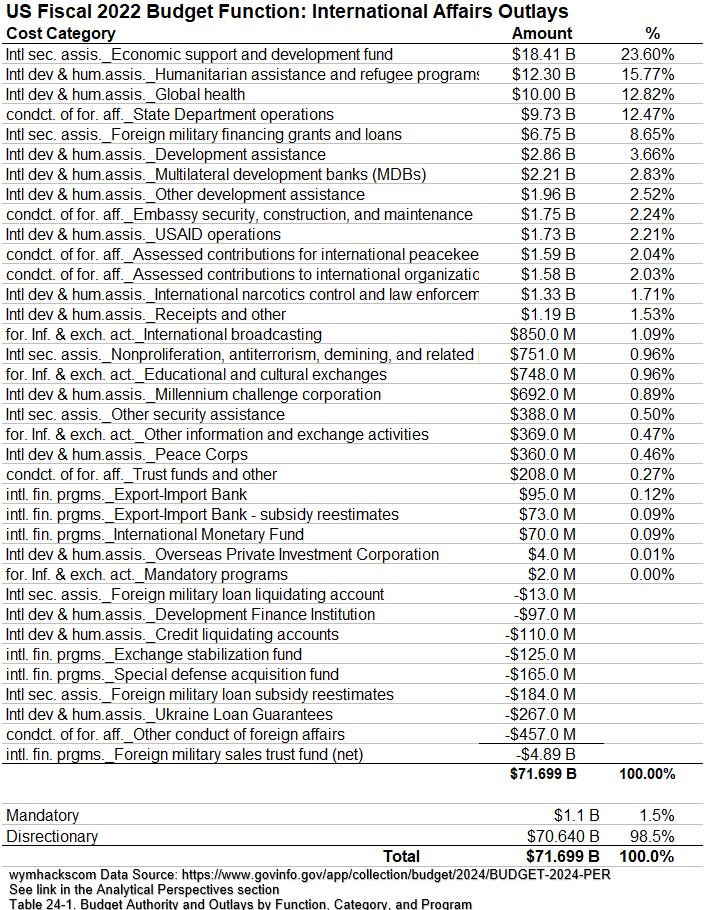

US FY2022 Federal Budget Outlays:

International Affairs ($71.699 Billion; 1.1% of total outlays)

Function and Sub-Function Codes (150/151,152,153,154,155)

There were 18 accounts each with at least $1 billion in outlays, 30 each with outlays between $100 million and $1 billion, and another 44 accounts each with between $1 million and $1 billion. Almost 99% of these are Discretionary spending programs (i.e. subject to the annual Appropriations process).

Schematic 18.1 – FY2022 US Federal Budget Circle Packing Chart – International Affairs Outlays

Schematic 18.2 – FY2022 US Federal Budget Table – International Affairs Outlays

Outlays by Sub-Function (International Affairs FY2022)

See the GAO Glossary Appendix IV for Function and Sub-Function Definitions

151/ International development and humanitarian assistance/$34.16 Billion

152/ International security assistance/$26.10 B

153/ Conduct of foreign affairs/$14.40 B

154/ Foreign information and exchange activities/ $1.97 B

155/ International financial programs/ -$4.94 B

Grand Total $71.699 B

Outlays by Account (International Affairs FY2022)

See Appendix 11 for a complete list of accounts under this Sub-Function.

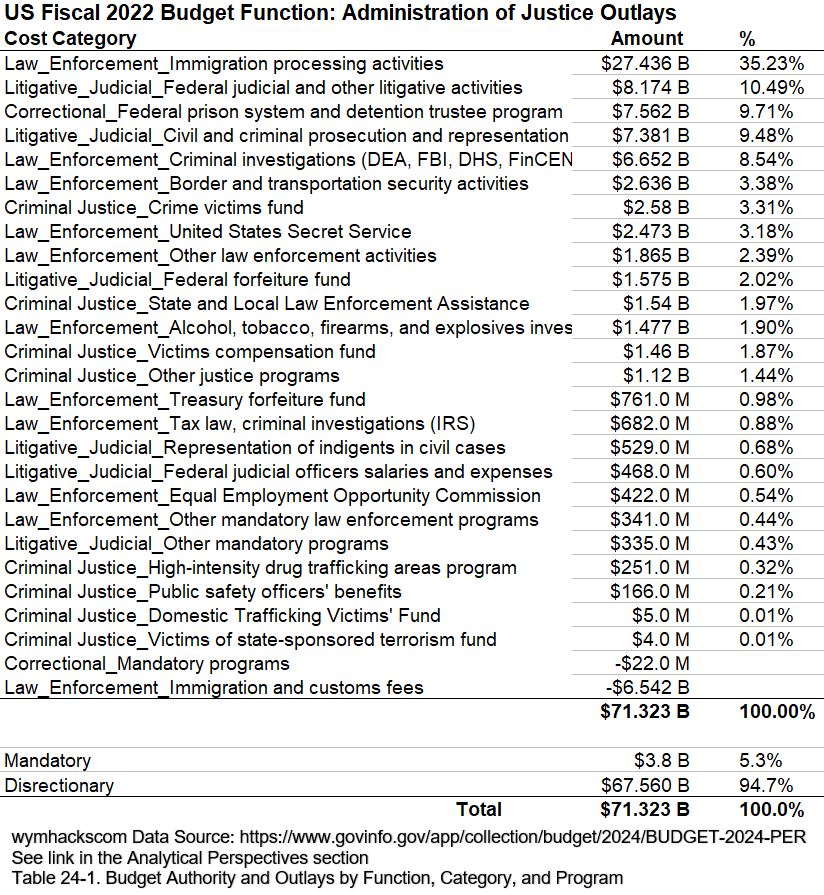

US FY2022 Federal Budget Outlays:

Administration of Justice ($71.323 Billion; 1.1% of total outlays)

Function and Sub-Function Codes (750/751,752,753,754)

There were 20 accounts each with at least $1 billion in outlays, 44 each with outlays between $100 million and $1 billion, and another 74 accounts each with between $1 million and $1 billion. Almost 95% of these are Discretionary spending programs (i.e. subject to the annual Appropriations process).

Schematic 19.1 – FY2022 US Federal Budget Circle Packing Chart – Justice Administration Outlays

Schematic 19.2 – FY2022 US Federal Budget Table – Justice Administration – Outlays

Outlays by Sub-Function (Administration of Justice FY2022)

See the GAO Glossary Appendix IV for Function and Sub-Function Definitions

752/ Federal litigative and judicial activities/ $18.46 B

753/ Federal correctional activities/ $7.54 B

754/ Criminal justice assistance/ $7.12 B

Grand Total $71.32 B

Top 20 Outlays by Account (Administration of Justice FY2022)

- U.S. Customs and Border Protection/ Operations and Support Discretionary $14.11 Billion

- U.S. Immigration and Customs/ Enforcement Operations and Support Discretionary $8.45 B

- Federal Prison System/ Salaries and Expenses Discretionary $7.47 B

- Courts of Appeals, District Courts, and Other Judicial Services/ Salaries and Expenses Discretionary $5.72 B

- Citizenship and Immigration Services/ Immigration Examinations Fee Mandatory $4.11 B

- Federal Bureau of Investigation/ Salaries and Expenses Discretionary $3.42 B

- State, Local, and Tribal Justice Assistance/ Crime Victims Fund Mandatory $2.50 B

- Drug Enforcement Administration Salaries and Expenses/ Discretionary $2.43 B

- United States Secret Service/ Operations and Support/ Discretionary $2.39 B

- Legal Activities and U.S. Marshals/ Salaries and Expenses, United States Attorneys Discretionary $2.37 B

- Legal Activities and U.S. Marshals/ Federal Prisoner Detention Discretionary $2.20 B

- U.S. Customs and Border Protection/ Operations and Support Mandatory $2.19 B

- Legal Activities and U.S. Marshals/ Salaries and Expenses, United States Marshals Service Discretionary $1.52 B

- Management Directorate/ Operations and Support Discretionary $1.49 B

- Bureau of Alcohol, Tobacco, Firearms, and Explosives/ Salaries and Expenses Discretionary $1.48 B

- Legal Activities and U.S. Marshals Victims Compensation Fund Mandatory $1.46 B

- State, Local, and Tribal Justice Assistance State and Local Law Enforcement Assistance Discretionary $1.38 B

- Legal Activities and U.S. Marshals Assets Forfeiture Fund Mandatory $1.34 B

- Courts of Appeals, District Courts, and Other Judicial Services Defender Services Discretionary $1.32 B

- Legal Activities and U.S. Marshals Salaries and Expenses, General Legal Activities Discretionary $1.01 B

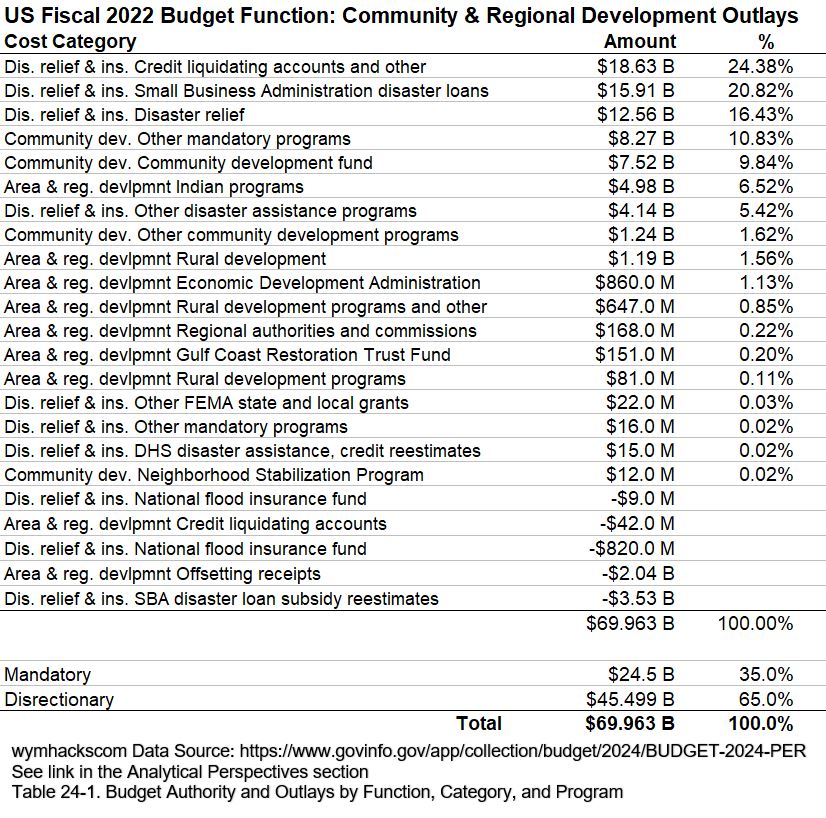

US FY2022 Federal Budget Outlays:

Community and Regional Development ($69.963 Billion; 1.1% of total outlays)

Function and Sub-Function Codes (450/451,452,453)

There were 11 accounts each with at least $1 billion in outlays, 25 each with outlays between $100 million and $1 billion, and another 53 accounts each with between $1 million and $1 billion. Almost 95% of these are Discretionary spending programs (i.e. subject to the annual Appropriations process).

Schematic 20.1 – FY2022 US Federal Budget Circle Packing Chart – Community and Regional Development Outlays

Schematic 20.2 – FY2022 US Federal Budget Table – Community and Regional Development Outlays

Outlays by Sub-Function (Community and Regional Development FY2022)

See the GAO Glossary Appendix IV for Function and Sub-Function Definitions

452/ Disaster relief and insurance/ $46.92 B

451/ Community development/ $17.04 B

452/ Area and regional development/ $6.00 B

Grand Total $69.96 B

Outlays by Bureau (Community and Regional Development FY2022)

- Federal Emergency Management Agency/ $35.34 Billion

- Small Business Administration/ $12.38 B

- Departmental Offices/ $8.92 B

- Community Planning and Development/ $7.53 B

- Bureau of Indian Affairs/ $3.73 B

- Bureau of Trust Funds Administration/ $1.19 B

- Rural Utilities Service/ $1.04 B

- Economic Development Administration/ $935.00 Million

- Management and Administration/ $643.00 M

- Rural Development/ $321.00 M

- Rural Housing Service/ $312.00 M

- Rural Business-Cooperative Service/ $264.00 M

- Neighborhood Reinvestment Corporation/ $166.00 M

- Fiscal Service/ $151.00 M

- Appalachian Regional Commission/ $129.00 M

- Office of Lead Hazard Control and Healthy Homes/ $115.00 M

- Farm Service Agency/ $102.00 M

- Bureau of Indian Education/ $56.00 M

- Policy Development and Research/ $52.00 M

- Office of the Secretary and Executive Management/ $27.00 M

- Delta Regional Authority/ $19.00 M

- Northern Border Regional Commission/ $17.00 M

- National Capital Planning Commission/ $8.00 M

- Commission of Fine Arts/ $3.00 M

- Denali Commission/ $3.00 M

- Management Directorate/ $3.00 M

- Office of Health Affairs/ $1.00 M

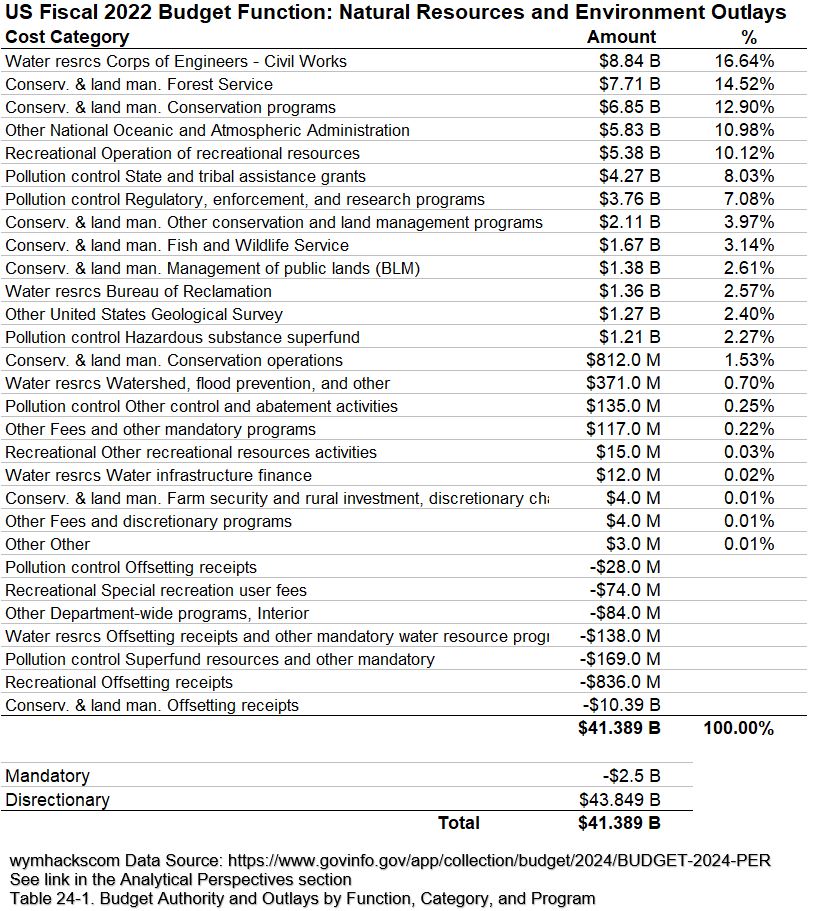

US FY2022 Federal Budget Outlays:

Natural Resources and Environment ($41.389 Billion; .6% of total outlays)

Function and Sub-Function Codes (300/301,302,303,304,306)

There were 19 accounts each with at least $1 billion in outlays, 40 each with outlays between $100 million and $1 billion, and another 123 accounts each with between $1 million and $1 billion. Almost 95% of these are Discretionary spending programs (i.e. subject to the annual Appropriations process).

Schematic 21.1 – FY2022 US Federal Budget Circle Packing Chart – Natural Resources and Environmental Outlays

Schematic 21.2 – FY2022 US Federal Budget Table – Natural Resources and Environmental Outlays

Outlays by Sub-Function (Natural Resources and Environment FY2022)

See the GAO Glossary Appendix IV for Function and Sub-Function Definitions

301/ Water resources/ $10.45 Billion

302/ Conservation and land management/ $10.14 B

304/ Pollution control and abatement/ $9.17 B

306/ Other natural resources/ $7.15 B

Recreational resources/ $4.48 B

Grand Total $41.39 B

Outlays by Bureau (Natural Resources and Environment FY2022)

Here are the bureaus that are charging to this Natural Resources and Environmental Budget Function. Please note that some of these might not represent the full amount spent by that bureau (because there were charges made under other Budget Functions).

For example, the EPA spend of $9.28 Billion is the full outlay for FY2022, but the NOAA full outlay is $6.269 Billion (of which $5.97 Billion is charged to this Budget Function). Also, often there will be both outlays and credits (negative outlays) assigned to bureaus, so the total amount will be the net of charges and credits.

- Environmental Protection Agency (EPA)/ $9.28 B

- Corps of Engineers–Civil Works/ $8.64 B

- Forest Service/ $8.19 B

- National Oceanic and Atmospheric Administration/ $5.97 B

- Natural Resources Conservation Service/ $4.29 B

- National Park Service/ $3.82 B

- United States Fish and Wildlife Service/ $3.27 B

- Farm Service Agency $1.82 B

- Bureau of Land Management/ $1.60 B

- Department-Wide Programs/ $1.56 B

- Bureau of Reclamation/ $1.56 B

- United States Geological Survey/ $1.28 B

- Departmental Offices/ $537.00 M

- Office of Surface Mining Reclamation and Enforcement/ $318.00 M

- Bureau of Indian Affairs/ $219.00 M

- Bureau of Safety and Environmental Enforcement/ $162.00 M

- Bureau of Ocean Energy Management/ $152.00 M

- International Commissions/ $136.00 M

- Office of the Solicitor/ $89.00 M

- United States Coast Guard/ $79.00 M

- Central Utah Project/ $71.00 M

- Office of Inspector General/ $63.00 M

- Presidio Trust/ $15.00 M

- Chemical Safety and Hazard Investigation Board/ $12.00 M

- Executive Operations/ $8.00 M

- Forest and Wildlife Conservation, Military Reservations/ $7.00 M

- Advisory Council on Historic Preservation/ $7.00 M

- Marine Mammal Commission/ $4.00 M

- Morris K. Udall and Stewart L. Udall Foundation/ $3.00 M

- Fiscal Service/ $1.00 M

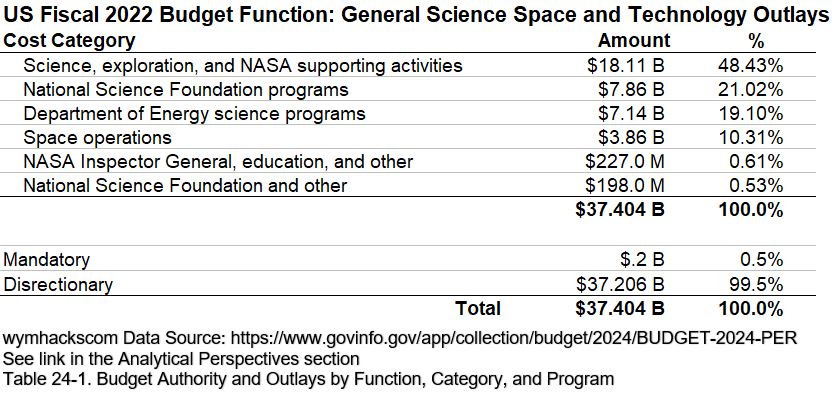

US FY2022 Federal Budget Outlays:

General Science, Space, and Technology ($37.404 Billion; .6% of total outlays)

Function and Sub-Function Codes (250/251,252)

There were 7 accounts each with at least $1 billion in outlays, 6 each with outlays between $100 million and $1 billion, and another 8 accounts each with between $1 million and $1 billion. About99.5% of these are Discretionary spending programs (i.e. subject to the annual Appropriations process).

Schematic 22.1 – FY2022 US Federal Budget Circle Packing Chart – General Science and Technology Outlays

Schematic 22.2 – FY2022 US Federal Budget Table – General Science and Technology Outlays

Outlays by Sub-Function (General Science and Technology FY2022)

251/ General science and basic research $15.205 B

252/ Space flight, research, and supporting activities $22.199 B

Grand Total $37.404 B

Outlays by Bureau (General Science and Technology FY2022)

National Aeronautics and Space Administration $22.199 B

National Science Foundation $8.062 B

Energy Programs $7.143 B

Grand Total $37.404 B

Outlays by Bureau and Account (General Science and Technology FY2022)

Department of Energy $7.143 B

- Science $7.143 B

National Aeronautics and Space Administration $22.199 B

- Science $7.174 B

- Deep Space Exploration Systems $6.487 B

- Space Operations $3.858 B

- Safety, Security and Mission Services $2.884 B

- Space Technology $1.144 B

- Construction and Environmental Compliance and Restoration $425.00 M

- Science, Technology, Engineering, and Mathematics Engagement $122.00 M

- Working Capital Fund $59.00 M

- Office of Inspector General $46.00 M

National Science Foundation $8.062 B

- Research and Related Activities $6.495 B

- STEM Education $1.001 B

- Agency Operations and Award Management $403.00 M

- Major Research Equipment and Facilities Construction $156.00 M

- Office of Inspector General $19.00 M

- Office of the National Science Board $5.00 M

- Donations $3.00 M

- Donations, National Science Foundation -$20.00 M

Grand Total $37.404 B

US FY2022 Federal Budget Outlays:

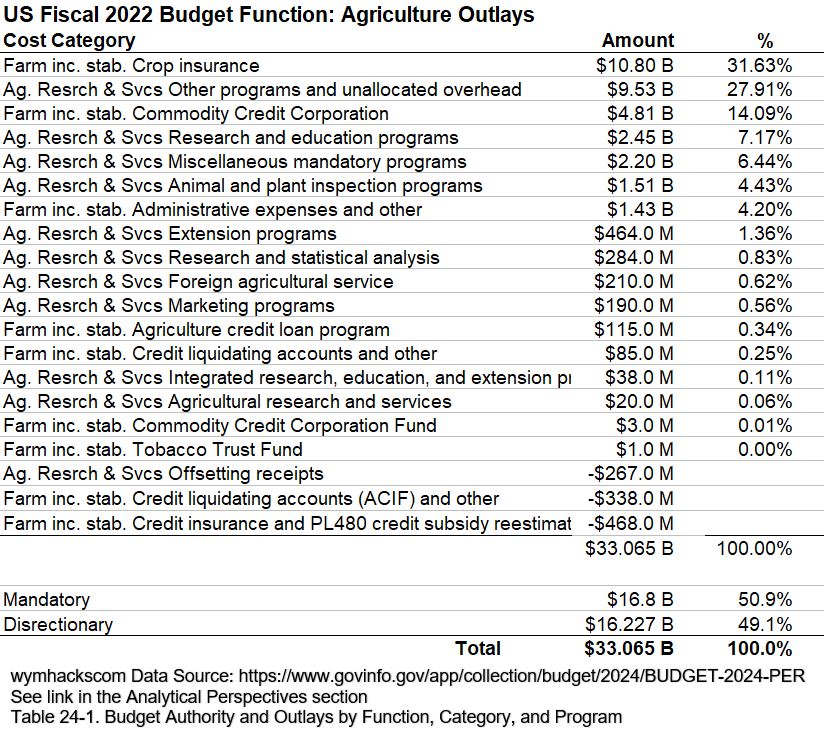

Agriculture ($33.065 Billion; .5% of total outlays)

Function and Sub-Function Codes (350/351,352)

There were 6 accounts each with at least $1 billion in outlays, 14 each with outlays between $100 million and $1 billion, and another 34 accounts each with between $1 million and $1 billion. Discretionary and Mandatory spending each account for about 50% of the total spend.

Schematic 23.1 – FY2022 US Federal Budget Circle Packing Chart – Agricultural Outlays

Schematic 23.2 – FY2022 US Federal Budget Table – Agricultural Outlays

FY2022 Agricultural Outlays By Budget Function

Agricultural research and services $16.63 Billion

Farm income stabilization $16.44 B

Grand Total $33.07 B

FY2022 Agricultural Outlays By Bureau and Account

See Appendix 12.

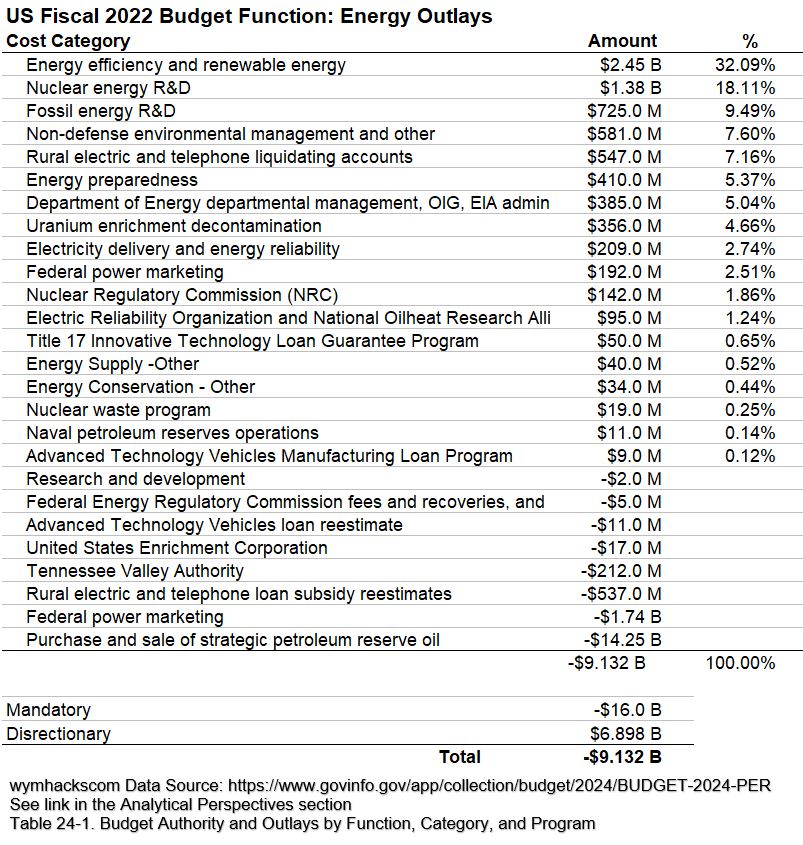

US FY2022 Federal Budget Outlays:

Energy ($-9.132 Billion…this is a credit)

Function and Sub-Function Codes (270/271,272,274,276)

There were 2 accounts each with at least $1 billion in outlays, 15 each with outlays between $100 million and $1 billion, and another 22 accounts each with between $1 million and $1 billion.

Schematic 24.1 – FY2022 US Federal Budget Circle Packing Chart – Energy Outlays

Schematic 24.2 – FY2022 US Federal Budget Table – Energy Outlays

FY2022 Energy Budget Function Outlays by Sub-Function

271/ Energy supply/ $4.06 Billion

276 /Energy information, policy, and regulation/ $.62 B

272/ Energy conservation/ $.03 B

274/ Emergency energy preparedness/ -$13.84 B

Grand Total / -$9.13 Billion

FY2022 Energy Budget Function Outlays by Agency/Bureau/Account

See Appendix 13.

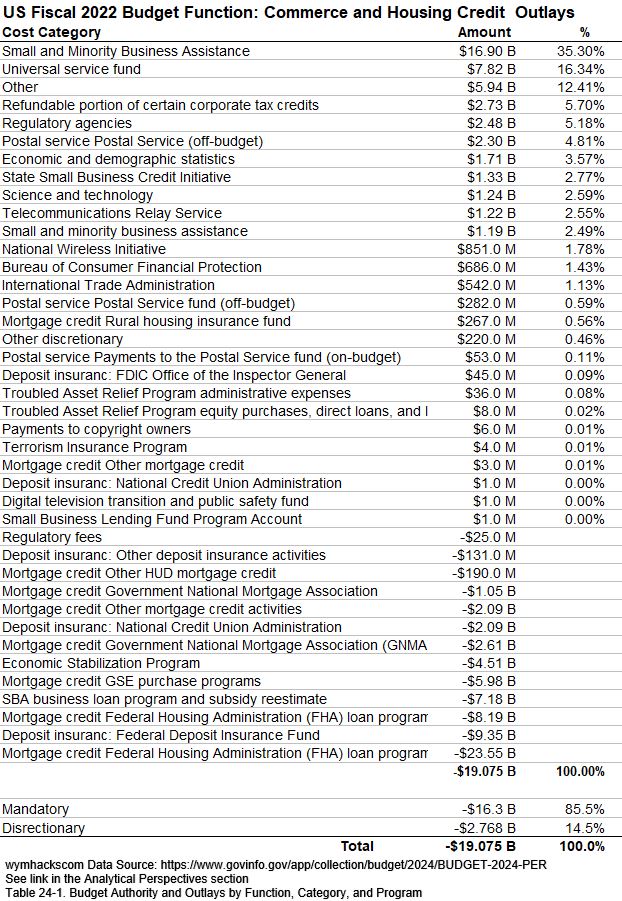

US FY2022 Federal Budget Outlays:

Commerce and Housing ($-19.075 Billion…this is a credit)

Function and Sub-Function Codes (370/371,372,373,376)

There were 14 accounts each with at least $1 billion in outlays, 27 each with outlays between $100 million and $1 billion, and another 65 accounts each with between $1 million and $1 billion.

Schematic 25.1 – FY2022 US Federal Budget Circle Packing Chart – Commerce and Housing Credit Outlays

Schematic 25.2 – FY2022 US Federal Budget Table – Commerce and Housing Credit Outlays

FY2022 Commerce and Housing Credit Budget Outlays by Sub-Function

372/ Postal service/ $2.64 B

373/ Deposit insurance/ -$11.53 B

371/ Mortgage credit/ -$43.39 B

Grand Total/ -$19.08 B

FY2022 Commerce and Housing Credit Budget Outlays by Bureau

- (FCC) Federal Communications Commission/ $15.21 B

- (SBA) Small Business Administration/ $10.85 B

- (IRS) Internal Revenue Service/ $2.73 B

- Postal Service/ $2.64 B

- Bureau of the Census/ $1.62 B

- Departmental Offices/ $1.49 B

- (NIST) National Institute of Standards and Technology/ $1.24 B

- National Telecommunications and Information Administration/ $1.07 B

- (SEC) Securities and Exchange Commission/ $778.00 M

- Bureau of Consumer Financial Protection/ $686.00 M

- International Trade Administration/ $542.00 M

- Federal Housing Finance Agency/ $334.00 M